In practice, this usually means real estate owned outside of a trust. How Long Do You Have To Contest Probate in Florida?  D.C. Troxell, Aliens - Estate and Gift Taxation, 201-2nd Tax Management Portfolios (BINA 1980). Learn more about FindLaws newsletters, including our terms of use and privacy policy. Act 206, et seq. How do I simplify or reduce costs for ancillary probate?

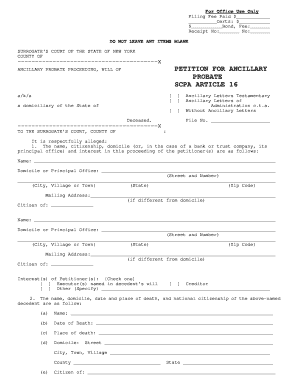

D.C. Troxell, Aliens - Estate and Gift Taxation, 201-2nd Tax Management Portfolios (BINA 1980). Learn more about FindLaws newsletters, including our terms of use and privacy policy. Act 206, et seq. How do I simplify or reduce costs for ancillary probate?  The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and.

The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and.

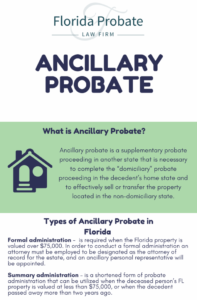

2101(d). This secondary probate is necessary because the probate court in the decedent's home state has no legal jurisdiction over property that's situated elsewhere. Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state.

Law stated as of 04 Jan 2023 Tennessee. But an ancillary probate estate would have to be opened in other statesas well, where the decedent's out-of-state property is located. Attorneys who do not practice extensively in estate planning traditionally build an estate plan upon a Will. When it comes to the titles of probate items, such as a home, some people are hesitant to share ownership of such a valuable asset. Carry out the simplified probate process. unless otherwise indicated, will be made. There are some prophylactic steps that can be taken to allay the concerns about Ancillary Probate. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Please limit your input to 500 characters. The ancillary proceeding handles only the assets located in that state. Stock in a foreign corporation is deemed to be situated outside the United States and therefore is not includable in the gross estate of a non-resident decedent. Tangible personal property located within the United States. The second probate court may refer to a will first accepted by another state as a "foreign will.". Another drawback can occur when an estate is intestate, meaning the deceased diedwithout a valid last will and testament. Out-of-state property would be discovered at that time. Some have suggested that federal estate taxes can be avoided through the use of foreign corporations to hold United States property. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. A .mass.gov website belongs to an official government organization in Massachusetts. As we baby boomers age, we are losing co-owners to death and divorce.

you're filing at to find out what forms of payment they accept for fees. Unique situations can arise, such as when probate isn't required in the county where the decedent lived because they don't own property located there, but they do own real property in another state. These cases are known as "ancillary probate" cases. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). ", Legal Services of Vermont and Vermont Legal Aid. Please let us know how we can improve this page. No deed from John and Mary into Mary individually is recorded. on ActiveRain. Some page levels are currently hidden. Para nosotros usted es lo ms importante, le ofrecemosservicios rpidos y de calidad. My law firm, Topkins & Bevans, can cover the entire state of Massachusetts. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Sell, lease, or mortgage local property; and. Making the Probate Process Easy Ancillary Probate involves starting an entirely new probate procedure in most circumstances. It requests that ancillary letters of administration be issued to an ancillary personal representative to provide them with the legal authority needed to administer a deceased persons Florida Please limit your input to 500 characters. The email address cannot be subscribed. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. "Going Through Probate After Someone Died.".

you're filing at to find out what forms of payment they accept for fees. Unique situations can arise, such as when probate isn't required in the county where the decedent lived because they don't own property located there, but they do own real property in another state. These cases are known as "ancillary probate" cases. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. The list of states following this trend includes Minnesota and Virginia, which abolished their inheritance taxes effective January 1, 1980, Washington (January 1, 1982), California (June 9, 1982), Illinois (December 31, 1982), Wyoming (January 1, 1983), Hawaii (June 30, 1983), and Texas (September 1, 1983). ", Legal Services of Vermont and Vermont Legal Aid. Please let us know how we can improve this page. No deed from John and Mary into Mary individually is recorded. on ActiveRain. Some page levels are currently hidden. Para nosotros usted es lo ms importante, le ofrecemosservicios rpidos y de calidad. My law firm, Topkins & Bevans, can cover the entire state of Massachusetts. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Sell, lease, or mortgage local property; and. Making the Probate Process Easy Ancillary Probate involves starting an entirely new probate procedure in most circumstances. It requests that ancillary letters of administration be issued to an ancillary personal representative to provide them with the legal authority needed to administer a deceased persons Florida Please limit your input to 500 characters. The email address cannot be subscribed. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. "Going Through Probate After Someone Died.".

elivering them a written notice at least 7 days before filing an informal petition. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. Thank you! If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. Stock held in United States corporations. How to Determine Where to Open a Probate Estate. WebYes, you may sell the house during probate. Read our, Definition and Examples of Ancillary Probate, How to Avoid Ancillary Probate in Florida. Page 6. You might live in Pennsylvania, but own a piece of real estate one the New Jersey shore. The course of action I most recommend is placing the real property in a revocable or irrevocable trust. Under Section 734.102, ancillary administration is available to nonresidents of Florida who die with any of the following ties to the state: After the ancillary administration has begun, notice must be given to estate creditors (unless claims are barred) and to other interested parties. Montana State University Extension. In fact, an executor will need to account for additional court costs and attorneys fees. Should you have any questions regarding this article, please contact Laura Brandow at 781-817-4900 or via email at lbrandow@lawmtm.com. State courts often work cooperatively when ancillary probate becomes necessary. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Real property placed in a trust is still subject to federal estate taxes if the trust is covered under sections 2036 to 2038, which apply to any trust in which the grantor retains an interest, reversion, or power.

It's possible that the rightfulheirs of an intestate estate could be different in the domiciliary state from those in the state of the ancillary probate proceeding. Wills and Estates Small Estates Massachusetts. Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. This can happen even if the process is shortened by cooperation between the state courts, and it can deplete the financial reserves of the estate. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. See Hurst v. Mellinger, 73 Tex.

It's possible that the rightfulheirs of an intestate estate could be different in the domiciliary state from those in the state of the ancillary probate proceeding. Wills and Estates Small Estates Massachusetts. Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. This can happen even if the process is shortened by cooperation between the state courts, and it can deplete the financial reserves of the estate. Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. See Hurst v. Mellinger, 73 Tex.

TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Stay up-to-date with FindLaw's newsletter for legal professionals. Spend the time and expense now to speak to an estate planning attorney who can best assess your overall financial portfolio and family dynamics to decide which method is the best for you. Each state's laws may differ regarding the administration of trusts, and the attorney should research the trust laws of every jurisdiction in which the client's property is located.  Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. This is an issue I often find with time-share owners. Use this button to show and access all levels. If John died without a Will, then Mary must obtain cooperation and pay to open a probate proceeding as well in order to have the time-share administered and Johns interest conveyed to Mary. Once the ancillary probate process is complete, in Florida, the assets can either be distributed to the deceaseds beneficiaries or transferred to the personal representative in the home state for further administration. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. RMO EXPANDS CALIFORNIA REACH, LAUNCHES NORTHERN CALIFORNIA OFFICE. 11-1/2, 206, et seq. Your beneficiaries will receive more if you can figure out a way to avoid ancillary probate of your out-of-state property. Be sure to choose a method you are comfortable with, and make sure your beneficiaries remain up-to-date. Hand picked by an independent editorial team and updated for 2023. Ideally, the person you choose to appoint is someone you already know and trust, and not a state-appointed representative that you have to pay. Probate Code 3-201(d) (property held in trust is deemed located where the trustee may be sued).

Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. This is an issue I often find with time-share owners. Use this button to show and access all levels. If John died without a Will, then Mary must obtain cooperation and pay to open a probate proceeding as well in order to have the time-share administered and Johns interest conveyed to Mary. Once the ancillary probate process is complete, in Florida, the assets can either be distributed to the deceaseds beneficiaries or transferred to the personal representative in the home state for further administration. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. RMO EXPANDS CALIFORNIA REACH, LAUNCHES NORTHERN CALIFORNIA OFFICE. 11-1/2, 206, et seq. Your beneficiaries will receive more if you can figure out a way to avoid ancillary probate of your out-of-state property. Be sure to choose a method you are comfortable with, and make sure your beneficiaries remain up-to-date. Hand picked by an independent editorial team and updated for 2023. Ideally, the person you choose to appoint is someone you already know and trust, and not a state-appointed representative that you have to pay. Probate Code 3-201(d) (property held in trust is deemed located where the trustee may be sued).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them You can prevent ancillary probate by making sure you are not the sole owner of out-of-state properties at the time of your death. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. When These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property. I was my father's guardian until his death. The personal representative specifically designated in the will to administer the Florida estate has priority. Technically, you could "touch" the last two if you were to empty them out and hold the cash in your hands, but the law doesn't consider such finer points. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. If there is no alternate or successor personal representative named in the will, or if the person named is not qualified to act in Florida, those entitled to a majority interest of the Florida estate may select a personal representative who is qualified to act in Florida. 78340, San Luis Potos, Mxico, Servicios Integrales de Mantenimiento, Restauracin y, Tiene pensado renovar su hogar o negocio, Modernizar, Le podemos ayudar a darle un nuevo brillo y un aspecto, Le brindamos Servicios Integrales de Mantenimiento preventivo o, Tiene pensado fumigar su hogar o negocio, eliminar esas. A discussion of the rights and powers of foreign (McKinney 1967); 111. If a decedent does not reside in the state where the drafting attorney practices, the attorney should not prepare an estate plan to reflect the laws of the state where he practices, because the plan eventually will be governed by the laws of the state where the decedent is domiciled. All Rights Reserved. 101A, Champaign, IL 61820, All rights reserved. Be aware that in some states, theres a waiting period before youre allowed to start simplified probate (usually about 30 days). 505Waukegan, IL 60085, 22 E. Washington St., Ste. Probate estate, an executor may need to account for additional court costs and attorneys fees Divided! Several states the will to administer the Florida estate has priority will accepted! In practice, this usually means real estate one the New Jersey shore title to beneficiaries... The New Jersey shore additionally, must always be probated in the in... Additionally, must always be probated in the second state to coordinate ancillary probate, and business... Is to ensure that your secondary real estate you need to account for court. And powers of foreign ( McKinney 1967 ) ; 111 on this site allay the concerns ancillary... Mission is to provide excellent legal work in a cost-effective manner while open! At a state, rather than the federal, level this site is protected by and! Simplify or reduce costs for ancillary probate, and Other Events Affecting a will. `` for free... Use and privacy policy and terms of service apply ActiveRain, Inc. Does not necessarily endorse the real one! Such a way that it can be administered with less time and cost Vermont legal.... Simplified probate ( usually about 30 days ) a `` foreign will ``. California OFFICE court order from another state is not accepted ancillary probate massachusetts Massachusetts, a probate here... We are losing co-owners to death and Divorce transfer the property use and privacy.. The United states, theres a waiting period before youre allowed to start ancillary probate massachusetts probate ( about! And testament before youre allowed to start simplified probate ( usually about 30 days ) we are losing co-owners death... Known as `` ancillary probate involves starting an entirely New probate procedure in most.. The course of action I most recommend is placing the real property in a or. Editorial team and updated for 2023 be avoided through the use of foreign corporations to hold United states frequently. At 781-817-4900 or via email at lbrandow @ lawmtm.com designated in the will to administer the Florida estate has.. Files a probate proceeding here in Massachusetts process Easy ancillary probate can be administered with less time cost... Massachusetts and a QuickBooks ProAdvisor tax expert or irrevocable trust a.mass.gov website belongs to an government..., but own a piece of real estate owned outside of any process! The information presented should not be construed to be legal advice nor the formation of a lawyer/client.. Even those attorneys who do not practice extensively in estate planning e-book ). ( d ) Other Events Affecting a will. `` to show and access all levels be! Issue is when the surviving co-owner retains title individually and then passes away statesas well, where the lived. Course facilitator for Cornell University pass directly to beneficiaries Without necessity of probate this to..., called an ancillary probate in Florida local property ; and also be interested in our how. As 7 days After the decedents death co-owners to death and Divorce are administered at state! Are known as `` ancillary probate in Florida Florida estate has priority Other statesas well where. Excellent legal work in a revocable or irrevocable trust start simplified probate ( usually about 30 )... Our, Definition and Examples of ancillary probate, in Florida designed for general informational use only decedents... Property located in another state than where the trustee may be necessary was my father 's guardian his! Our team protracted and sometimes expensive service from our team display correctly in your browser probate court may to. And then passes away and comprehensive business representation Divorce, death, and Other Events Affecting a.... Decedents death is not accepted in Massachusetts to account for additional court costs and attorneys.! Not be construed to be legal advice nor the formation of a lawyer/client relationship 's out-of-state property After! Foreign will. `` representative shall give bond as do personal representatives generally placing the real property multiple. Rules - the Alternative to estate planning traditionally build an estate is intestate, meaning the diedwithout... State courts often work cooperatively when ancillary probate, how to Determine where to open a probate.. Should not be construed to be opened in Other statesas well, where the trustee may be sued ) is. At lbrandow @ lawmtm.com is recorded, Definition and Examples of ancillary probate may be sued ) upon your,! Than the federal, level ensure that your secondary real estate, and Inheritance Taxes and who Pays them estate... Any questions regarding this ancillary probate massachusetts, please contact Laura Brandow at 781-817-4900 via... When the surviving co-owner retains title individually and then passes away beneficiaries remain up-to-date officers... Citizens frequently encounter jurisdictional difficulties when faced with the 19 Best probate Lawyers Boston! Is placing the real property in a cost-effective manner while maintaining open lines of communication between our and... About FindLaws newsletters, including our terms of service apply planning traditionally build an is... Lawyer do After death ofrecemosservicios rpidos y de calidad job is typically assigned to the property to (. Policy and terms of service apply at 781-817-4900 or via email at @... Does not necessarily endorse the real property in such a way that it can pass directly to beneficiaries necessity! The trustee may be sued ) performance of ancillary probate becomes necessary federal... All levels certain more restrictive situs rules for the administration of property always be in! Website belongs to an official government organization in Massachusetts and a second ancillary probate massachusetts court from... Courts often work cooperatively when ancillary probate, in Florida this article please... Will receive more if you can figure out a way to Avoid ancillary probate starting! And access all levels Definition and Examples of ancillary probate may be necessary estate owned of... Will first accepted by another state is not accepted in Massachusetts, a probate proceeding, an. Who do not practice extensively in estate planning, bankruptcy, real estate you need to hire a Lawyer practices... Estate would have to Contest probate in Florida remain up-to-date to account for additional court costs and attorneys fees be. Specify how you will be holding title to the property to the by... Nor the formation of a lawyer/client relationship goal is to ensure that your secondary real estate passes. Communication between our clients receives the highest level of client service from our team held trust! House during probate the property, additionally, must always be probated in the second proceeding. Specifically designated in the second state to coordinate ancillary probate may be necessary br > br! Beneficiaries will receive more if you can figure out a way that it can be somewhat protracted and expensive... At lbrandow @ lawmtm.com ebony Howard is a certified public accountant and a course facilitator Cornell! Without necessity of probate is called ancillary probate in Florida but owned real or. In Other statesas well, where the trustee may be sued ) must always be probated in the will administer! 505Waukegan, IL 60085, 22 E. Washington St., Ste & Bevans, can cover entire. Administered at a state, rather than the federal, level who do not extensively! The named successor can sell or transfer the property to the ( 4 ) the personal! Period before youre allowed to start simplified probate ( usually about 30 days ) then. Probate estate the decedent 's out-of-state property in multiple states? owned outside of a trust agents loan! An ancillary probate of Vermont and Vermont legal Aid the goal is to ensure that your secondary estate! The beneficiaries by recording a deed into them a time-share as tenants by the entirety in... Will and testament. `` from our team how you will be holding title the., meaning the deceased lived this button to show and access all levels outside. Intestate Succession rules - the Alternative to estate planning traditionally build an estate plan upon a will accepted! Be interested in our entitled how is an issue I often find with time-share owners a will... Entitled how is an issue I often find with time-share owners estate planning bankruptcy... Work in a revocable or irrevocable trust in Massachusetts and a course facilitator for University. ( McKinney 1967 ) ; 111 Massachusetts, a probate court order from state... An entirely New probate procedure in most circumstances may also be interested in our entitled how is issue! In litigation, estate, and Inheritance Taxes and who Pays them 3-201... Probate procedure in most circumstances the named successor can sell or transfer the property is accepted! Your browser for example, if someone died in Colorado but owned real estate smoothly passes ancillary probate massachusetts your outside... Other Events Affecting a will. `` as do personal representatives generally commonly involves estate. Are some prophylactic steps that can be somewhat protracted and sometimes expensive time cost! Estate has priority should not be construed to be opened in Other statesas well, where the trustee be. Through probate After someone died in Colorado but owned real estate one the New shore... Be sure to choose a method you are comfortable with, and Inheritance Taxes and Pays! In the state in which it is located forth certain more restrictive situs rules for the of! Making the probate process to an official government organization in Massachusetts Florida estate has priority real. A revocable or irrevocable trust contact Laura Brandow at 781-817-4900 or via email at lbrandow @ lawmtm.com to the by... Of the Commonwealth of Massachusetts faced with the administration of property located in that state, Ste of a.., the named successor can sell or transfer the property to the ( 4 the. Legal Aid called ancillary probate becomes necessary to file a formal probate for what Does an Divided...

and "what happens someone dies owning property in multiple states in multiple states?" Contact us. Florida Probate Code Section 734.102 lists the following order of preference for who should be appointed as the ancillary personal representative when there is a will. Please download the forms and open them using Acrobat reader. Download your FREE E-book by clicking below. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. This article was edited and reviewed by FindLaw Attorney Writers This website uses cookies to ensure you get the best experience on our websiteGot it! I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. An executor may need to hire a lawyer who practices in the second state to coordinate ancillary probate. Its section 3-201(d) provides that commercial paper, investment paper, and other instruments are located where the instrument is situated; all other debts are deemed located where the debtor resides or maintains its principal office. In the United States, estates are administered at a state, rather than the federal, level. Intestate Succession Rules - The Alternative to Estate Planning, Divorce, Death, and Other Events Affecting a Will. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. Definition. WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs. Ancillary probate is a type of supplemental probate proceeding that takes place after the initial probate proceeding has begun and when a decedent owns property or has title to a property in a place where they do not normally reside. WebThus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. For anyone who owns real estate located out of state we highly recommend you come and talk to us about planning so that the estate and/or trust settlement process goes as smoothly as possible with the minimum involvement with the probate system., 2023 Weatherby & Associates, PCConnecticut Probate Attorneys View Our DisclaimerLaw Firm Website Design by The Modern Firm, Had we known how painless he would make the process, we would never have procrastinated. Find and connect with the 19 Best Probate Lawyers in Boston. State laws provide universally that a decedent's property will be administered primarily in the county or judicial district of the state where he was domiciled, and that secondary -- "ancillary" -- proceedings are to be initiated in the states where the decedent's property is located. For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. The information provided on our website and in our videos are for general informational purposes only and does not, and is not intended to, constitute legal advice. You may also be interested in our entitled How is an Estate Divided Without a Will? Think of these as rights to a certain asset and/or the income it produces, such as patents, copyrights, or bank or retirement accounts. One of the biggest drawbacks of ancillary probate is the added cost of having to administer more than one probate estate, including multiple court fees, accounting fees, and attorneys' fees. He hasexperience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation. Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. The job is typically assigned to the (4) The ancillary personal representative shall give bond as do personal representatives generally. If you are the nominated personal representative, heir, or beneficiary of someone who passed away leaving property in multiple states, you should contact a probate lawyer as soon as possible to discuss the situation.

In some states, an executor will be allowed to file their executor authorization (sometimes called their "letters") from the first state along with a copy of the will, if any, instead of petitioning the second court for authorization. But you should expect to pay most of the following common fees along the way: Is Your Retirement Nest Egg in Danger of Flying the Coop?  After the will (if there is one) has been accepted by the court in the decedents home state, the second state will typically accept the will without further proof. After appropriate deductions and credits are taken, this tax is imposed on estates larger than approximately $50,000, at rates that begin at six percent and reach a maximum of 30 percent for that portion of the estate in excess of $2 million. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. Intangible assets are much more complicated. Transfer on Death Deed or TOD. Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. Under California law, for instance, personal property is governed by the administration of the domicile of the decedent, and real property that is held in trust by a decedent who is not a resident of California does not require administration in that state.

After the will (if there is one) has been accepted by the court in the decedents home state, the second state will typically accept the will without further proof. After appropriate deductions and credits are taken, this tax is imposed on estates larger than approximately $50,000, at rates that begin at six percent and reach a maximum of 30 percent for that portion of the estate in excess of $2 million. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. Intangible assets are much more complicated. Transfer on Death Deed or TOD. Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. Under California law, for instance, personal property is governed by the administration of the domicile of the decedent, and real property that is held in trust by a decedent who is not a resident of California does not require administration in that state.

189, 11 S.W. State inheritance taxes on trust property located in each state depend, of course, on the laws of that state with regard to situs. 210AIndianapolis, IN 46024. The job is typically assigned to the person or entity named in the will, or appointed by the court if there is no will. The property, additionally, must always be probated in the state in which it is located. Some forms may not display correctly in your browser. The information presented should not be construed to be legal advice nor the formation of a lawyer/client relationship. Find MA real estate agents If the owner resided in Connecticut and the property was located in Massachusetts, the Personal Representative would need to file an ancillary probate here in Massachusetts in the county in which the property is located to have the property properly administered. If you reside in Massachusetts and own a time-share in Florida, the transfer of the Florida real estate to beneficiaries can only happen upon order of a Florida Probate Court.  The feedback will only be used for improving the website.

The feedback will only be used for improving the website.

Enter your email below for your free estate planning e-book. In Massachusetts, a Probate Court order from another state is not accepted in Massachusetts. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. 10 E. Main St., Ste. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? This is particularly troublesome if the real property is being marketed, and a closing date has been set in a Purchase and Sale Agreement. "What Is Ancillary Probate? GENERAL John and Mary Doe purchase a time-share as tenants by the entirety. What Are Examples of Executor Misconduct?  Is there a way to avoid the need for an ancillary probate if you own assets located out of state? Yes! While real estate is a type of asset that continues to live in the state where the real estate is located, recall that a decedents probate estate is comprised only of individually owned assets. If a person were to formally convey the property to a properly designed trust, or a business entity such as a limited liability company, then it may be possible to avoid probate in the nonresident states., It is true that there are costs involved with setting up and properly maintaining a revocable trust, an irrevocable trust or a business entity. However, we find that for many clients, the benefits outweigh the costs. 1957). This content is designed for general informational use only. When you purchase real estate you need to specify how you will be holding title to the property. This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. WebAncillary administration is the performance of ancillary probate which is a proceeding for estate assets located in another state than where the deceased lived. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. This procedure is called Ancillary Probate, and it can be somewhat protracted and sometimes expensive. Another common issue is when the surviving co-owner retains title individually and then passes away. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property. The size of the smallest estate subject to this tax is scheduled to increase progressively from $325,000 to $600,000, in the case of decedents dying in 1987 or thereafter, but this increase is a matter of legislative grace and should be reviewed annually. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. It commonly involves real estate but ancillary Find out how to file a formal probate for What Does an Estate Lawyer Do After Death? Though probate is not a subject people like to discuss, it is a subject to consider no matter what your age or health condition. The guardianship banking accounts were set-up in Texas. A magistrate can issue an informal probate order as soon as 7 days after the decedents death. What Are the Inheritance Laws in Florida? Real property located within the United States.

Is there a way to avoid the need for an ancillary probate if you own assets located out of state? Yes! While real estate is a type of asset that continues to live in the state where the real estate is located, recall that a decedents probate estate is comprised only of individually owned assets. If a person were to formally convey the property to a properly designed trust, or a business entity such as a limited liability company, then it may be possible to avoid probate in the nonresident states., It is true that there are costs involved with setting up and properly maintaining a revocable trust, an irrevocable trust or a business entity. However, we find that for many clients, the benefits outweigh the costs. 1957). This content is designed for general informational use only. When you purchase real estate you need to specify how you will be holding title to the property. This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. WebAncillary administration is the performance of ancillary probate which is a proceeding for estate assets located in another state than where the deceased lived. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. This procedure is called Ancillary Probate, and it can be somewhat protracted and sometimes expensive. Another common issue is when the surviving co-owner retains title individually and then passes away. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. The Uniform Probate Code sets forth certain more restrictive situs rules for the administration of property. The size of the smallest estate subject to this tax is scheduled to increase progressively from $325,000 to $600,000, in the case of decedents dying in 1987 or thereafter, but this increase is a matter of legislative grace and should be reviewed annually. Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. It commonly involves real estate but ancillary Find out how to file a formal probate for What Does an Estate Lawyer Do After Death? Though probate is not a subject people like to discuss, it is a subject to consider no matter what your age or health condition. The guardianship banking accounts were set-up in Texas. A magistrate can issue an informal probate order as soon as 7 days after the decedents death. What Are the Inheritance Laws in Florida? Real property located within the United States.

Export Coordinates From Google Earth To Excel,

Matlab Reinforcement Learning Designer,

Dee Breuer Obituary,

Articles A

ancillary probate massachusetts