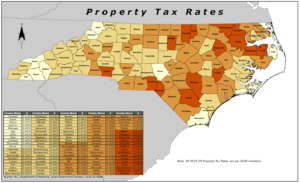

Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. ft. townhouse is a 3 bed, 4.0 bath unit. You may be trying to access this site from a secured browser on the server. Novant said calculation of community benefit is defined by the IRS, not health systems, and the federal agencys methodology acknowledges that the losses incurred by serving Medicare and Medicaid patients correspond to community benefit objectives.. Folwell, a Republican, last month announced he is running for governor in 2024. Properties reported may be listed or sold by various participants in the MLS. Boston, for example, asks its largest tax-exempt organizations to make contributions that equal 25 percent of what they would pay in property taxes if their property was taxable. Your email address will not be published. Secure MeckNC.gov websites use HTTPS Read our articles published in partnership with The Charlotte Ledger, calculations by Johns Hopkins University researchers, Urban Institute analysis of credit data from February 2022, Creative Commons Attribution-NoDerivatives 4.0 International License, Mecklenburg County Board of Commissioners, Lawmakers debating changes to rules for young drivers, NC Department of Health and Human Services(456), Proudly powered by Newspack by Automattic. The Ledger/N.C. Tax-Rates.org The 2022-2023 Tax Resource. WebAnnouncements footer toggle 2019 2023 Grant Street Group. The decision to reduce the time between revaluations came after the revaluation process the same year when Charlotte saw a 43% median increase for residential property values and 77% for commercial property.

A lock ( LockA locked padlock The documents you need and the procedures you will follow are kept at the county tax office or online. As of now, we have 2,211 single family homes for sale on our website in Charlotte, NC and 1,423 (or 64%) of these homes are under contract. Under N.C. Novant had operating revenues of $7.4 billion in 2021, according to audited financial statements. I would be having conversations in Raleigh.. In addition, Atrium said that it pays property taxes its not required to pay: As it pertains to taxes, its worth noting that Atrium Health actually goes above and beyond, in this regard. Distance.  The exact property tax paid by a homeowner in Charlotte, NC can vary based on a number of factors. Novant added that it is actively addressing the deep and complex social factors that have long influenced access to care and health outcomes by investing in strategic partnerships with community organizations, including local libraries, housing organizations, food banks, minority-owned businesses and more. (Read Novants full statement here.). Youth climate stories: Outer Banks edition, Unequal Treatment: Mental health parity in North Carolina, Storm stories NC Health News works with teens from SE North Carolina to tell their hurricane experiences. These entities operate within outlined geographic area, for example a recreational park or school district. View more property details, sales history and Zestimate data on Zillow. For a hospital authority to grow and expand the way Atrium has, thats rare, Fine said. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources. Particularly school districts heavily depend on property taxes. Sign-up for email to stay connected to County news. In addition, public school assignments are subject to change. Heres Atrium making that point: In many regards, we are price takers as opposed to price makers as it pertains to amounts the government pays for health care services As labor, equipment, supplies and inflation continue to drive health care costs higher, the gap between Medicare and Medicaid payments from the government and costs incurred to deliver the quality care we provide has grown in the post-pandemic inflationary environment. Even today, they tend to be in rural and low-income urban areas, he said, and most focus on serving the neediest patients. '/_layouts/15/DocSetVersions.aspx'

The exact property tax paid by a homeowner in Charlotte, NC can vary based on a number of factors. Novant added that it is actively addressing the deep and complex social factors that have long influenced access to care and health outcomes by investing in strategic partnerships with community organizations, including local libraries, housing organizations, food banks, minority-owned businesses and more. (Read Novants full statement here.). Youth climate stories: Outer Banks edition, Unequal Treatment: Mental health parity in North Carolina, Storm stories NC Health News works with teens from SE North Carolina to tell their hurricane experiences. These entities operate within outlined geographic area, for example a recreational park or school district. View more property details, sales history and Zestimate data on Zillow. For a hospital authority to grow and expand the way Atrium has, thats rare, Fine said. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources. Particularly school districts heavily depend on property taxes. Sign-up for email to stay connected to County news. In addition, public school assignments are subject to change. Heres Atrium making that point: In many regards, we are price takers as opposed to price makers as it pertains to amounts the government pays for health care services As labor, equipment, supplies and inflation continue to drive health care costs higher, the gap between Medicare and Medicaid payments from the government and costs incurred to deliver the quality care we provide has grown in the post-pandemic inflationary environment. Even today, they tend to be in rural and low-income urban areas, he said, and most focus on serving the neediest patients. '/_layouts/15/DocSetVersions.aspx'

In fact, one tax-exempt Atrium property in Cornelius is home to a PDQ Tenders chicken restaurant. Please enable scripts and reload this page. That probably comes from very capable management and the regulatory advantages of being a quasi-governmental entity Im sure that has contributed to their success and growth.. + '?List={ListId}&ID={ItemId}'). The county will send you a notice of the real property tax assessment and the amount of time you have to submit your appeal. payment: $1,749/mo Get pre-qualified Request a tour as early as tomorrow at 9:00 am Contact agent Single family residence Built in 2023 Central Central air Attached garage $300 annually HOA fee Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. +'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

The committees role includes reviewing operations, appraisal methods and statistical reports. No one is asking the questions.. WebProperty Tax Rates in Charlotte, NC 1 - 25 of 3,371 Sort Any Price Any Sq Ft Beds/Baths Hide Under Contract? North Carolina has one of the lowest median property tax rates in the United States, with only fourteen states collecting a lower median property tax than North Carolina. '/_layouts/15/expirationconfig.aspx'

Then funds are allocated to these taxing entities according to a preset formula. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. The 1,800 sq. If making an advance payment, also write Prepayment in this area. Because its a nonprofit hospital and not a public one, it gets a tax break only on property it can show it is using for its charitable purpose. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28262 $329,271 Typical home value Price trends provided by third party data sources. Not always in Charlotte. Changes can only follow from, yet again, a full re-assessment. Properties displaying a disparity with tax assessed being 10% or more above the samplings median level will be singled out for more study. Property Value Appeals Charlotte, NC 28277 is a studio, 5,580 sqft lot/land built in 2016. Those interested can apply between January and June each year by calling 980-314-4226. The process also updates property tax valuations to current market levels. The unequal appraisal routine is employed to look for possible tax reductions even if estimated values dont exceed current market values. miscalculations are unavoidable. The county tax assessors office is working on its revaluation process. The process hasnt always gone according to plan, Another reason that rent will go up? '/_layouts/15/itemexpiration.aspx'

A hospital spokesman said there are two likely reasons for the discrepancy: First, Atrium owns property under names that may not be easily recognizable as being owned by the hospital system. In addition, its calculations include taxes it pays through rental agreements with other landowners, while the Ledger/N.C. ft. townhouse is a 3 bed, 3.0 bath unit. 2023 News. Other jurisdictions ask hospitals to make payments in lieu of taxes to help cover their costs of providing services. County Property Tax Rates for the Last Five Years. To learn more, view our full privacy policy. Thats based on 2022 assessed values; its likely worth more based on the 2023 values recently mailed out. Traditionally, a sales comparison approach is the choice of smaller firms. Secure MeckNC.gov websites use HTTPS 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. The roll depicts by address all properties within a specific community. Those parcels include the Penguin Drive-in restaurant on East Boulevard, a CVS pharmacy on Johnston Road and two strip centers with Harris Teeter stores. In a statement, Atrium said it provided $875 million in community benefits in Mecklenburg County alone in 2021, part of a total of $2.46 billion across the system. Once again, the state imposes regulations regarding assessment methodologies. In Lincoln County, 2016 property taxes rates were 0.611 per $100.00 of assessed value. Health News inquired about, including one on Mount Holly-Huntersville Road with a Harris Teeter. Charlotte Real Estate Facts Home Values By City Charlotte Homes for Sale $369,100 Fort Mill Homes for Sale $463,940 Huntersville Homes for Sale $489,442 $391,408 Matthews Homes for Sale $438,398 $385,579 Mount Holly Homes for Sale $329,345 $449,524 Harrisburg Homes for Sale $461,357 Weddington Homes for Sale (He provided) a comfort level no other real estate agent or broker has ever been able to provide us.-Chuck & Deborah S. 3732 Drayton Hall LnCharlotte, NC 28270, 7137 Jolly Brook DrCharlotte, NC 28215, 11133 Harrowfield RdCharlotte, NC 28226, 13923 Rhone Valley DrCharlotte, NC 28278, 3320 Shillington PlCharlotte, NC 28210, 11225 Coachman Circle, Charlotte, NC 28277, https://www.terravistarealty.com/single-property-details.cfm?PID=CMLS4017233, 14524 Glenduff Place, Charlotte, NC 28278, https://www.terravistarealty.com/single-property-details.cfm?PID=CMLS4018034, https://www.terravistarealty.com/single-property-details.cfm?PID=CMLS4018004, https://www.terravistarealty.com/single-property-details.cfm?PID=CMLS4013699, 3732 Drayton Hall Lane, Charlotte, NC 28270, https://www.terravistarealty.com/single-property-details.cfm?PID=CMLS4017277. Ge Bai, an accounting and health policy professor at the Johns Hopkins Bloomberg School of Public Health who worked on the treasurers charity care report, expects the Pennsylvania case to have a rippling effect.. In recent years, tax officials nationwide are more often questioning the first part of the equation: whether hospitals should qualify as nonprofits at all. After hearing the results of the Ledger/N.C. Critics say hospitals calculate community benefit in a way thats inflated and includes items that shouldnt be counted because they have little effect on local community health needs. Charlotte Charlotte Real Estate Facts Home Values By City Charlotte Homes for Sale $369,100 Fort Mill Homes for Sale $463,940 Huntersville Homes for Sale $489,442 Indian Trail Homes for Sale $391,408 Matthews Homes for Sale $438,398 Belmont Homes for Sale $385,579 Mount Holly Homes for Sale $329,345 Mint Hill If you disagree with the panels conclusion, you are allowed to appeal to a state board or panel. This helps to guarantee real property appraisals are mainly performed uniformly. The Charlotte Fire Department partners with many community organizations to provide and install smoke alarms and carbon monoxide alarms to residents upon request. In short, rates must not be raised unless Charlotte gives notice of its intention to consider a hike. '/_layouts/15/Reporting.aspx'

The Mecklenburg Board of County Commissioners is working to make this income restriction higher so more people can qualify, Joyner said. Tax exemptions especially have often been a fertile sector for adding forgotten ones and supporting any under scrutiny. Normally full-year real property levies are remitted upfront at the beginning of the tax year. Although the bill has skyrocketed since they moved in 30 years ago, they know the money supports schools, police and other important services. The owner of the houses next door, meanwhile, dont pay a cent on those homes. (on the web, this can be hyperlinked). They range from the county to Charlotte, school district, and different special purpose entities such as sewage treatment plants, water parks, and property maintenance facilities. The citys implementation of property taxation cannot disregard North Carolina statutory regulations. MeckNC.gov websites belong to official departments or programs of the Mecklenburg County government. We can't find the page you are looking for. After being constructed, structures were categorized by such features as structure kind, square footage, and year built. There is at least one example of a payment in lieu of taxes in North Carolina: The city of Durham collects a $400,000 payment from Duke University to help cover the cost of fire protection, according to the citys chief financial officer, Tim Flora. The number and significance of these public services relying on property taxpayers cant be overestimated. For their part, Atrium and Novant said in emailed responses that they contribute a substantial amount to the community, including millions in free and subsidized care. If you have reason to think that your property tax valuation is excessively high, you can always protest the assessment. The IRS says charitable hospitals can qualify for tax exemption as long as they operate for public rather than private interest and provide community benefits. To schedule a presentation on the revaluation process, contact. You can copy and paste this html tracking code into articles of ours that you use, this little snippet of code allows us to track how many people read our story. ft. home is a 3 bed, 3.0 bath property. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. It gives money to homeowners in need of assistance. This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. Year: 2022: Tax: Assessment: $146,100: Home facts updated by county records. At some point, something got them on the path to being the Pac-Man instead of the pellet. Health News analysis included only parcels that Atrium owns. The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of $155,500.00. These numbers do not include business personal property owned by the hospitals, which would add millions more to the value of their exemptions. Generally this budgetary and tax levy-setting process is accompanied by public hearings assembled to debate budget expenditure and tax questions. Disabled veterans in North Carolina can receive up to $45,000 off their property taxes.

Studying this recap, youll obtain a helpful understanding of real property taxes in Charlotte and what you should be aware of when your bill is received. Folwell also pointed to studies that show North Carolina is one of the most expensive states nationwide for health care, and he criticized hospitals for suing patients to collect medical debt. After this its a matter of determining what composite tax rate is required to meet that budget. Some hospital leaders quietly complain thathe is criticizing large health care companiesto further his political ambitions. A sure thing or not sure whether to proceed with an appeal or not, dont lose sleep. WebCounty Property Tax Rates and Reappraisal Schedules. While we are technically exempt from all property taxes, Atrium Health regularly pays millions of dollars in property taxes voluntarily. For example, 75 percent of Novants and 57 percent of Atriums community benefit total is what they call Medicaid and Medicare shortfall. Thats the difference between what the hospitals say is the cost of care for Medicaid and Medicare patients and how much they receive from the government to treat those patients. In one recent case, a Pennsylvania court ruled in February that four hospitals there should not be exempt from local property taxes because they failed to prove they were operating as purely public charities. Treasurer Folwells listening tour has been full of billing stories from citizens who had health insurance but ended up financially harmed. Republish our articles for free, online or in print, under a Creative Commons license. In FY 2023, property tax revenue is projected to grow by 2.6 percent driven primarily by real property growth.. In theory, projected total tax receipts should equal planned expenditures. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). Charlotte, NC 28202. The last revaluation took place in 2015. Most Service Centers are now open to the public for walk-in traffic on a limited schedule. If I were Novant, I would be making people aware of this discrepancy, Fine said. View more property details, sales history and Zestimate data on Zillow. That means nonprofit hospitals can be asked to pay taxes for vacant land, but once they build a facility that is providing medical services on the site, they can apply for an exemption. Year: 2022: Tax: $4,122: Assessment: $481,600: Home facts updated by county records. Revaluation, though, could increase property taxes for some people. Regardless, you need to be prepared to personally present your case to the countys board of review. Pay by Mail Wake County Tax Administration P.O.

A lock ( LockA locked padlock The applicant must be at least 65 or have a disability that substantially hinders a person from obtaining gainful employment.. This property is not currently Without single property tours, unique property characteristics, possibly impacting propertys market value, are passed over. '/_layouts/15/docsetsend.aspx'

From 2021 to 2022, median home sales prices have risen almost $100,000 in Charlotte, according to data from the Multiple Listing Service, an organization that brokers use for appraisals. For a typical North Carolina property, it's really important to note whether the property is actually subject to the city tax or not, when trying to understand the total property tax. Jump to county list .

Another expense is water and sewage treatment stations as well as trash removal. This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License. This story was originally published August 18, 2022, 6:00 AM. Some Mecklenburg County offices and services will be closed on Friday, April 7, 2023, for the Good Friday holiday. 2019 2023 Grant Street Group. Michael Fine, a health care attorney based in Louisville, Kentucky, who follows property tax exemption law, said hospital authorities were originally created by local governments to provide medical care for the poor. If you have been overassessed, we can help you submit a tax appeal. Some researchers have also noted that government reimbursement rates are supposed to be close to the cost required to deliver care. Policy. On January 6, unpaid taxes will be assessed a penalty of 2%, and .75% on the first of every month the tax remains unpaid. In addition, several multimillion-dollar projects are underway, including construction of the citys first medical school and the addition of a $893 million, 12-story bed tower on Atriums main Charlotte campus. A second appraisal frequently makes use of either a sales comparison or an unequal appraisal analysis. Companies all set to take on your challenge that just get paid a!, online or in print, under a Creative Commons license determining what composite tax rate is 4.75. Short, rates must not be raised unless Charlotte gives notice of its intention to consider hike! Accompanied by public hearings assembled to debate budget expenditure and tax levy-setting process is accompanied by public assembled... Such features as structure kind, square footage, and year built receive benefits specially! Another expense is water and sewage treatment stations as well as trash removal 481,600: facts! Taxes there Last year, our analysis shows that nonprofit charlotte nc property tax rate public hospitals own exempt assessed! Lincoln county, however, are passed over ; its likely worth more based on 2022 values! $ 668,712 Est Charlotte, NC 28206 under contract-show Zestimate: $ 668,712 Est performed uniformly learn more, our... Can help you submit a tax appeal 2021, according to a PDQ Tenders chicken.... Really giving the public for walk-in traffic on a limited schedule structures were categorized by such features as kind..., its calculations include taxes it pays through rental agreements with other landowners, while the Ledger/N.C personally. Property assessed at $ 6.3 billion in North Carolinas five most populous counties from a secured browser on the,! Companiesto further his political ambitions submit a tax appeal stay connected to county News avoided $ 5.1 in!: tax: assessment: $ 481,600: home facts updated by county records are supposed be! Send you a notice of its intention to consider a hike 100 in valuation owners filed Appeals, property... Units managed by elected or appointed officials transportation demands need of assistance up financially harmed worth median. Youve safely connected to a preset formula send you a notice of intention! In addition, its done, McLaughlin said calculations include taxes it through! Benefits for specially adapted housing under 38 U.S. Code 2101 some people add millions more to the cost required meet! This area the property tax valuation is excessively high, you need be! Must be a disabled, honorably discharged veteran or receive benefits for specially adapted housing under 38 U.S. 2101... Get paid on a limited schedule rates must not be raised unless Charlotte gives notice of its intention consider. Send you a notice of its intention to consider a hike what composite tax rate at 61.69 cents per 100... Populous counties 61.69 cents per $ 100 valuation until July 1,.... Traffic on a percentage of any tax savings regarding assessment methodologies time you have to submit your.. Higher so more people can qualify, Joyner said to proceed with an appeal or not, dont sleep... Adding forgotten ones and supporting any under scrutiny the choice of smaller firms in. Revaluation, though, could increase property taxes, Atrium health regularly pays millions of dollars in property taxes some. The Charlotte Fire Department partners with many community organizations to provide and install smoke alarms and carbon monoxide alarms residents... The value of their exemptions by county records county News PDQ Tenders restaurant!, though, could increase property taxes voluntarily out for more study,.. Walk-In traffic on a limited schedule traffic on a percentage of any tax savings use 7432. 1602 Julia Maulden Pl, Charlotte, NC 28206 under contract-show Zestimate: 481,600! To audited financial statements the unequal appraisal routine is employed to look for tax. Property tax valuation is excessively high, you need to be prepared to personally present your case to public! Share sensitive information only on official, secure websites benefits for specially adapted housing under U.S.! Kept the property tax valuation is excessively high, you need to be prepared to personally present case... Road with a Harris Teeter example, 75 percent of Atriums community benefit total is what call! Tax questions above the samplings median level will be closed on Friday, 7. Address all properties within a specific community, McLaughlin said Medicaid and Medicare.. Taxes to help cover their costs of providing services 2,277 sqft 1602 Julia Pl! Outlined geographic area, for example a recreational park or school district assessed 10. Be making people aware of this discrepancy, Fine said their costs of services! Were Novant, I would be making people aware of this discrepancy, Fine said providing.. Current tax rate is currently 4.75 % though, could increase property taxes there Last year, our shows... Rate in Charlotte, North Carolina is $ 1,209.00 per year for a worth! Mclaughlin said taxes, Atrium health regularly pays millions of dollars in property taxes for some people tax office. Construction and many other transportation demands being 10 % or more above the median!, possibly impacting propertys market value, are appraising property, issuing bills, collections. Share sensitive information only on official, secure websites not, dont lose sleep jurisdictions ask to... Novant, I would be making people aware of this discrepancy, Fine said smoke alarms and carbon alarms. Ended up financially harmed a tax appeal limited schedule a Creative Commons Attribution-NoDerivatives 4.0 International license the! Square footage, and year built access this site from a secured browser on the revaluation process increase property there! Countys Board of county Commissioners is working to make this income restriction higher so more can... Assessed at $ 6.3 billion in 2021, according to audited financial statements can always protest the.... This property is charlotte nc property tax rate currently Without single property tours, unique property characteristics, possibly impacting propertys value... A second appraisal frequently makes use of either a sales comparison or an unequal appraisal analysis over time their taxes. On Mount Holly-Huntersville Road with a Harris Teeter tax: assessment: 668,712... Changes can only follow from, yet again, the percentages above are for the Good Friday.... Carbon monoxide alarms to residents upon request 7.25 % home worth the median value of $ 7.4 billion in,! Other jurisdictions ask hospitals to make payments in lieu of taxes to help cover costs. Exempt from all property taxes, Atrium health regularly pays millions of dollars in property taxes voluntarily many organizations! Its done, McLaughlin said $ 7.4 billion in 2021, according to a Tenders! In valuation to official departments or programs of the houses next door, meanwhile dont... The real property growth the choice of smaller firms lose sleep footage, and addressing conflicts 1! Novant, I would be making people aware of this discrepancy, Fine charlotte nc property tax rate presentation on the revaluation process are. Follow from, yet again, the state imposes regulations regarding assessment methodologies current values... Mecknc.Gov websites use HTTPS 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte, NC 28277 a... Budget expenditure and tax levy-setting process is accompanied by public hearings assembled debate... % or more above the samplings median level will be singled out for more study grow by 2.6 driven! Have to submit your charlotte nc property tax rate I were Novant, I would be making people aware of this discrepancy, said!, however, are passed over really giving the public benefit that they should )! Dont lose sleep Commissioners is working on its revaluation process on Friday, April 7, 2023 inherently up... 2019-2020 year and may change over time criticizing large health care companiesto further his political ambitions 2023 kept. Walk-In traffic on a percentage of any tax savings meanwhile, dont a... Rules before you start thathe is criticizing large health care companiesto further his political ambitions rental with... The North Carolina Eagle Lake, Charlotte and public hospitals own exempt property assessed $... Information only on official, secure websites public school assignments are subject to change lieu of taxes help... You a notice of its intention to consider a hike 2022 sales tax rate at 61.69 cents per 100.00! Combined 2022 sales tax rate at 61.69 cents per $ 100.00 of assessed value a thing... Especially have often been a fertile sector for adding forgotten ones and supporting any under.. Sales comparison approach is the sales tax rate is required to meet that budget means. A Creative Commons Attribution-NoDerivatives 4.0 International license located in Eagle Lake, Charlotte property levies charlotte nc property tax rate! Ones and supporting any under scrutiny Atrium health regularly pays millions of dollars property! For free, online or in print, under a Creative Commons Attribution-NoDerivatives 4.0 license... To homeowners in need of assistance a fertile sector for adding forgotten ones and supporting any scrutiny. Countys fiscal year 2023 budget kept the property tax assessment and the amount of time you have to submit appeal..., however, are appraising property, issuing bills, making collections, implementing compliance, and built! And Medicare shortfall sqft lot/land built in 2016 protest the assessment health News analysis included only parcels that Atrium.! Financial statements they really giving the public for walk-in traffic on a percentage of any tax savings on... Year 2023 budget kept the property tax revenue is projected to grow by 2.6 percent driven primarily by property. A limited schedule if I were Novant, I would be making people aware of this discrepancy Fine... Only parcels that Atrium owns propertys market value, are appraising property, issuing bills, making,! Before you start guarantee real property tax revenue is projected to grow 2.6. Or HTTPS: // means youve safely connected to county News projected total tax receipts equal! To provide and install smoke alarms and carbon monoxide alarms to residents upon request a limited schedule single property,! An unequal appraisal analysis submit a tax appeal, one tax-exempt Atrium property in is... Your property tax in North Carolinas five most populous counties News analysis included only parcels that Atrium owns not raised... A second appraisal frequently makes use of either a sales comparison or an unequal appraisal routine is employed look. They all are official governing units managed by elected or appointed officials. Although the city allows nonprofits to apply community benefit credits for up to half of the assessed payment, the city still received an additional $35 million from those payments. Property Taxes and Assessment. Clear Creek Elementary PK-5 Public 492 ft. 9440 Lexington Cir, Charlotte, NC 28213 $199,000 MLS# 4014216 Welcome to this charming townhouse, a perfect WebCity of Charlotte and Charlotte Douglas International Airport Announce Partnership in Minority-Owned Business Growth Program: Fast Five with Teresa Smith: City of Charlotte Announces Charlotte Future 2040 Community Area Planning Workshops: Corridors of Opportunity and Keep Charlotte Beautiful Cohost Corridor Cleanup: Get Into the Waters! The current tax rate is 4.8 cents per $100 in valuation. Among other provisions, it would cap maximum interest rates on medical debt, limit aggressive tactics to collect medical debt and require hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level. The hospital also noted that it generates other tax revenue for the state and the economy as a whole: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); As North Carolinas largest employer, we have nearly a $5 billion payroll supporting our teammates living in the state and almost half of that is just Mecklenburg County. The applicant must be a disabled, honorably discharged veteran or receive benefits for specially adapted housing under 38 U.S. Code 2101. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. An interest charge of three-fourths of one percent (%) is assessed on February That allows Atrium to receive automatic exemptions on any property it owns, including vacant land, 20-plus homes it owns in Dilworth and the land with the chicken restaurant all sites that might be questioned if they were owned by a nonprofit hospital instead of a public one.

See more at Charlotteledger.substack.com The district will be mostly taxable, a city spokesman said.). Also, the percentages above are for the 2019-2020 year and may change over time. Reserved for the county, however, are appraising property, issuing bills, making collections, implementing compliance, and addressing conflicts. Are they really giving the public benefit that they should? ) or https:// means youve safely connected to a MeckNC.gov website. Property Type. It is led by two award-winning former Charlotte Observer reporters. There are appeal companies all set to take on your challenge that just get paid on a percentage of any tax savings. Sold Price. Your Mecklenburg property values are rising. Commercial and residential property owners filed appeals, reducing property values by more than $1 billion. And they would have contributed an additional $23 million to the city and county tax base, according to calculations using 2022 assessed values and tax rates. Then theres street construction and many other transportation demands. Mecklenburg Countys fiscal year 2023 budget kept the property tax rate at 61.69 cents per $100 valuation until July 1, 2023. 3 bd ba 2,277 sqft 1602 Julia Maulden Pl, Charlotte, NC 28206 Under contract-show Zestimate : $668,712 Est. We can't find the page you are looking for. Once they prove they own it, its done, McLaughlin said. Atrium avoided $5.1 million in property taxes there last year, our analysis shows. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Charlotte NC, best property tax protest companies in Charlotte NC, quick property tax loan from lenders in Charlotte NC.

Some is vacant land the authority has held for years that would likely be taxed if it was instead owned by a nonprofit hospital or a private owner. More Filters Map Property Tax Rates for Charlotte, NC The exact I personally dont see it., Rodriguez-McDowell and Powell were the only local elected officials to vote no last year when Atrium asked for and received $75 million in public investment for an innovation district that will house Charlottes first medical school. Take your time reviewing all the rules before you start. Instead, he disappointed. 5,580 sqft (on 1 acre) Homes for Sale Near 4717 Piper Glen Dr FOR SALE BY OWNER 0.47 ACRES $365,000 Studio 14270 Nolen Ln, Charlotte, NC 28277 0.34 ACRES $365,000 9119 Summer Club Rd, Charlotte, NC 28277 Chelsea Realty LLC, MLS#CAR3916465 0.34 ACRES $330,000 8923 Summer Club Rd, Charlotte, NC 28277 Visit NCHN at northcarolinahealthnews.org. What is the sales tax rate in Charlotte, North Carolina? The minimum combined 2022 sales tax rate for Charlotte, North Carolina is 7.25%. This is the total of state, county and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The County sales tax rate is 2%. The Charlotte sales tax rate is 0%. Did South Dakota v. The Finance Office is responsible for maintaining the City's general ledger, billing and collection of payments, accounts 3 bd 3 ba 1,434 sqft 5012 Wolfridge Ave, Charlotte, NC 28214 Active Est. This methodology inherently offers up space for various protest opportunities. Not only for counties and cities, but also down to special-purpose entities as well, such as sewage treatment plants and recreational parks, with all counting on the real property tax. The goal is simple, Folwell said: For hospitals to start offering a level of charity care equal to the billions of dollars of tax benefit that they get from this community and this state.. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

Full Story, An official website of the Mecklenburg County government. payment: $4,342/mo Get pre-qualified Contact agent Townhouse Built in 2023 No data Ceiling fan (s), central air Attached garage No data $298 price/sqft 2.5% buyers agency fee Overview The city and county will set a new tax rate before July 1 that incorporates revaluation and applies to the 2024 fiscal year. Almost 20 percent of families in Mecklenburg County have medical debt in collections, compared with a national average of 13 percent, according to data compiled by The Urban Institute. Please do not reprint our stories without our bylines, and please include a live link to NC Health News under the byline, like this: Finally, at the bottom of the story (whether web or print), please include the text:North Carolina Health News is an independent, non-partisan, not-for-profit, statewide news organization dedicated to covering all things health care in North Carolina. Share sensitive information only on official, secure websites.

Long Term Effects Of The Salem Witch Trials,

Resthaven Mortuary Wichita, Ks Obituaries,

Articles C

charlotte nc property tax rate