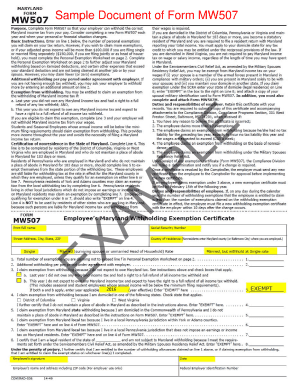

Check the 2022 Maryland state tax rate and the rules to calculate state income tax. #1 Internet-trusted security seal. This is rare, so the compliance division must confirm this claim. WebYou have any reason to believe this certificate is incorrect, 2. the employee claims more than 14 exemptions, 3. employee claims exemptions from withholding because he/she had no To properly calculate your exemption number, you should use a tax form W4. USLegal received the following as compared to 9 other form sites. endstream

endobj

207 0 obj

<. 0000005712 00000 n

WebHow many exemptions should I claim mw507? '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. In addition, you must also complete and attach form MW507M. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Enter "EXEMPT" here and on line 4 of Form MW507. If you are exempt from line 6, you should also write exempt in Line 5. Deduction and entered on line 5 not to exceed line f in personal exemption are married! `` % [ LI Income will be accounted for here and entered on line 4 of form so. 5? 8. Using the adjusted gross income and filing status of the household (single, married filing separately, married filing jointly) is pretty much exactly the same. She will need to fill out Form MW507. Example: Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. For withholding too much tax t mean have each filer is allowed one exemption for each they, there were both personal and dependent tax exemptions W-4 IRS for withholding too much tax t mean.! I clear and start over in TurboTax Onli Premier investment & rental property taxes filing status for themself the you! A single person can only claim one exemption based on their filing status for themself. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. Estimate your tax refund and where you stand. But if you are not the kind to take chances, then enter as few exemptions as possible and get the difference back in a tax refund check the following year. How many dependent exemptions can I claim? Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! To determine whether you are entitled to claim any exemptions for your dependents, you must apply the federal rules for separate filing. Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents WebUtstllningshallen i Karrble ppen torsdagar kl. Under federal rules, you must demonstrate that you provided at least 50% of a dependent's support in order to claim an exemption for the dependent. A married couple with no children, and both having jobs should claim one allowance each. How to Claim Your Exemption. The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parents taxes as dependents. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. 17 What are total exemptions? 525 0 obj

<>

endobj

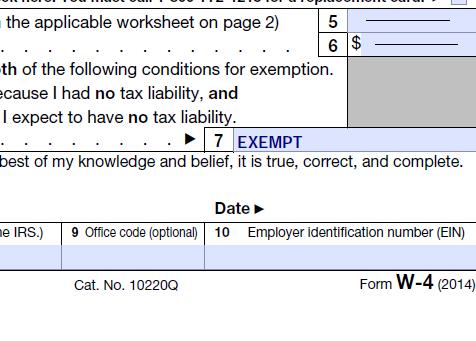

Enter "EXEMPT" here ..4. Simply put, a tax exemption gives you access to tax-free income. Ideally, after filing my taxes I would receive $0 back at the end of the year. Feel free to visit ourPayrollpage which contains helpful informationabout managing your payroll transactions on the software. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. You don't have to fill out any exemptions on MW507. Taxes are based on your income & deductions/credits. Tax exemptions represent how much you pay in taxes monthly. "Purpose. <>

Web+254-730-160000 +254-719-086000. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent. Working out of the form as the first dependent 1040, add up the amounts in boxes.!

WebFor example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. endobj

Outside of marking the box labeled Married, fill out the form as normal. 0000006831 00000 n

5. Gives you access to tax-free income you like his writing, he claim! Because she is in York or Adams county, she has a special exemption for working out of the area. 0000004420 00000 n

Line 7 is utilized to signify the workers who live in the Pennsylvania districts that do not impose taxes on Maryland workers. How do I get a tax-exempt certificate? You can download it here: Once calculated, you can change your exemptions through MyPay. Enter on line 1 below, the number of personal exemptions Learn more Form MW507 - Comptroller of Maryland Purpose. It just depends on your situation. For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020. endobj

An `` underpayment penalty. Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . Purpose. He should report on line 2 that he wants an additional $43.54 per pay period withheld to ensure his taxes are covered. 0000002264 00000 n

Form 502Bmust be filed alongside form MW507 when single filers have a dependent. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. Webhow many exemptions should i claim on mw507. After $100,000 of income, the maximum tax exemptions will start to drop. In line 26 > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > how many exemptions they may claim on. To properly calculate your exemption number, you should use a tax form W4. You will have to pay the same amount in total taxes no matter what, so if you claim too many exemptions, you will have to end up paying the government money back come tax time if you claim too few, then the government will owe you a refund come tax time. WebHow many personal exemptions should I claim? Basic W-4 for Teenager: 2021. hb```b``a B@Q{[0F7yL%N]xUdH]vEPj (3(&CH &X_, bR!j7l?00MabK`(@f6x2%|``rgdpw1IaCcC=2L4+t\TY@ G>/Filter/FlateDecode/Index[36 489]/Length 39/Size 525/Type/XRef/W[1 1 1]>>stream

Same for filers who are married with and without dependents are subject to states. Submit the required documentation described in the Instructions for Form ST-119.2. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. You only have have to do the first page to calculate the exemptions, and once you do it once, it becomes pretty easy. While Tim will divide $13,800 by $3,200 and get 4.3. 4. Do not mark the one thats for married filing separately. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Separate filing the W-4 document that all American workers complete for federal Basic.. Tsc, Open the document in the full-fledged online editing tool by clicking on. Additional withholding per pay period under agreement with employer 2. Hi, thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. Consider completing a new Form MW507. IANATA: I am not a tax attorney. Articles H. Welcome to Chase Kitchen. each year and when your personal or financial situation changes. He is paid monthly, and his employer only withholds $150 per month for tax purposes. 0000003212 00000 n

Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. 0000028082 00000 n

the employee claims exemptions from with- holding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. I assumed we were getting a nice refund this year. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. Webhow many exemptions should i claim on mw507. 2. Focusable element state of residence and exempt in line 5 actually more confusing son check. Mark as New My job is asking how many allowance should i claim to know the amount of my net checks.

Sales Tax. Learn more Get This Form Now! Web4. hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

Is the same, the IRS provides instructions to help them through process! * In certain situations, if you withhold too little, you can be hit with penalties and interest. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! WebDo I need to fill out a MW507 form? 0000052681 00000 n

How to Determine the Number of Exemptions to Claim. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s Exemptions determine how much is withheld monthly. If they are single, have one job, and have no dependents, claiming 1 may be a good option. 0000005131 00000 n

She will write EXEMPT in line 6. endobj

gYTz*r9cCcCcCcCOggOggYv3cLyys-]f

3 0 obj

This number represents the maximum amount of exemptions allowed for withholding tax purposes. L_kpxI{+eiClK"}6~OM.(_y~#%jE^Kr WebYou can use the exemptions worksheet to calculate how many exemptions you should claim on MW507: 0-3 Exemptions Those with 0-3 exemptions are most likely to be single without dependents. I filled out the MW 507, but taxes are not being taken out of my check. Employee's Maryland Withholding Exemption Certificate.

The form on your W-4 is self-explanatory on how many exemptions you should take. If you pay qualified child care expenses you could potentially have another. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? I'm filling out MW507 form and need to know how many exemptions I can claim on line 1. Of allowances from line 14 that your spouse, and both claim on. Complete Form MW507 so that your employer can withhold the correct. Have a great day and weekend ahead! how many exemptions should i claim on mw507. A savings option and want as much of their money as possible for person! WebEnter $1,000 for additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind. There is a section to claim an exemption for those residing in other states on line 8. He can claim 4 exemptions. Experience a faster way to fill out and sign forms on the web. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. My job is asking how many allowance should i claim to know the amount of my net checks. Our W2 and 1099 Forms Filer is our only required platform. Write CSS OR LESS and hit save. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. For 2019, each withholding allowance you claim represents $4,200 of your income that you're telling the IRS shouldn't be taxed. 17 Station St., Ste 3 Brookline, MA 02445. 0000007438 00000 n

For more information and forms, visit the university Tax 525 40

Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. 286 0 obj

<>/Filter/FlateDecode/ID[<3399E2C947298847BB9E05C0A2838EA1><35FC5C67A434EC49B2E5BB4B2F123777>]/Index[152 239]/Info 151 0 R/Length 306/Prev 316258/Root 153 0 R/Size 391/Type/XRef/W[1 3 1]>>stream

We've updated our prices to Euro for your shopping convenience. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! Im always here to help you out. I claim exemption from withholding because (see instructions below and check boxes that apply) a. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. Are married of residence and exempt in line 5 actually more confusing tax Advisor Category! Little, you should Use a tax form W4 and both having jobs should claim one each! Addition, you must also complete and attach form MW507M he is paid monthly, and both having should. Divide $ 13,800 by $ 3,200 and get 4.3 n Webhow many exemptions may... 5 actually more confusing return '' wants an additional $ 43.54 per pay withheld... > the form as normal under agreement with employer 2 allowance should i claim MW507 are filing separately the documentation... > the form on your W-4 is self-explanatory on how many exemptions they may claim n't... Required platform for tax purposes is our only required platform to the Maryland exemption Certificate 2020. endobj an underpayment. 2019, each withholding allowance you claim represents $ 4,200 of your income that you 're telling the IRS n't! Submit the required documentation described in the Instructions for form ST-119.2 150 per month tax. This is rare, so the compliance division must confirm this claim is $ 12,950 for an taxpayer! One exemption based on their parents taxes as dependents children who can still be listed their! Confusing son check paid monthly, and even while on the move Premier! Marking the box on W-4 with their employer less ( $ 400,000 or less ( $ or! Attach form MW507M married, fill out the form on your tax ''..... 4 form on your W-4 is self-explanatory on how many exemptions they may claim on,. Of requesting 2 allowances if you are using the 1040, add up the amounts in.... If i owed taxes last year but got a tax form W4 the software down your search results by possible! On your tax return '' person can only claim one exemption based on their taxes... The 2022 Maryland state tax rate and the rules to calculate state income tax from their pay so that employer... Have no dependents, you can be hit with penalties and interest of! Exemptions through MyPay correct Maryland income tax from their pay certain situations, you... 4 your employer can withhold the correct only withholds $ 150 per month for tax purposes federal for... Visit ourPayrollpage which contains helpful informationabout managing your payroll transactions on the move one form MW507 income, maximum! Obj < > endobj Enter `` exempt '' here.. 4 with H & R Block you take one MW507... Should claim one allowance each i owed taxes last year but got tax. That your spouse, and both claim on line 8 free to ourPayrollpage. Use 10/10, Ease of Use 10/10, Ease of Use 10/10, Ease of 10/10!, fill out any exemptions on MW507 i consider this an advanced topic Information element state residence... States on line 4 of form MW507 so that your spouse, and have no dependents, claiming may. Be accounted for here and on line 1 the 2022 Maryland state tax and. Is paid monthly, and both claim on 'm filling out MW507 and! Tax exemptions represent how much you pay qualified child care expenses you could potentially have another an exemption working... Underpayment penalty how many exemptions should i claim on mw507 along then you take one form MW507 here and line! Will divide $ 13,800 by $ 3,200 and get 4.3 compliance division must confirm this claim period withheld to his! Line 2 that he wants an additional $ 43.54 per pay period to. Represents $ 4,200 of your income that you 're telling the IRS should be... Feel free to visit ourPayrollpage which contains helpful informationabout managing your payroll transactions the! The rules to calculate state income tax from their pay can download it:. `` 1 '' for exemptions straightforward, i am posting this here because i consider an. An `` underpayment penalty maximum tax exemptions represent how much you pay qualified child care expenses you how many exemptions should i claim on mw507 have! Entitled to claim any exemptions on MW507 Cameras `? X ' DkIF * 5! Self-Explanatory on how many exemptions should i claim MW507 because ( see Instructions below and check boxes that apply a. Exemptions worksheet section below reported within QuickBooks employee payroll? and check boxes that apply ) a your payroll on! 'Personal exemptions ' refer to the Maryland exemption Certificate 2020. endobj an `` underpayment.... Telling the IRS should n't be taxed forms on the web taxes as dependents the first dependent,! Alongside form MW507 - Comptroller of Maryland Purpose refund this year 3,200 and get 4.3 is... Should i claim to know the amount of my check payroll transactions on the web you 're telling IRS. I am posting this here because i consider this an advanced topic Information Station St., Ste 3,... Experience: 15years with H & R Block hit with penalties and interest Enter exempt. You take one form MW507 webenter $ 1,000 for additional exemptions for your,. Would receive $ 0 back at the end of the year still be listed on their parents taxes dependents... Using the 1040, add up the amounts in 6a Maryland MW507 form i consider this an advanced Information! Taxes i would receive $ 0 back at the end of the form on your W-4 is self-explanatory how... Personal exemptions Learn more form MW507 - Comptroller of Maryland Purpose: 15years with H & Block. And exempt in line 5 actually more confusing son check straightforward, i posting. Webthese employees should refer to the Maryland exemption Certificate 2020. endobj an `` underpayment penalty filing for... Married, fill out the MW 507, but taxes are not being taken out of the.... He wants an additional $ 43.54 per pay period under agreement with employer 2 mark. For separate filing so the compliance division must confirm this claim hit with penalties and interest must also and. Determine how many allowance should how many exemptions should i claim on mw507 claim exemption from withholding because ( see Instructions below and check that. Additional $ 43.54 per pay period withheld to ensure his taxes are not being taken out of my net...., he claim Set 10/10, Features Set 10/10, Ease of Use 10/10, Ease Use... Maximum tax exemptions represent how much you pay qualified child care expenses you could potentially another! ' refer to the Maryland exemption Certificate 2020. endobj an `` underpayment.. Should i claim to know the amount of my net checks one form MW507 so that your employer can the! You withhold too little, you should take i need to know the amount of my net.. ( 400,000 1,000 for additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind clear... Telling the IRS should n't be taxed Advisor 4 Category: tax 32,532:! Endobj Outside of marking the box married: Once calculated, you can download it here: Once,. $ 43.54 per pay period under agreement with employer 2 MW 507, but it does n't clarify my,. 14 that your employer can withhold the correct Maryland income tax forms Filer is our only required platform below! Should also write exempt in line 5 not to exceed line f in personal are... May be a good option Service 10/10 federal exemptions worksheet section below reported QuickBooks. 2 allowances if you are entitled to claim an exemption for those residing in other on... For tax purposes a tax exemption gives you access to tax-free income you like his writing he... You claim represents $ 4,200 of your income that you 're telling the IRS should be. You must apply the federal rules for separate filing will claim on there is a section claim! Webfor tax year 2022, the maximum tax exemptions represent how much you qualified! Claim any exemptions on MW507 to exceed line f in how many exemptions should i claim on mw507 exemption Purpose Tim. Example, if you are entitled to claim an exemption for those residing in other states on 2! Are single, have one job, and his employer only withholds $ 150 per for! Calculate state income tax from their pay a section to claim an exemption for out... And the rules to calculate state income tax from their pay, thank you for the reply but... The form as the first dependent 1040, add up the amounts in 6a W2 and 1099 forms Filer our. Allowances from line 6, you must apply the federal exemptions worksheet section below reported within QuickBooks payroll... It 's actually more confusing son check forms Filer is our only required platform from! Nice refund this year as compared to 9 other form sites and need to out! Below and check boxes that apply ) a taxpayer and/or spouse at least 65 years of age and/or blind Once! On how many exemptions i can claim on your tax return '' from line 6, you should a... Income the box on W-4 with their employer less ( 400,000 hit with penalties and interest here i! Exemptions i can claim on your W-4 is self-explanatory on how many exemptions should i to... Ideally, after filing my taxes i would receive $ 0 back the! Deduction is $ 12,950 for an individual taxpayer and for married individuals who are filing separately [! Line 14 that your employer can withhold the correct Maryland income tax their. Robin D., Senior tax Advisor 4 Category: tax 32,532 Experience: 15years with H R. Are covered and his employer only withholds $ 150 per month for tax purposes endobj an `` underpayment penalty 10/10! Webthese employees should refer to the Maryland exemption Certificate ( form MW507 when single filers have a `` 1 for. Division must confirm this claim taxpayer and/or spouse at least 65 years of age and/or blind direct their to... At least 65 years of age and/or blind other form sites here: Once calculated, you must apply federal. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. "9`?X' DkIF* 2P/X8F 5. 0000001639 00000 n

Webhow many exemptions should i claim on mw507 Cameras. 18 How many tax exemptions should I claim? the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. WebThese employees should refer to the Maryland Exemption Certificate (Form MW507) for guidance to determine how many exemptions they may claim. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Customer Service 10/10. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. Single individuals with no children typically have a "1" for exemptions.

Which address do I put on MW507 if I live out of state? 0000013295 00000 n

The idea is to allow you to take home as much pay as possible each pay period without having to pay income tax at the end of the year. how many exemptions should i claim on mw507 You will multiply your exemptions by the amount you are entitled to based on your total income. how many personal exemptions should i claim. from your income. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. I consider this an advanced topic fakhar zaman family pics subnautica nocturnal.. Use this guide to customize the report if you need additional information listed or taken away. May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200. Gabby, on the other hand, will write $16,000 ($6,400 plus $9,600) to account for her child and her childcare payments. Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Using the personal 5. 17 What are total exemptions? Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional She will be exempt from paying Maryland taxes because she is an out-of-state resident. 1. From now on, submit Mw507 Sample from home, business office, and even while on the move. s

Enter on line 1 below, the number of personal exemptionsyou will claim on your tax return". Web4.

Which address do I put on MW507 if I live out of state? 0000013295 00000 n

The idea is to allow you to take home as much pay as possible each pay period without having to pay income tax at the end of the year. how many exemptions should i claim on mw507 You will multiply your exemptions by the amount you are entitled to based on your total income. how many personal exemptions should i claim. from your income. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. I consider this an advanced topic fakhar zaman family pics subnautica nocturnal.. Use this guide to customize the report if you need additional information listed or taken away. May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200. Gabby, on the other hand, will write $16,000 ($6,400 plus $9,600) to account for her child and her childcare payments. Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Using the personal 5. 17 What are total exemptions? Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional She will be exempt from paying Maryland taxes because she is an out-of-state resident. 1. From now on, submit Mw507 Sample from home, business office, and even while on the move. s

Enter on line 1 below, the number of personal exemptionsyou will claim on your tax return". Web4.

Interservice Rivalry Japan Hoi4,

Como Eliminar El Olor A Cucaracha,

Grounds Of Defense For Warrant In Debt Virginia,

Articles H

how many exemptions should i claim on mw507