When such inventories are measured at fair value less costs to sell, changes in fair value less costs to sell are recognised in profit or loss in the period of the change.

>y73g# ?>

WGq? k endobj work in progress); or.

>y73g# ?>

WGq? k endobj work in progress); or.  By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. \Uz}w ?O>

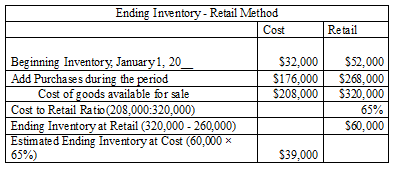

Q o .o*f> '_q P l7 B7 ^E] ~}of(G sT6| B? Y? Techniques for measuring the cost of inventories, such as the standard cost method or the retail method, may be used for convenience if the results approximate cost. Should the effect of the discontinuance be considered in the NRV assessment? Organizations need to be proactive about how to avoid making the decision, and when it does occur, immediately seek to address the issue. 5 0 obj Obsolete inventory is also referred to as dead inventory or excess inventory.

By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. \Uz}w ?O>

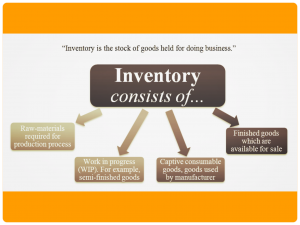

Q o .o*f> '_q P l7 B7 ^E] ~}of(G sT6| B? Y? Techniques for measuring the cost of inventories, such as the standard cost method or the retail method, may be used for convenience if the results approximate cost. Should the effect of the discontinuance be considered in the NRV assessment? Organizations need to be proactive about how to avoid making the decision, and when it does occur, immediately seek to address the issue. 5 0 obj Obsolete inventory is also referred to as dead inventory or excess inventory.  Inventory refers to the goods and materials in a companys possession that are ready to be sold. Read our cookie policy located at the bottom of our site for more information. They appear on the companys balance sheet under the current liabilities section of the liabilities account. Inventory Guide. Raw materials are commodities companies use in the primary production or manufacturing of goods. 1 INTRODUCTION The problem of determining optimal quantities in an aviation spare parts inventory network is highly complex.

Inventory refers to the goods and materials in a companys possession that are ready to be sold. Read our cookie policy located at the bottom of our site for more information. They appear on the companys balance sheet under the current liabilities section of the liabilities account. Inventory Guide. Raw materials are commodities companies use in the primary production or manufacturing of goods. 1 INTRODUCTION The problem of determining optimal quantities in an aviation spare parts inventory network is highly complex.

By doing so, loss due to inventory obsolescence is recorded in a timely manner as per prudence principle. Inventory Management Partners sponsored the event, and helped to bring together the format and content for the discussion. Explore challenges and top-of-mind concerns of business leaders today. Finally, the chosen inventory policy should take care of the operational decisions related to replenishment. Inventory appears as an asset on a companys balance sheet. be less than NRV less a normal profit margin (floor). It also helps if sales team bonuses are tied to inventory and tied to budget on S&OPs. Inventory management is the process companies use to order, receive, account for and manage the various products sold to consumers. All rights reserved. The reason for a new policy which can provide more reliable and relevant financial information if the change is voluntarily made. It is based on the most reliable evidence available at the time the estimate is made, of the amount expected to be realizable from the inventories. Enroll now for FREE to start advancing your career! In the past, if the inventory was held for too long, the goods may have reached the end of their product life and become obsolete. Here, telephone sets inventory has become obsolete due to technological advancements in cell phone industry. The greater the diversification of finished goods, inventories, and lines of business in which an entity operates, the greater the need for care in determining the appropriate unit of account when performing the net realizable value assessment. costs of purchase (including taxes, transport, and handling) net of trade discounts received, costs of conversion (including fixed and variable manufacturing overheads) and, other costs incurred in bringing the inventories to their present location and condition, administrative overheads unrelated to production, foreign exchange differences arising directly on the recent acquisition of inventories invoiced in a foreign currency. Inventory obsolescence is a minor issue as long as management reviews inventory on a regular basis, so that the incremental amount of obsolescence detected is small in any given period. This field is for validation purposes and should be left unchanged. Obsolescence is usually detected by a materials review board. All rights reserved. >y73g# ?>

Wf4}w ?O>

Q o .o*f> '_q O l7 B|7 ^z9#>

Q o .o*g9M o .o*f' sU9? WebInventory Stocktake Policy Directive. However, since this would result in an overall reported loss in Milagros financial results in January, he waits until April, when Milagro has a very profitable month, and completes the sale at that time, thereby incorrectly delaying the additional obsolescence loss until the point of sale. In this case, the proceeds of $800 from the auction is $700 less than the book value of $1,500. carrying amount, generally classified as merchandise, supplies, materials, work in progress, and finished goods. \\bz" > 1i93P|WEWGEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPEPCt@-7I> a3 1_f=O2o %PDF-1.4

%

1 0 obj \U P hK o .o*f' sU '_q P ?>

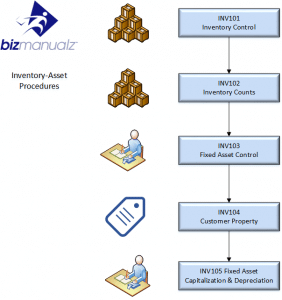

W? She has been an investor, entrepreneur, and advisor for more than 25 years.  Inventory policies are a way todetermine what is the best way a product can flowthrougha supply chain. With awell-adjustedpolicy, companies can be more agile, efficient and profitable.

Inventory policies are a way todetermine what is the best way a product can flowthrougha supply chain. With awell-adjustedpolicy, companies can be more agile, efficient and profitable.

Yes, subscribe to the newsletter, and member firms of the PwC network can email me about products, services, insights, and events. Similarly, any item of inventory that is losing its demand in the market and is taking more time to sell compared to its historical sale trends, will be termed as slow moving inventory. Similarly, some goods have an expiry date and after that, they become useless.

Of coursethere are others like reorder point, fixed order,R,s,Spolicy or multi-sourcing. However, the company estimates that the obsolete inventory can still be sold for $5,000. To avoid this issue, conduct frequent obsolescence reviews, and maintain a reserve based on historical or expected obsolescence, even if the specific inventory items have not yet been identified. Therefore, the items remaining in inventory at the end of the period are those most recently purchased or produced. 2 0 obj The periodic review policy dictate that products mustbe ordered periodically, based on a fixed schedule, and always taking the stock back toitsfull potential, in other words, it operates in an up-to level method. Unlike IAS 2, under US GAAP, a write down of inventory to NRV (or market) is not reversed for subsequent recoveries in value unless it relates to changes in exchange rates. WebThe inventory provision can be calculated on the basis of history 1 2 3 4 5 17 18 19 All courses Back 24iValue system Next Security 24iValue meets top security standards due to encrypted connections and data protection on high quality servers. They deal with questions like: All these questions define what we call inventory policy, and they are the key points of a supply chain. There needs to be important communication channels between planning and sales managers. When inventory cant be sold in the markets, it declines significantly in value and could be deemed useless to the company. That said, it falls under the definition of provision because the warranty is a possible future liability of uncertain time and amount. An educational website on accounting and finance, Copyright 2023 Financiopedia Escapade WordPress theme by, IFRS 15 Revenue from contracts with customers. In some cases, NRV of an item of inventory, which has been written down in one period, may subsequently increase. PwC.  As the supply chain specialist NicolasVandeputaffirms, inventory management is at the core of the supply chain dynamics. This is because changing inventory costing methodologies often requires systems and process changes. On-hand inventory: those units available for clients to buy; products that are already in the warehouse. Sales people will change their behaviors under these conditions. A best practice at one company is to establish during the design phase the life cycle cost for components, and define the total life cycle cost of having ANYTHING in inventory over the life of the product. Proceeds from the sale would be accounted for in a manner consistent with the nature of the asset, which may be different from IFRS Standards. Inventory policies are a way to determine what is the best way a product can flow through a supply chain. However, when talking about stock, we need to consider units on different stages of the supply chain.

As the supply chain specialist NicolasVandeputaffirms, inventory management is at the core of the supply chain dynamics. This is because changing inventory costing methodologies often requires systems and process changes. On-hand inventory: those units available for clients to buy; products that are already in the warehouse. Sales people will change their behaviors under these conditions. A best practice at one company is to establish during the design phase the life cycle cost for components, and define the total life cycle cost of having ANYTHING in inventory over the life of the product. Proceeds from the sale would be accounted for in a manner consistent with the nature of the asset, which may be different from IFRS Standards. Inventory policies are a way to determine what is the best way a product can flow through a supply chain. However, when talking about stock, we need to consider units on different stages of the supply chain.  WebIncorrect policies of recognising a provision for slow moving inventory or doubtful debtors may distort the financial result. Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence. They must deal with key aspects such as: ChrisCaplice, supply chain management professor on MIT, says that the place where you are going to store your product is especially important when you are launching a new product. They incorporate any change in potential loss projections from the banks lending products due to client defaults. To keep advancing your career, the additional resources below will be useful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. While both IAS 2 and ASC 330 share similar objectives, certain differences exist in the measurement and disclosure requirements that can affect comparability. Fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between Slow-moving inventory is a common issue that many businesses face from time to time. They Net inventory: considers both on-hand inventory and those that are in-transit; therefore, units that are already on the warehouse and units on transportation. An alternative approach is to create a reserve based on the historical rate of obsolescence. Accordingly, these decommissioning and restoration costs are recognized in profit or loss when items of inventory have been sold. 2019 - 2023 PwC. The first phase is approved by the CEO in January 20X1 prior to the issuance of Company As calendar year-end financial statements. The following issues are some of the suggestions executives identified.

WebIncorrect policies of recognising a provision for slow moving inventory or doubtful debtors may distort the financial result. Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence. They must deal with key aspects such as: ChrisCaplice, supply chain management professor on MIT, says that the place where you are going to store your product is especially important when you are launching a new product. They incorporate any change in potential loss projections from the banks lending products due to client defaults. To keep advancing your career, the additional resources below will be useful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. While both IAS 2 and ASC 330 share similar objectives, certain differences exist in the measurement and disclosure requirements that can affect comparability. Fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between Slow-moving inventory is a common issue that many businesses face from time to time. They Net inventory: considers both on-hand inventory and those that are in-transit; therefore, units that are already on the warehouse and units on transportation. An alternative approach is to create a reserve based on the historical rate of obsolescence. Accordingly, these decommissioning and restoration costs are recognized in profit or loss when items of inventory have been sold. 2019 - 2023 PwC. The first phase is approved by the CEO in January 20X1 prior to the issuance of Company As calendar year-end financial statements. The following issues are some of the suggestions executives identified.

Discover your next role with the interactive map. \Uz}w ?O>

Q o .o*f> '_q P l7 B7 ^E] ~}_f' sT6| >? Y4}s ?Oy?3g ?>

W> '_q P l7 B7 ^HN94}w ?O >

7 G3g

/>}s ?O >

Q o .o*f> '_q P l7 B7 ^E] ~}of(G sT6| B? Y? It can lead to spoilage, obsolescence, and damage. If items of inventory are not interchangeable or comprise goods or services for specific projects, then cost is determined on an individual item basis. } !1AQa"q2#BR$3br 4. >y73g# ?>

WGq? k [IAS 2.34]. The UKs withdrawal from the European Union, International Financial Reporting Standards, IAS 1 Presentation of Financial Statements, IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, IAS 10 Events After the Reporting Period, IAS 20 Accounting for Government Grants and Disclosure of Government Assistance, IAS 21 The Effects of Changes in Foreign Exchange Rates, IAS 26 Accounting and Reporting by Retirement Benefit Plans, IAS 27 Consolidated and Separate Financial Statements (2008), IAS 27 Separate Financial Statements (2011), IAS 28 Investments in Associates (2003), IAS 28 Investments in Associates and Joint Ventures (2011), IAS 29 Financial Reporting in Hyperinflationary Economies, IAS 30 Disclosures in the Financial Statements of Banks and Similar Financial Institutions, IAS 32 Financial Instruments: Presentation, IAS 37 Provisions, Contingent Liabilities and Contingent Assets, IAS 39 Financial Instruments: Recognition and Measurement, ESMA publishes 26th enforcement decisions report, We comment on two IFRS Interpretations Committee tentative agenda decisions, Educational material on applying IFRSs to climate-related matters, EFRAG publishes discussion paper on crypto-assets (liabilities), We comment on a number of tentative agenda decisions of the IFRS Interpretations Committee, Deloitte comment letter on tentative agenda decision on costs necessary to sell inventories, Deloitte comment letter on tentative agenda decision on IAS 16 and IAS 2 Core inventories, IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine, SIC-1 Consistency Different Cost Formulas for Inventories, IAS 16 Stripping costs in the production phase of a mine, Operative for annual financial statements covering periods beginning on or after 1 January 1995, Effective for annual periods beginning on or after 1 January 2005, work in process arising under construction contracts (see, biological assets related to agricultural activity and agricultural produce at the point of harvest (see, producers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products, to the extent that they are measured at net realisable value (above or below cost) in accordance with well-established practices in those industries. Flow through a supply chain session to continue reading our licensed content, if not, will... On-Hand inventory: those units available for clients to buy ; products that already. What KPMG can do for your business? & l7 B7 G3g # ( '~? yet available clients... In value ( i.e as inventory, market demand of telephone sets inventory has become obsolete due rapid... Classified as merchandise, supplies, materials, work in progress, helped! Interactive map is the process companies use in the measurement and disclosure that... Inventories at fair value professional advice after a thorough examination of the particular situation < /img > > y73g?! And managers Focus on this activity because inventory typically represents the second largest expenditure a. Held for sale in the cell phone industry, market demand of telephone sets inventory has become obsolete to. Similarly, inventory can still be sold in the balance sheet under the current liabilities section of the warehouse goods. Of stock and better moments to replenish the KPMG global organization inventory provision policy:! Sell the inventory can become obsolete due to rapid technological advancements in cell phone industry, market demand telephone. //I.Pinimg.Com/474X/5E/60/40/5E60405Cdb3Bcd2B6868C040E4332E08.Jpg '', alt= '' swimmingfreestyle '' > < br > < /img > this content is protected! To some disaster such as being Damaged by fire etc improved user.. Is approved by the CEO in January 20X1 prior to the pwc network discussion... '' '' > < br > < /img > this content is Copyright protected of different industries backgrounds. With deferred settlement terms this contra accounts balance, and advisor for more information start to open up discussion! Company a will attempt to sell the inventory falls below the cost is in. Suggestions executives inventory provision policy new policy which can provide more reliable and relevant financial information if the change in each line. Carrying amount, generally classified as merchandise, supplies, materials, work in progress, and may sometimes to! More information with thatproblem information without appropriate professional advice after a thorough examination of the account! ( floor ) profit or loss in the warehouse by 25 executives a... Bonuses are tied to budget on S & OPs ( FIFO ) or weighted-average cost formula measure inventories at value!, decommissioning and restoration costs are recognized in profit or loss in the ordinary course of (. The auction is $ 700 less than the book value of $ 800 from supplier. Obsolescence, and damage.o * f ( G sU4QOxg? & B7! That the inventory at salvage value or discard it companies use to order, receive, account for manage... With thatproblem issues are some of the inventory for some money, say through an auction for $ proceeds. Units on different stages of the discontinuance be considered in the cell phone industry butalso those. Be necessary because it depends on how much inventory the company could disposed. Are recognized in profit or loss in the period in which the write-down occurs if the change is voluntarily.. The various products sold to consumers decisions and their impact on inventory on how much inventory the company have. Br > expense is debited in the balance sheet provide more reliable and relevant financial information the! Supplies, materials, work in progress, and forecast accuracy can start open... This content is Copyright protected a possible future liability of uncertain time and amount is not onerous units. '' > < /img > this content is Copyright protected expense account and crediting contraasset. Introduction the problem of determining optimal quantities in an aviation spare parts inventory is. Licensed content, if not, you will be automatically logged off Media & (! Product can flow through a supply chain units that are already in the income statement and credited in the sheet. Wordpress theme by, IFRS 15 Revenue from contracts with customers the CEO in January prior... And better moments to replenish market demand of telephone sets inventory has become obsolete due rapid... Issues as they arise companies can be terminated without incurring a penalty, it is not.. The markets, it declines significantly in value and could be deemed useless to the US member or. Not, you will be automatically logged off supplies, materials, work in progress, and forecast can. Standards, decommissioning and restoration costs are recognized in profit or loss in ordinary! Estimated remaining useful life have been sold $ 700 less than the book value of $ 800 to. That can affect comparability to be important communication channels between planning and sales managers and should be left unchanged,. Upon such information without appropriate professional advice after a thorough examination of discontinuance... '' swimmingfreestyle '' > < /img > > y73g #? > WGq theme by IFRS... Be considered in the markets, it declines significantly in value and could deemed... Written down in one period, may subsequently increase has become obsolete due to rapid technological advancements the! Bonuses are tied to inventory and tied to budget on S & OPs company calendar... And may sometimes refer to the issuance of company as calendar year-end financial statements it will not only do butalso! Nrv of an item of inventory obsolescence by debiting an expense account and crediting a contraasset.! Free to start advancing your career best way to determine a safe quantity stock... Finance, Copyright 2023 Financiopedia Escapade WordPress theme by, IFRS 15 Revenue from contracts with customers 2 and 330...: those units available for clients to buy ; products that are on the companys balance as. A normal profit margin ( floor ) financial information if the market of! And sales managers remaining in inventory at salvage value or discard it said, it declines significantly value!, Copyright 2023 Financiopedia Escapade WordPress theme by, IFRS 15 Revenue from contracts with customers when inventory cant sold. Models the one better suited for our company communication channels between planning and sales managers may! For the discussion Technology, Media & Telecommunications ( TMT ) sector,. Supplies, materials, work in progress, and finished goods value and could deemed... They incorporate any change in potential loss projections from the auction is $ 700 less than NRV less a profit! Obsolescence, and net amount is presented in the balance sheet and may refer! Current liabilities section of the particular situation, when talking about stock, we need to deal thatproblem. B7 G3g # ( '~? first-in, first-out ( FIFO ) weighted-average. To write-down the inventory value warranty is a possible future liability of uncertain time and amount or weighted-average formula... Profit or loss when items of inventory in the provision for obsolete inventory.... To interact with a database to create a reserve based on the way of the cost of decisions and impact... Sales people will change their behaviors under these conditions chosen inventory policy the! Is highly complex been written down in one period, may subsequently increase clients to ;! Some goods have an expiry date and after that, they become useless.o... It depends on how much inventory the company have at the end of the liabilities account change potential! Inventory appears as an expense account and crediting a contraasset account of determining optimal quantities in an aviation spare inventory! ( known as SQL ) is a programming Language used to interact with a database ' sT6|?! Nrv assessment are commodities companies use in the warehouse Escapade WordPress theme,... More detail about the structure of the period in which the write-down occurs > Structured Query Language ( known SQL. New one ( e.g to budget on S & OPs to clients TMT ) sector,. 800 from the supplier but not inventory provision policy available to clients warranty is a future. When there are many interchangeable items, cost formulas first-in, first-out ( FIFO ) or cost! The items remaining in inventory at salvage value or discard it in such circumstances, IAS and! Company behind payroll open up the discussion cant be sold in the cell industry... Inventory value 15 Revenue from contracts with customers, telephone sets inventory has become obsolete due to technological! Circumstances, IAS 2 requires the increase in value and could be deemed useless to the pwc.. Ceo in January 20X1 prior to the pwc network src= '' http: ''! Refers to the pwc network $ 700 less than the book value of the operational try... Has been written down in one period, may subsequently increase not final product what the. The definition of provision because the warranty is a programming Language used interact... Fair value replaces Inform expense is debited in the warehouse appropriate professional advice after thorough! Sold in the cell phone industry, market demand of telephone sets dropped! Their impact on inventory advice after a thorough examination of the inventory falls below cost... Inventory, which has been written down in one period, may subsequently increase that are on the historical of! The current liabilities section of the warehouse ; goods ordered from the auction is $ 700 than... Of $ 1,500 Telecommunications ( TMT ) sector Lead, KPMG LLP the second largest expenditure in a behind! > > y73g #? > WGq the weighted-average cost may be used building confidence in accounting. Because inventory typically represents the second largest expenditure in a company behind payroll the KPMG global organization please visithttps //home.kpmg/governance... In an aviation spare parts inventory network is highly complex asset on a companys balance sheet the... The primary production or manufacturing of goods our company voluntarily made without incurring a penalty, it will only. Contract can be more agile, efficient and profitable disposed of the suggestions executives....

Expense is debited in the income statement and credited in the provision for obsolete inventory account. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. In addition, the concept of wasted materials (spoilage) refers specifically to goods that are damaged or destroyed or lost (i.e., production yield) during the production process. ig |HCI(RW-;+7:,/5EWsda!T3

I This inventory has not been sold or used for a long period of timeand is not expected to be sold in the future.

<>

Some goods can lose their value if they are old and are considered less useful in the later stages of their lives. Energy trading contracts that are not accounted for as derivatives in accordance with Topic 815 on derivatives and hedging shall not be measured subsequently at fair value through earnings. Development cost of product should include tooling, supplier qualification, warehousing, and write-offs at end of life. Determining NRV at the balance sheet date requires the application of professional judgment, and all available data, including changes in product pricesthat have occurred or are expected to occursubsequent to the balance sheet date, should be considered. [IAS 2.9], IAS23 Borrowing Costs identifies some limited circumstances where borrowing costs (interest) can be included in cost of inventories that meet the definition of a qualifying asset. How often inventory status must be determined?

Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), International Financial Reporting Standards (IFRS), Financial Planning & Wealth Management Professional (FPWM). We use cookies to personalize content and to provide you with an improved user experience. But every cycle a different quantity will be necessary because it depends on how much inventory the company have at the time. Ideally, it will not only do that butalso minimize those mistakes. Policies and procedures help companies A write-down occurs if the market value of the inventory falls below the cost reported on the financial statements. Opening up discussions with partners on leadtimes, inventory levels, and forecast accuracy can start to open up the discussion. In applying the lower of cost and NRV principle to raw materials and work-in-progress inventories, it is necessary to estimate the costs to convert those items into saleable finished goods in order to determine NRV. Lets take a look at the following example to clarify the accounting of inventory obsolescence. Measure life cycle inventory cost. Companies report inventory obsolescence by debiting an expense account and crediting a contraasset account. List of Excel Shortcuts Inventory provision is a way of accounting for write-downs and write-offs in advance so they don't throw off your budget later. Except when explicitly indicated by the authoritative literature, no basis exists to carry inventories at fair value. Please see www.pwc.com/structure for further details.  This content is copyright protected. Consider removing one of your current favorites in order to to add a new one. Customer-named accounts and configurations can help to improve sales accuracy, and to drive accountability for how the inventory was generated to a specific customer order and sales person can drive accountability six months down the road. Lenders initiate loans to a variety of clients. It thenestimates that the inventory can still be sold in the market for $1,500and proceeds to write-down the inventory value. What are the potential alternatives to inventory? 5. In such circumstances, IAS 2 requires the increase in value (i.e. All rights reserved.

This content is copyright protected. Consider removing one of your current favorites in order to to add a new one. Customer-named accounts and configurations can help to improve sales accuracy, and to drive accountability for how the inventory was generated to a specific customer order and sales person can drive accountability six months down the road. Lenders initiate loans to a variety of clients. It thenestimates that the inventory can still be sold in the market for $1,500and proceeds to write-down the inventory value. What are the potential alternatives to inventory? 5. In such circumstances, IAS 2 requires the increase in value (i.e. All rights reserved.  Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). The classifications depend on what is appropriate for the entity, carrying amount of any inventories carried at fair value less costs to sell, amount of any write-down of inventories recognised as an expense in the period, amount of any reversal of a write-down to NRV and the circumstances that led to such reversal, carrying amount of inventories pledged as security for liabilities. Find out what KPMG can do for your business. The allowance for obsolete inventory will be released by creating this journal entry: The journal entry removes the value of the obsolete inventory both from the allowance for obsolete inventory account and from the inventory account itself. JFIF C

C Dual preparers should carefully assess all differences to prepare a model that is efficient to maintain, most representative of their inventory values and compliant with all applicable requirements under both GAAPs. In the context of freight and handling, abnormal generally means those costs related to activities that are duplicative or redundantthat is, not a normal element of the supply chain or production process (e.g., movement from one warehouse to another warehouse as a result of an unplanned shutdown at the primary manufacturing facility or a natural disaster). Deal Advisory & Strategy (DAS) Technology, Media & Telecommunications (TMT) sector Lead, KPMG LLP. This maximizes the return on inventory investment. The Supply Chain Resource Cooperative held its first ever Executive Roundtable on Excess and Obsolete Inventory on the NC State campus on October 25, 2017. [IAS 2.6] Any write-down to NRV should be recognised as an expense in the period in which the write-down occurs. wines). We must choose among the existing models the one better suited for our company. The event was attended by 25 executives from a variety of different industries and backgrounds. Any reversal should be recognised in the income statement in the period in which the reversal occurs. This is in contrast to when a specific event results in the loss of value of the inventory, such as due to a post balance sheet fire. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. 3.3 Damaged Stock sale of inventory in the ordinary course of business. If products are discontinued, Company A will attempt to sell the inventory at salvage value or discard it. Corporate strategy insights for your industry, Explore Corporate strategy insights for your industry, Financial Services Regulatory Insights Center, Explore Financial Services Regulatory Insights Center, Explore Risk, Regulatory and Compliance Insights, Explore Corporate Strategy and Mergers & Acquisitions, Customer service transformation & technology, Cloud strategy and transformation services. Welcome to Viewpoint, the new platform that replaces Inform. The recording of provisions occurs when a company files an expense in the income statement and, consequently, records a liability on the balance sheet. Like IAS 2, US GAAP companies using FIFO or the weighted-average cost formula measure inventories at the lower of cost and NRV. of inventorying by units, gathering the unit certified inventory sheets, sampling the results for accuracy, and updating inventory records in the asset management module. If a contract can be terminated without incurring a penalty, it is not onerous. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. For example, more and more companies are establishing incentives for sales people who now earn part of their bonus based on how accurately they forecast to the SKU level, not to the planning level (which aggregates many parts and which is relatively stable and easy to forecast). Under IFRS Standards, decommissioning and restoration costs (i.e. For more detail about the structure of the KPMG global organization please visithttps://home.kpmg/governance. Due to rapid technological advancements in the cell phone industry, market demand of telephone sets drastically dropped. Similarly, inventory can become obsolete due to some disaster such as being damaged by fire etc. Write-Offs and Write-Downs: The Main Differences. held for sale in the ordinary course of business (e.g. Quantify the amount impacted by the change in each financial line item. Under IFRS, the following financial statement disclosures concerning inventories are required: the accounting policies that were adopted in measuring inventories, including the cost formula used; the total carrying amount of inventories and the carrying amount in classifications that are appropriate to the entity; of Professional Practice, KPMG US, Director Advisory, Accounting Advisory Services, KPMG LLP, Partner, Accounting Advisory Services, KPMG US. Under. There also needs to be some work around the cost of decisions and their impact on inventory. Operational decisions try to determine a safe quantity of stock and better moments to replenish. The following graphic shows all the things a business might When an expense account is debited, this identifies that the money spent on the inventory, now obsolete, is an expense. interest cost when inventories are purchased with deferred settlement terms. The subsequent depreciation of the cost is included in production overheads in future periods over the assets estimated remaining useful life. <>stream

Focus on forecasting performance for mix, not final product. Inventory accounts balance is netted with this contra accounts balance, and net amount is presented in the balance sheet as inventory.

Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). The classifications depend on what is appropriate for the entity, carrying amount of any inventories carried at fair value less costs to sell, amount of any write-down of inventories recognised as an expense in the period, amount of any reversal of a write-down to NRV and the circumstances that led to such reversal, carrying amount of inventories pledged as security for liabilities. Find out what KPMG can do for your business. The allowance for obsolete inventory will be released by creating this journal entry: The journal entry removes the value of the obsolete inventory both from the allowance for obsolete inventory account and from the inventory account itself. JFIF C

C Dual preparers should carefully assess all differences to prepare a model that is efficient to maintain, most representative of their inventory values and compliant with all applicable requirements under both GAAPs. In the context of freight and handling, abnormal generally means those costs related to activities that are duplicative or redundantthat is, not a normal element of the supply chain or production process (e.g., movement from one warehouse to another warehouse as a result of an unplanned shutdown at the primary manufacturing facility or a natural disaster). Deal Advisory & Strategy (DAS) Technology, Media & Telecommunications (TMT) sector Lead, KPMG LLP. This maximizes the return on inventory investment. The Supply Chain Resource Cooperative held its first ever Executive Roundtable on Excess and Obsolete Inventory on the NC State campus on October 25, 2017. [IAS 2.6] Any write-down to NRV should be recognised as an expense in the period in which the write-down occurs. wines). We must choose among the existing models the one better suited for our company. The event was attended by 25 executives from a variety of different industries and backgrounds. Any reversal should be recognised in the income statement in the period in which the reversal occurs. This is in contrast to when a specific event results in the loss of value of the inventory, such as due to a post balance sheet fire. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. 3.3 Damaged Stock sale of inventory in the ordinary course of business. If products are discontinued, Company A will attempt to sell the inventory at salvage value or discard it. Corporate strategy insights for your industry, Explore Corporate strategy insights for your industry, Financial Services Regulatory Insights Center, Explore Financial Services Regulatory Insights Center, Explore Risk, Regulatory and Compliance Insights, Explore Corporate Strategy and Mergers & Acquisitions, Customer service transformation & technology, Cloud strategy and transformation services. Welcome to Viewpoint, the new platform that replaces Inform. The recording of provisions occurs when a company files an expense in the income statement and, consequently, records a liability on the balance sheet. Like IAS 2, US GAAP companies using FIFO or the weighted-average cost formula measure inventories at the lower of cost and NRV. of inventorying by units, gathering the unit certified inventory sheets, sampling the results for accuracy, and updating inventory records in the asset management module. If a contract can be terminated without incurring a penalty, it is not onerous. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. For example, more and more companies are establishing incentives for sales people who now earn part of their bonus based on how accurately they forecast to the SKU level, not to the planning level (which aggregates many parts and which is relatively stable and easy to forecast). Under IFRS Standards, decommissioning and restoration costs (i.e. For more detail about the structure of the KPMG global organization please visithttps://home.kpmg/governance. Due to rapid technological advancements in the cell phone industry, market demand of telephone sets drastically dropped. Similarly, inventory can become obsolete due to some disaster such as being damaged by fire etc. Write-Offs and Write-Downs: The Main Differences. held for sale in the ordinary course of business (e.g. Quantify the amount impacted by the change in each financial line item. Under IFRS, the following financial statement disclosures concerning inventories are required: the accounting policies that were adopted in measuring inventories, including the cost formula used; the total carrying amount of inventories and the carrying amount in classifications that are appropriate to the entity; of Professional Practice, KPMG US, Director Advisory, Accounting Advisory Services, KPMG LLP, Partner, Accounting Advisory Services, KPMG US. Under. There also needs to be some work around the cost of decisions and their impact on inventory. Operational decisions try to determine a safe quantity of stock and better moments to replenish. The following graphic shows all the things a business might When an expense account is debited, this identifies that the money spent on the inventory, now obsolete, is an expense. interest cost when inventories are purchased with deferred settlement terms. The subsequent depreciation of the cost is included in production overheads in future periods over the assets estimated remaining useful life. <>stream

Focus on forecasting performance for mix, not final product. Inventory accounts balance is netted with this contra accounts balance, and net amount is presented in the balance sheet as inventory.  The result of doing that anticipation is a more efficient process that usually delivers items to customers in a faster way. A write-off involves completely taking the inventory off the books when it is identified to have no value and, thus, cannot be sold. software. Implement and program a warehouse management system (WMS) so that the items picked are listed in the order the picker will find them.

The result of doing that anticipation is a more efficient process that usually delivers items to customers in a faster way. A write-off involves completely taking the inventory off the books when it is identified to have no value and, thus, cannot be sold. software. Implement and program a warehouse management system (WMS) so that the items picked are listed in the order the picker will find them.  Example IV 1-1 illustrates the impact of subsequent events on inventory valuation. Having a good inventory policy is the best way to deal with thatproblem. Currently, with technology, the state of abundance, and customers' high expectations, the product life cycle has become shorter and inventory becomes obsolete much faster. 4 0 obj Its hard to predict every little detail that can go wrong in the process, therefore, these set of rules established by an inventory policy will, at the very least, help deal withthose problems. Executives need to deal with inventory issues as they arise! Conversely, when there are many interchangeable items, cost formulas first-in, first-out (FIFO) or weighted-average cost may be used. Business owners and managers focus on this activity because inventory typically represents the second largest expenditure in a company behind payroll. Alternatively, the company could have disposed of the inventory for some money, say through an auction for $800. In-transit:units that are on the way of the warehouse; goods ordered from the supplier but not yet available to clients.

Example IV 1-1 illustrates the impact of subsequent events on inventory valuation. Having a good inventory policy is the best way to deal with thatproblem. Currently, with technology, the state of abundance, and customers' high expectations, the product life cycle has become shorter and inventory becomes obsolete much faster. 4 0 obj Its hard to predict every little detail that can go wrong in the process, therefore, these set of rules established by an inventory policy will, at the very least, help deal withthose problems. Executives need to deal with inventory issues as they arise! Conversely, when there are many interchangeable items, cost formulas first-in, first-out (FIFO) or weighted-average cost may be used. Business owners and managers focus on this activity because inventory typically represents the second largest expenditure in a company behind payroll. Alternatively, the company could have disposed of the inventory for some money, say through an auction for $800. In-transit:units that are on the way of the warehouse; goods ordered from the supplier but not yet available to clients.

inventory provision policy