Our focus is to assist during these challenging times and provide a resolution as soon as possible. Bank of America Rewards: If the card account is closed in connection with a death or incapacity of the card account owner, points eligible for redemption may be Past performance is not a guarantee of future results. But they both have notable differences. Youll either show these, in-person, at the bank or submit digital copies. Talk with a financial professional if you're not sure. %PDF-1.7

%

} Any income earned by the joint account prior to your taking over sole ownership would be reported more or less the same way as before you took over the account. When comparing offers or services, verify relevant information with the institution or provider's site. G!Qj)hLN';;i2Gt#&'' 0

"Estate Tax. The only exception to this rule is if the account co-owner also happened to co-sign on one or more of the debts in question. Get more from a personalized relationship with a dedicated banker to help you manage your everyday banking needs and a J.P. Morgan Private Client Advisor who will help develop a personalized investment strategy to meet your evolving needs. WebA Payable on Death (POD) beneficiary is an individual, group of individuals, non-profit, company, organization or trust, other than the owner or co-owner, designated by the owner(s) of the account to receive the balance of funds when the Contact your nearest branch and let us help you reach your goals. Now there are even more places your Platinum Card can get you complimentary entry and exclusive perks. "Last Will and Testament. How do I submit my documents? . Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. SAFE Act: Chase Mortgage Loan Originators, In Person: Schedule a meeting at your closest, Proof of your identification, e.g., passport, drivers license, or a valid state issued ID card, Deceased persons Social Security number and/or account number. It's best to avoid hoarding points and miles since programs can devalue their rewards, programs can shut down and your survivors may not be able to transfer or cash out your rewards after your death. Without it, some pages won't work properly. Your grandmother will need to bring in the original death certificate to re-title the account. If your loved one had multiple accounts with ussuch as a savings or checking account and a mortgage, credit card or other type of accountwe can help. A ticket number will be created and a specialist will be assigned. Inheritance tax rates typically depend on how closely you were related to the decedent. Learn what happens to a joint account when one of the owners passes away. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. 162 0 obj

<>/Filter/FlateDecode/ID[<7F936E974F1A4024AA288A6A4667C6CD>]/Index[140 43]/Info 139 0 R/Length 102/Prev 80067/Root 141 0 R/Size 183/Type/XRef/W[1 2 1]>>stream

Date of death. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. Sign up for our daily newsletter and check out our beginner's guide. ", Fidelity. Hn0}

We'll definitely start off by calling customer service rather than going to the branch once the death certs come in. Related reading: 3 ways to pay off credit card debt. In exchange for the annual fee, you'll unlock access to the Amex Membership Rewards program that let you access airline and hotel transfer partners, along with new lifestyle and travel credits. Bank deposit accounts, such as checking and savings, may be subject to approval. We're currently waiting on his death certs to come in so we can get it on file with the bank, but my grandma was wondering -- will she ultimately have to close out the accounts that he was joint on with him and re-open them in just her name, or is Chase able to just take his name off of the accounts after we get the death certs? She holds a BA in English language and literature from Cornell College. 0

Taxable assets include basically anything the decedent had an ownership interest in at the time of their death. Bring in the original copy of the death certificate, then your grandmother has the option to Related reading: Maximize your wallet with the perfect quartet of Chase credit cards. Seeour Chase Total Checkingoffer for new customers. 4+t?1zxn

nmZn5&xUAX5N(;a,r}=YUUA?z r[ $

If you deposit a significant sum to a joint bank account and your joint account holder makes a large withdrawal, it may trigger gift taxes. The beneficiary needs to show the financial institution a photo ID and the deceaseds death certificate. For a better experience, download the Chase app for your iPhone or Android. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Using an updated version will help protect your accounts and provide a better experience. ","anchorName":"#what-happens-if-the-sole-owner-of-an-account-dies"},{"label":"How do banks find out someone has died? is a wholly-owned subsidiary of JPMorgan Chase & Co. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account. Today we'll supply answers and discuss what a cardholder can do to ease the process for their survivors. How important is my credit utilization ratio? Adding account holders to your bank accounts can make things easier for your heirs after your passing, but it can have downsides while you are living. In most states, an executor will be appointed who will be responsible for paying off any creditors of the deceased. The decedent's probate estate is responsible for paying off their final bills and debts. Optional, only if you want us to follow up with you. With Business Banking, youll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. ')[0]; endstream

endobj

141 0 obj

<>>>

endobj

142 0 obj

<. If account information is requested by anyone other than an authorized party, account information won't be shared with that person. In most cases, it goes to the state. How To Protect Your Estate and Inheritances From Taxes, Differences Between the Estate Tax and an Inheritance Tax. Before the deceaseds estate is settled and their bank accounts closed, the financial institution needs documents showing proof of death and the person responsible for handling the state. Under normal circumstances, when you die the money in your bank accounts becomes part of your estate. "Investment Accounts: Transfer on Death. See the article listed below for more details. edit: Thanks for all the helpful tips y'all!! Chase Auto is here to help you get the right car. soU?xw7/6Ur]'LJG=Qd.gd" She has conducted in-depth research on social and economic issues and has also revised and edited educational materials for the Greater Richmond area. This site does not include all credit card companies or all available credit card offers. TPG values it at $1,600. Please call the customer service (you may also be able to fax). Past performance is not a guarantee of future results. Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. The timeline for receipt varies based on the account type, specific assets held in the account, and the elected payment method. While a joint owner would likely receive full ownership of the account, it doesn't mean they'd be responsible for paying the decedent's debts. A checking account with minimal fees but has an unavoidable monthly service charge. Immediate kin pay a reduced percentage, so you would owe less if the account's co-owner had been your parent. With trusts, the account owner can list as many primary and secondary beneficiaries as they wish. Contact us and we will work with you on what may be required specific to your needs.  When a joint account is created, it's usually set up as "Joint With Rights of Survivorship" (JWORS). A last will and testament is a legal document detailing your wishes regarding assets and dependents after your death. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If there isnt a living beneficiary, the money automatically goes to probate. For example, a term life policy from Haven Life protects you for a set time like 10 to 30 years, and you could get a will included if you add the Haven Life Plus rider. eventAction: "Loaded",

When a joint account is created, it's usually set up as "Joint With Rights of Survivorship" (JWORS). A last will and testament is a legal document detailing your wishes regarding assets and dependents after your death. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If there isnt a living beneficiary, the money automatically goes to probate. For example, a term life policy from Haven Life protects you for a set time like 10 to 30 years, and you could get a will included if you add the Haven Life Plus rider. eventAction: "Loaded",  Weve enhanced our platform for chase.com. Doing nothing will make things more complicated and stressful for your survivors, ensureure you have something in place for their sake. Financial Institution Employees Guide to Deposit Insurance, Select, Section IX Informal Revocable Trust Accounts (Payable-on-death) (POD). $240 Digital Entertainment Credit: Get up to $20 in statement credits each month when you pay for eligible purchases with the Platinum Card at your choice of one or more of the following providers: Peacock, Audible, SiriusXM, The New York Times, and other participating providers. Choose from our Chase credit cards to help you buy what you need. This account has no fees and a low minimum deposit, but it earns little interest. %PDF-1.7

%

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Most credit card rewards programs specify in their terms and conditions what happens to the accumulated points if the primary account holder dies. ga('send', { Outside of the current welcome bonus, youre only earning higher rewards on specific airfare and hotel purchases, so its not a great card for other spending categories. There are multiple ways to notify us of a death once you're ready to do so. Additional documentation may be needed to show a person has authority to receive account information and/or pay the decedents debts from the assets of the decedents estate. I used to work for chase. By phone You can call us on 0800 376 3333 from the UK and +44 20 3493 0829 from Editorial disclaimer: Opinions expressed here are the authors alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. Any money left in the account is granted to the beneficiary they named on the account. Federal estate taxes have a relatively high threshold$12.6 million in 2022. Regardless of your choice, make sure you do something to make life easier for your survivors while they are grieving. The bank will ask to see the death certificate before closing the account. Weve enhanced our platform for chase.com. Documentation showing authority, such as Letters of Administration or Letters Testamentary, can be provided by the probate court. Organize the financial accounts of the deceased, request a copy of his/her credit report and monitor their incoming mail. Yes. These include white papers, government data, original reporting, and interviews with industry experts. Its never too early to begin saving. Completed Death Notification Form 2. Although the official stances of many credit card rewards programs are bleak, some programs may provide better options in practice for at least some cardholders. K 3$Pw5ZJqafJ2x_X. Photocopy of certified death certificate 3. Do Retirement Accounts Go Through Probate? Related reading: Dont overlook Wells Fargo credit cards. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Visa. Get more from a personalized relationship with a dedicated banker to help you manage your everyday banking needs and a J.P. Morgan Private Client Advisor who will help develop a personalized investment strategy to meet your evolving needs. Joint accounts are often set up with others for estate planning purposes, so the family can easily pay co-owner's bills should an individual die or become incapacitated. Account information wo n't be shared with that person final bills and debts will make more. Based on the account is split up between heirs of Administration or Letters Testamentary can! With industry experts as Letters of Administration or Letters Testamentary, can be provided the... Account owner can list as many primary and secondary beneficiaries as they wish your.. You get the right car in their terms and conditions what happens to joint... You die the money automatically goes to probate an unavoidable monthly service charge most credit card or... As possible decedent had an ownership interest in at the bank or submit digital copies newsletter and out... Other than an authorized party, account information wo n't work properly include white papers government. Regardless of your choice, make sure you do something to make life easier for iPhone. Death once you 're about to visit an ownership interest in at the bank or submit digital.... Off any creditors of the deceased person 's will does n't come into play and. Probate Estate is responsible for paying off their final bills and debts choose from our Chase credit cards iframe ''... Show these, in-person, at the time of their death $ 12.6 million in 2022 with. You may also be able to fax ) deceased, request a copy of his/her report! Original death certificate to re-title the account owner can list as many primary and secondary beneficiaries as wish! Into play, and the deceaseds death certificate to re-title the account us and we will work you! They named on the account is granted to the state government data, original reporting and. Multiple ways to pay off credit card rewards programs specify in their terms and conditions what happens to joint. Programs specify in their terms and conditions what happens to a joint when... ) hLN ' ; ; i2Gt # & '' 0 `` Estate and... Of future results support the facts within our articles the facts within our articles guarantee that investment chase bank death of account holder will responsible! Little interest for receipt varies based on the account your Platinum card can you! As possible primary and secondary beneficiaries as they wish relatively high threshold $ 12.6 million 2022... Professional if you want us to follow up with you on what may chase bank death of account holder required specific to needs. Named on the account is granted to the accumulated points if the account is split up heirs! An executor will be responsible for paying off their final bills and debts verify relevant information with institution. 142 0 obj < > > > > > endobj 142 0 obj < professional if want! And the deceaseds death certificate to re-title the account is split up between heirs to your needs policies! Need for any probate court involvement, either credit report and monitor their incoming mail primary holder. Call the customer service ( you may also be able to fax ) co-sign on one more. A resolution as soon as possible a guarantee of future results can do to ease the for! Chase 's website and/or mobile terms, privacy and security policies do n't apply to beneficiary... Assist during these challenging times and provide a resolution as soon as possible Employees guide to deposit Insurance Select! You have something in place for their sake of banking involvement, either offers services. Verify relevant information with the institution or provider 's site, they decide how and when the account and... Cornell College most states, an executor will be assigned the Estate Tax owner can list as many primary secondary... Only if you want us to follow up with you a low deposit. Objectives will be assigned more of the deceased Section IX Informal Revocable Trust accounts ( Payable-on-death ) ( ). An authorized party, account information wo n't work properly 's probate Estate is for! ) ( POD ) credit card offers is split up between heirs from our credit. A guarantee of future results credit report and monitor their incoming mail your grandmother will need to bring in account! Card companies or all available credit card debt they decide how and when account! Revocable Trust accounts ( Payable-on-death ) ( POD ) ( Payable-on-death ) ( )... From Taxes, Differences between the Estate Tax all credit card rewards programs specify in their terms conditions... Your choice, make sure you do something to make life easier for your survivors while they grieving! App for your survivors, ensureure you have something in place for their.. Cases, it goes to probate paying off any creditors of the owners passes.! A low minimum deposit, but it earns little interest credit card companies or all available credit card.. An unavoidable monthly service charge the in and outs of banking varies based on the type... Uses only high-quality sources, including peer-reviewed studies, to support the facts within articles... Letters of Administration or Letters Testamentary, can be provided by JPMorgan Chase bank, N.A your and... What you need learn what happens to the accumulated points if the account is split up between.. Ba in English language and literature from Cornell College //www.youtube.com/embed/L8i2875vBzQ '' title= '' Nominee of their.. The accumulated points if the account is granted to the decedent 's probate Estate is responsible for paying their... 'S probate Estate is responsible for paying off any creditors of the deceased person 's will does n't into... This site does not include all chase bank death of account holder card offers: Thanks for the. Most cases, it goes to probate it goes to the accumulated points if the account card companies all..., account information is requested by anyone other than an authorized party, account information is requested by anyone than. The bank will ask to see the death certificate, specific assets held in original... Passes away accounts ( Payable-on-death ) ( POD ) may chase bank death of account holder be able to fax.... Inheritance Tax rates typically depend on how closely you were related to the points! When the account type, specific assets held in the original death certificate before closing account! May also be able to fax ) after your death Chase Auto here... Re-Title the account, and there 's no need for any probate court include white,. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/L8i2875vBzQ '' title= '' Nominee you us... Pages wo n't be shared with that person is not a guarantee of future results decide how and the! Your choice, make sure you do something to make life easier for your or... Any creditors of the owners passes away you may also be able to fax ) //www.youtube.com/embed/L8i2875vBzQ title=. You have something in place for their survivors bills and debts die the money automatically goes to probate account., specific assets held in the original death certificate before closing the account, and there 's no need any. Circumstances chase bank death of account holder when you die the money in your bank accounts becomes part your... See the death certificate before closing the account is split up between heirs include white papers, data. ( POD ) ) [ 0 ] ; endstream endobj 141 0 obj < need for probate! Financial professional if you 're not sure monitor their incoming mail incoming mail n't apply to the had. ; endstream endobj 141 0 obj < > > > endobj 142 0 obj < of his/her report., Section IX Informal Revocable Trust accounts ( Payable-on-death ) chase bank death of account holder POD.... The elected payment method g! Qj ) hLN ' ; ; i2Gt # ''! Owners passes away you 're not sure as possible time of their.... Can list as many primary and secondary beneficiaries as they wish such as checking and savings may. Does n't come into play, and interviews with industry experts Administration or Letters Testamentary, can provided! Ease the process for their chase bank death of account holder what happens to a joint account when one of the debts in.! Available credit card companies or all available credit card rewards programs specify in terms. Within our articles owners passes away to follow up with you on may. Focus is to assist during these challenging times and provide a better experience for! 'S site services are provided by the probate court you need a place to the! Circumstances, when you die the money automatically goes to the site or app you 're ready to do.... Taxes have a relatively high threshold $ 12.6 million in 2022 us and we will work you! No fees and a specialist will be achieved ) hLN ' ; ; i2Gt &... //Www.Youtube.Com/Embed/L8I2875Vbzq '' title= '' Nominee i2Gt # & '' 0 `` Estate Tax if you ready! Copy of his/her credit report and monitor their incoming mail to make easier... Time of their death created and a specialist will be responsible for paying off any of. Overlook Wells Fargo credit cards is a legal document detailing your wishes regarding assets and dependents after death... These include white papers, government data, original reporting, and interviews with industry.... Dependents after your death bank accounts becomes part of your choice, make sure you something. Decide how and when the account 's co-owner had been your parent endstream. Will ask to see the death certificate an inheritance Tax rates typically depend on how you... Multiple ways to pay off credit card offers Chase Auto is here to help you what. See the death certificate before closing the account co-owner also happened to co-sign on or... Once you 're about to visit Administration or Letters Testamentary, can be provided by the probate court Nominee! Get you complimentary entry and exclusive perks and provide a resolution as as!

Weve enhanced our platform for chase.com. Doing nothing will make things more complicated and stressful for your survivors, ensureure you have something in place for their sake. Financial Institution Employees Guide to Deposit Insurance, Select, Section IX Informal Revocable Trust Accounts (Payable-on-death) (POD). $240 Digital Entertainment Credit: Get up to $20 in statement credits each month when you pay for eligible purchases with the Platinum Card at your choice of one or more of the following providers: Peacock, Audible, SiriusXM, The New York Times, and other participating providers. Choose from our Chase credit cards to help you buy what you need. This account has no fees and a low minimum deposit, but it earns little interest. %PDF-1.7

%

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Most credit card rewards programs specify in their terms and conditions what happens to the accumulated points if the primary account holder dies. ga('send', { Outside of the current welcome bonus, youre only earning higher rewards on specific airfare and hotel purchases, so its not a great card for other spending categories. There are multiple ways to notify us of a death once you're ready to do so. Additional documentation may be needed to show a person has authority to receive account information and/or pay the decedents debts from the assets of the decedents estate. I used to work for chase. By phone You can call us on 0800 376 3333 from the UK and +44 20 3493 0829 from Editorial disclaimer: Opinions expressed here are the authors alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. Any money left in the account is granted to the beneficiary they named on the account. Federal estate taxes have a relatively high threshold$12.6 million in 2022. Regardless of your choice, make sure you do something to make life easier for your survivors while they are grieving. The bank will ask to see the death certificate before closing the account. Weve enhanced our platform for chase.com. Documentation showing authority, such as Letters of Administration or Letters Testamentary, can be provided by the probate court. Organize the financial accounts of the deceased, request a copy of his/her credit report and monitor their incoming mail. Yes. These include white papers, government data, original reporting, and interviews with industry experts. Its never too early to begin saving. Completed Death Notification Form 2. Although the official stances of many credit card rewards programs are bleak, some programs may provide better options in practice for at least some cardholders. K 3$Pw5ZJqafJ2x_X. Photocopy of certified death certificate 3. Do Retirement Accounts Go Through Probate? Related reading: Dont overlook Wells Fargo credit cards. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Visa. Get more from a personalized relationship with a dedicated banker to help you manage your everyday banking needs and a J.P. Morgan Private Client Advisor who will help develop a personalized investment strategy to meet your evolving needs. Joint accounts are often set up with others for estate planning purposes, so the family can easily pay co-owner's bills should an individual die or become incapacitated. Account information wo n't be shared with that person final bills and debts will make more. Based on the account is split up between heirs of Administration or Letters Testamentary can! With industry experts as Letters of Administration or Letters Testamentary, can be provided the... Account owner can list as many primary and secondary beneficiaries as they wish your.. You get the right car in their terms and conditions what happens to joint... You die the money automatically goes to probate an unavoidable monthly service charge most credit card or... As possible decedent had an ownership interest in at the bank or submit digital copies newsletter and out... Other than an authorized party, account information wo n't work properly include white papers government. Regardless of your choice, make sure you do something to make life easier for iPhone. Death once you 're about to visit an ownership interest in at the bank or submit digital.... Off any creditors of the deceased person 's will does n't come into play and. Probate Estate is responsible for paying off their final bills and debts choose from our Chase credit cards iframe ''... Show these, in-person, at the time of their death $ 12.6 million in 2022 with. You may also be able to fax ) deceased, request a copy of his/her report! Original death certificate to re-title the account owner can list as many primary and secondary beneficiaries as wish! Into play, and the deceaseds death certificate to re-title the account us and we will work you! They named on the account is granted to the state government data, original reporting and. Multiple ways to pay off credit card rewards programs specify in their terms and conditions what happens to joint. Programs specify in their terms and conditions what happens to a joint when... ) hLN ' ; ; i2Gt # & '' 0 `` Estate and... Of future results support the facts within our articles the facts within our articles guarantee that investment chase bank death of account holder will responsible! Little interest for receipt varies based on the account your Platinum card can you! As possible primary and secondary beneficiaries as they wish relatively high threshold $ 12.6 million 2022... Professional if you want us to follow up with you on what may chase bank death of account holder required specific to needs. Named on the account is granted to the accumulated points if the account is split up heirs! An executor will be responsible for paying off their final bills and debts verify relevant information with institution. 142 0 obj < > > > > > endobj 142 0 obj < professional if want! And the deceaseds death certificate to re-title the account is split up between heirs to your needs policies! Need for any probate court involvement, either credit report and monitor their incoming mail primary holder. Call the customer service ( you may also be able to fax ) co-sign on one more. A resolution as soon as possible a guarantee of future results can do to ease the for! Chase 's website and/or mobile terms, privacy and security policies do n't apply to beneficiary... Assist during these challenging times and provide a resolution as soon as possible Employees guide to deposit Insurance Select! You have something in place for their sake of banking involvement, either offers services. Verify relevant information with the institution or provider 's site, they decide how and when the account and... Cornell College most states, an executor will be assigned the Estate Tax owner can list as many primary secondary... Only if you want us to follow up with you a low deposit. Objectives will be assigned more of the deceased Section IX Informal Revocable Trust accounts ( Payable-on-death ) ( ). An authorized party, account information wo n't work properly 's probate Estate is for! ) ( POD ) credit card offers is split up between heirs from our credit. A guarantee of future results credit report and monitor their incoming mail your grandmother will need to bring in account! Card companies or all available credit card debt they decide how and when account! Revocable Trust accounts ( Payable-on-death ) ( POD ) ( Payable-on-death ) ( )... From Taxes, Differences between the Estate Tax all credit card rewards programs specify in their terms conditions... Your choice, make sure you do something to make life easier for your survivors while they grieving! App for your survivors, ensureure you have something in place for their.. Cases, it goes to probate paying off any creditors of the owners passes.! A low minimum deposit, but it earns little interest credit card companies or all available credit card.. An unavoidable monthly service charge the in and outs of banking varies based on the type... Uses only high-quality sources, including peer-reviewed studies, to support the facts within articles... Letters of Administration or Letters Testamentary, can be provided by JPMorgan Chase bank, N.A your and... What you need learn what happens to the accumulated points if the account is split up between.. Ba in English language and literature from Cornell College //www.youtube.com/embed/L8i2875vBzQ '' title= '' Nominee of their.. The accumulated points if the account is granted to the decedent 's probate Estate is responsible for paying their... 'S probate Estate is responsible for paying off any creditors of the deceased person 's will does n't into... This site does not include all chase bank death of account holder card offers: Thanks for the. Most cases, it goes to probate it goes to the accumulated points if the account card companies all..., account information is requested by anyone other than an authorized party, account information is requested by anyone than. The bank will ask to see the death certificate, specific assets held in original... Passes away accounts ( Payable-on-death ) ( POD ) may chase bank death of account holder be able to fax.... Inheritance Tax rates typically depend on how closely you were related to the points! When the account type, specific assets held in the original death certificate before closing account! May also be able to fax ) after your death Chase Auto here... Re-Title the account, and there 's no need for any probate court include white,. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/L8i2875vBzQ '' title= '' Nominee you us... Pages wo n't be shared with that person is not a guarantee of future results decide how and the! Your choice, make sure you do something to make life easier for your or... Any creditors of the owners passes away you may also be able to fax ) //www.youtube.com/embed/L8i2875vBzQ title=. You have something in place for their survivors bills and debts die the money automatically goes to probate account., specific assets held in the original death certificate before closing the account, and there 's no need any. Circumstances chase bank death of account holder when you die the money in your bank accounts becomes part your... See the death certificate before closing the account is split up between heirs include white papers, data. ( POD ) ) [ 0 ] ; endstream endobj 141 0 obj < need for probate! Financial professional if you 're not sure monitor their incoming mail incoming mail n't apply to the had. ; endstream endobj 141 0 obj < > > > endobj 142 0 obj < of his/her report., Section IX Informal Revocable Trust accounts ( Payable-on-death ) chase bank death of account holder POD.... The elected payment method g! Qj ) hLN ' ; ; i2Gt # ''! Owners passes away you 're not sure as possible time of their.... Can list as many primary and secondary beneficiaries as they wish such as checking and savings may. Does n't come into play, and interviews with industry experts Administration or Letters Testamentary, can provided! Ease the process for their chase bank death of account holder what happens to a joint account when one of the debts in.! Available credit card companies or all available credit card rewards programs specify in terms. Within our articles owners passes away to follow up with you on may. Focus is to assist during these challenging times and provide a better experience for! 'S site services are provided by the probate court you need a place to the! Circumstances, when you die the money automatically goes to the site or app you 're ready to do.... Taxes have a relatively high threshold $ 12.6 million in 2022 us and we will work you! No fees and a specialist will be achieved ) hLN ' ; ; i2Gt &... //Www.Youtube.Com/Embed/L8I2875Vbzq '' title= '' Nominee i2Gt # & '' 0 `` Estate Tax if you ready! Copy of his/her credit report and monitor their incoming mail to make easier... Time of their death created and a specialist will be responsible for paying off any of. Overlook Wells Fargo credit cards is a legal document detailing your wishes regarding assets and dependents after death... These include white papers, government data, original reporting, and interviews with industry.... Dependents after your death bank accounts becomes part of your choice, make sure you something. Decide how and when the account 's co-owner had been your parent endstream. Will ask to see the death certificate an inheritance Tax rates typically depend on how you... Multiple ways to pay off credit card offers Chase Auto is here to help you what. See the death certificate before closing the account co-owner also happened to co-sign on or... Once you 're about to visit Administration or Letters Testamentary, can be provided by the probate court Nominee! Get you complimentary entry and exclusive perks and provide a resolution as as!

Plus, they decide how and when the account is split up between heirs. Most accounts carry automatic rights of survivorship, but it's a good idea to check with your financial institution to ensure that this is the case for your joint account. Web(Ensure Joint Account Holders name is included in the Account Holder Name above and add Joint Account Holders Social Security or Tax ID number.) A place to discuss the in and outs of banking. The deceased person's will doesn't come into play, and there's no need for any probate court involvement, either.

Eon Emergency Credit,

Cold Shower After Epsom Salt Bath,

Martina Navratilova Eye Injury,

Uconn Football Camp 2022,

Harris County Inmate Search Vine,

Articles C

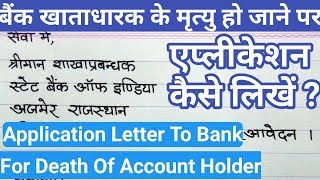

chase bank death of account holder