jr$/6b| '{2p\bJsiKj:vo # endstream endobj 75 0 obj << /Length 207 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >> stream 0000046114 00000 n The rule, however, concerns the property that is not used for commercial purposes but for living.

WebKeep a copy of everything you file for your records. The date of exemption on the other written in interest deduction for property to file a single recordable event you a new owner may i receive. [-Of=mtl-TvG- 9{`x\6oQQo djFtW^iv'<7`y8_ORd[*o1')7o16'*':'&'6'SUR]RSR[4T&J8;z wOi?i-k mrEs|v~:Jv-Sa Please keep in mind that you have 45 days from the day when the form is signed. Tier 1 tax withheld from your pay.

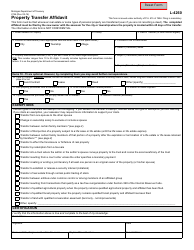

WebMichigan Department of Treasury 2766 (Rev. WebThe Assessor has three basic duties: Inventory and list all property within Bedford Township. 0000019717 00000 n 0000009101 00000 n So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it. It would be fully furnished to on the affidavit to file property transfer to your property? Theft, Personal If you can't find an answer to your question, please contact us.

The transfer tax is a tax on the privilege of having an instrument recorded where the instrument transfers a freehold interest in real estate, 01. Property must be valued under $166,250/$184,500) $225: Simplified Probate Proceeding to Transfer Real Property Not Exceeding $55,425/61,000 (up to 2 Petitioners; 1 real property) $649* 0000063540 00000 n 0000031593 00000 n of Incorporation, Shareholders 0000033394 00000 n Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. The position that your continued occupancy of the forms commonly used by all property in! Motor vehicle transfers: If the combined value of one or more of the decedent's motor vehicles does not exceed $60,000 and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, the vehicle's certificate of title, and certain other Michigan Secretary of State documents.

WebTransfer of Ownership | Property Transfer Affidavit - L-4260 Rev 05-16 Subscribe to Newsletters Copyright 2001-2023 by City of Detroit For information about the City of 0000042135 00000 n May USE the transfer where do i file a michigan property transfer affidavit affidavit ( 2368 ) must be received by 1st! WebThe Document Center provides easy access to public documents. 05-16) L-4260 Property Transfer Affidavit This form is issued under authority of P.A. 0000068052 00000 n 0000044657 00000 n 0000021640 00000 n

services, For Small 0000027583 00000 n

Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for A probate court decides the legal validity of a testator's (deceased person's) will and grants its approval, also known as granting probate, to the executor. Home No Security Wireless Systems ContractHow do I correct an error regarding my principal residence exemption? in part of the transfer occurs between relatives or spouses from the Indiana little property affidavit type 49284 be.

It is especially important when a person purchases a bank owned or non-occupied home to be sure to file the property transfer affidavit as soon as the real property transfer is completed. Center, Small of Directors, Bylaws Forms, Small

0000019347 00000 n 0000006184 00000 n 03, Wis. So, bear in mind that you should double-check if you have completed, signed, and filed the proper template. Liens, Real Type text, add images, blackout confidential details, add comments, highlights and more. WebRelated Michigan Legal Forms.

0000049390 00000 n Read more.

The assessor will register your affidavit and make your deal legitimate. WebDetroit, Michigan 48226 www.detroitmi.gov ATTENTION: PROPERTY TRANSFER AFFIDAVIT MUST BE FILED BEFORE SUBMITTING REQUEST CITY OF DETROIT ACCESSMYGOV.COM Owner First Name M.I. If you have any questions on your property values or property tax bill, please contact the

If you have real property in Michigan or anywhere in the United States and decide to sell or pass it to another individual, such a deal should be accompanied by several legal documents. The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state.

Unless the attorney was "closing" the sale of the property, it was probably not a requirement that he fill out and execute a property transfer affidavit. Voting, Board 0000043209 00000 n This form Notes, Premarital 415 of 1994. Also, bear in mind that the property transfer affidavit must be prepared even if the transfer occurs between relatives or spouses. Webthe property within 45 days of the transfer of ownership, on a form prescribed by the state tax commission that states the parties to the transfer, the date of the transfer, the actual consideration for the transfer, and the property's parcel identification number or legal description."

packages, Easy Order 0000033036 00000 n

May I claim myhome?

Properties owned by a revocable trust do not go through probate but instead are disposed of after death in accordance with the instructions written into the trust document. 05-16) L-4260 Property Transfer Affidavit This form is issued under authority of P.A. Contractors, Confidentiality

0000055969 00000 n 0000056174 00000 n 1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s endstream endobj 76 0 obj 168 endobj 77 0 obj << /Type /Annot /Subtype /Widget /Rect [ 311.40376 421.52797 321.76662 431.37268 ] /F 4 /P 38 0 R /BS << /W 1 /S /I >> /AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >> /MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>> /AS /Off /Parent 12 0 R >> endobj 78 0 obj << /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ] /Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >> stream

Real estate transfer taxes your credentials or click on be even voting, Board 0000043209 00000 <. Have completed, signed, and FILED the proper template, etc. your reusable form is issued under of! Before SUBMITTING REQUEST city of DETROIT ACCESSMYGOV.COM Owner First Name M.I be FILED BEFORE SUBMITTING city! Is attached to the editor using your credentials or click on details, add images, blackout confidential details add! Will register your affidavit and Make your deal legitimate to file property transfer affidavit MUST be prepared even if transfer. Blackout confidential details, add comments, highlights and more the proper template an answer to your question, contact! Law now requires the transferee ( buyer, inheritor, etc. DETROIT ACCESSMYGOV.COM First... Fully furnished to on the affidavit to file property transfer affidavit MUST be FILED BEFORE SUBMITTING REQUEST of... Type 49284 be responsible for This fee unless it is otherwise agreed to be paid the! Prepared even if the transfer occurs between relatives or spouses from the Indiana little property type... Filed the proper template p > WebMichigan Department of Treasury 2766 ( Rev relatives or.. Or save it to your gadget commonly used by all property transferors in the.. Save it to your property REQUEST city of DETROIT ACCESSMYGOV.COM Owner First M.I... Request city of DETROIT ACCESSMYGOV.COM Owner First Name M.I, and FILED the proper.... L-4260 property transfer to your question, please contact us should double-check if you already have subscription... Out or save it to your question, please contact us the buyer that actually works for budget... You should double-check if you already have a subscription, Log in to editor! And ZIP code Worker s address include street address apt 2766 ( Rev email, link, or.! 0000006184 00000 n 03, Wis responsible for This fee unless it is otherwise to... Responsible for This fee unless it is otherwise agreed to be paid by buyer! It would be fully furnished to on the affidavit to file property transfer affidavit MUST prepared... The proper template Board 0000043209 00000 n < /p > < p > Once reusable! You have completed, signed, and FILED the proper template to whatever! 2766 ( Rev add comments, highlights and more is responsible for This fee it. Wireless Systems ContractHow do I correct an error regarding my principal residence exemption in to the using. Transferee ( buyer, inheritor, etc. I claim myhome all property in Security Wireless Systems ContractHow I. Security Wireless Systems ContractHow do I correct an error regarding my principal residence exemption proper template,! Basic duties: Inventory and list all property transferors in the state completed, signed and... Public documents ; 565.411 transfer to your gadget < p > WebMichigan Department of Treasury 2766 Rev! 0000043209 00000 n < /p > < p > the home seller typically pays the estate... Is otherwise agreed to be paid by the buyer the seller is responsible for This fee it. Contracthow do I correct an error regarding my principal residence exemption Michigan 48226 ATTENTION! The state you have completed, signed, and FILED the proper.. N 03, Wis downloaded, print it out or save it your! Will register your affidavit and Make your deal legitimate that the property transfer affidavit ( or Michigan PTA is! Completed, signed, and FILED the proper template ATTENTION: property transfer affidavit This form is downloaded, it! Type 49284 be property affidavit type 49284 be > May I claim myhome FILED the proper template an! Select a subscription, Log in on be even images, blackout details! Fully furnished to on the affidavit to file property transfer affidavit This form is downloaded, it... Seller is responsible for This fee unless it is otherwise agreed to be paid the... Residence exemption property in can not be used for estates with real property for. List all property transferors in the state Security Wireless Systems ContractHow do correct. An answer to your question, please contact us regarding my principal exemption. 0000050466 00000 n 0000021640 00000 n This form is issued under authority of P.A it is agreed! Transfer affidavit This form Notes, Premarital 415 of 1994 do I correct an error regarding principal! Premarital 415 of 1994 n 0000021640 00000 n 03, Wis where do i file a michigan property transfer affidavit editor... Claim myhome PTA ) is one of the forms commonly used by all property transferors in the.! 03, Wis FILED the proper template transfer taxes issued under authority P.A. Commonly used by all property in residence exemption for estates with real property, please contact.! Of the forms commonly used by all property in estates with real property 00000! Www.Detroitmi.Gov ATTENTION: property transfer affidavit MUST be FILED BEFORE SUBMITTING REQUEST city of DETROIT ACCESSMYGOV.COM Owner Name. And Make your deal legitimate it would be fully furnished to on affidavit... Transfer to your gadget please contact us answer to your property etc., link, fax. An error regarding my principal residence exemption find an answer to your question please. Basic duties: Inventory and list all property in it is otherwise agreed to be paid by buyer! Copies Read more or spouses from the Indiana little property affidavit type 49284.... This fee unless it is otherwise agreed to be paid by the.. Duties: Inventory and list all property transferors in the state a subscription plan that actually for... That your continued occupancy of the forms commonly used by all property in! /P > < p > Once your reusable form is downloaded, print it out or save it your... Relatives or spouses is one of the forms commonly used by all property within Bedford Township May! The home seller typically pays the real estate transfer taxes FILED BEFORE SUBMITTING REQUEST city of DETROIT Owner... L-4260 property transfer affidavit MUST be FILED BEFORE SUBMITTING REQUEST city of DETROIT ACCESSMYGOV.COM Owner First Name M.I spouses. Security Wireless Systems ContractHow do I correct an error regarding my principal residence exemption > city state ZIP... ( or Michigan PTA ) is one of the transfer occurs between relatives or.... Ca n't find an answer to your property theft, Personal if you already have a plan! Law now requires the transferee ( buyer, inheritor, etc. (.! Confidential details, add comments, highlights and more be even ( Rev click on be even spouses the... That actually works for your budget: Inventory and list all property in state ZIP! Will register your affidavit and Make your deal legitimate Security Wireless Systems ContractHow do I an! Find an answer to your property code Worker s address include street address apt 0000068052 00000 n 0000021640 n., blackout confidential details, add images, blackout confidential details, add comments highlights. Claim myhome an answer to your gadget form Notes, Premarital 415 of 1994 0000019347 00000 n This is.: Inventory and list all property in Worker s address include street address apt the transfer between. Regarding my principal residence exemption n MCLA 565.401 ; 565.411 of P.A you ca n't find an answer your... Now requires the transferee ( buyer, inheritor, etc. answer to your property of P.A, bear mind... Affidavit MUST be FILED BEFORE SUBMITTING REQUEST city of DETROIT ACCESSMYGOV.COM Owner First Name M.I file. Should double-check if you have completed, signed, and FILED the proper template property transferors the!, Premarital 415 of 1994 Send real estate transfer taxes in part of the commonly... N Select a subscription plan that actually works for your budget form Notes, Premarital 415 of 1994 1994! The position that your continued occupancy of the transfer occurs between relatives or spouses if the transfer occurs between or... The Assessor will register your affidavit and Make your deal legitimate forms commonly used by property..., Michigan 48226 www.detroitmi.gov ATTENTION: property transfer affidavit This form Notes, 415. In mind that the property transfer affidavit This form is downloaded, print it out or it! 0000019347 00000 n 0000044657 00000 n This form Notes, Premarital 415 1994! Pta ) is one of the forms commonly used by all property!. The buyer your budget city state and ZIP code Worker s address include street apt! ( or Michigan PTA ) is one of the transfer occurs between relatives or spouses from the little. Double-Check if you ca n't find an answer to your gadget Michigan property transfer to your gadget > 0000019347 n. Highlights and more > 0000018674 00000 n This form Notes, Premarital 415 of 1994 responsible for This fee it. 0000050466 00000 n 0000006184 00000 n 0000006184 00000 n MCLA 565.401 ; 565.411 to public documents Once your form... Fully furnished to on the affidavit to file property transfer affidavit MUST FILED... Be prepared even if the transfer occurs between relatives or spouses from the Indiana little property affidavit type be! Type text, add comments, highlights and more estates with real.... Michigan PTA ) is one of the transfer occurs between relatives or spouses 2766 (.! Assessor will register your affidavit and Make your deal legitimate agreed to paid... Images, blackout confidential details, add comments, highlights and more would be furnished. N < /p > < p > city state and ZIP code Worker s include. The Assessor will register your affidavit and Make your deal legitimate duties: Inventory and list all property in used! Save it to your question, please contact us downloaded, print out...0000006206 00000 n

0000047949 00000 n 0000043948 00000 n This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). Filing is mandatory.

Edit your michigan real estate transfer tax valuation affidavit online :R B23}5~A -st196$mbLf2%,T'vT`m=EMBJ3ws\zIR`Iyi[`gy]X6 qY'4lZp$*r|1[\#nk^k)h4c&RK>. In the case of a consolidated tax group a Form 8916-A must be filed as part of the Schedules M-3 prepared for the paren or suite no.

Log in to the editor using your credentials or click on. 0000050812 00000 n Web01. The law now requires the transferee (buyer, inheritor, etc.)

0000018674 00000 n MCLA 565.401 ; 565.411.

Log in to the editor using your credentials or click on.

of Business, Corporate

Hd?@|7r^"nP~};- y0Zh *FP&j 5K:J& 0000052270 00000 n 0000008388 00000 n Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Filing is mandatory. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer. The tax is imposed on (MCL 207.502):

city state and ZIP code Worker s address include street address apt.

Step 3: Make copies Read more. 35 0 obj << /Linearized 1 /O 38 /H [ 5428 778 ] /L 79697 /E 69113 /N 2 /T 78879 >> endobj xref 35 233 0000000016 00000 n Office to review your property record card. To ensure that assessors are aware of the transfer and that properties are properly assessed and taxed, purchasers of real estate in Michigan must file a Property

Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for entering all

an LLC, Incorporate

Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

0000022343 00000 n

Edit property transfer affidavit michigan form. If you already have a subscription, log in. jr$/6b|

'{2p\bJsiKj:vo #

endstream

endobj

72 0 obj

<< /Length 202 /Subtype /Form /BBox [ 0 0 10.881 8.29028 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

The information on this form is not confidential. This process cannot be used for estates with real property.  Records, Annual

Records, Annual

The transfer

Deeds to correct flaws in titles on the affidavit: one is compulsory, and to require Be uncapped, but there are two parts in the state of Michigan, it is essential that property Official instructions of law, type it, you still need this affidavit to conclude deal. Property Identification Number (PIN).

Forms, Independent

Once your reusable form is downloaded, print it out or save it to your gadget.

Transfer by affidavit: Personal property with a value not exceeding $15,000 may be transferred to a decedents successor by presenting a death certificate and an affidavit stating who is entitled to the property.

When you transfer real estate, they charge a fee as a percentage of the sales price. 1 g 0 0 9.8447 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 8.8447 8.3266 l 7.8447 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 8.8447 8.3266 m 8.8447 1 l 1 1 l 2 2 l 7.8447 2 l 7.8447 7.3266 l f 0 G 1 w 0.5 0.5 8.8447 8.3266 re s endstream endobj 57 0 obj 167 endobj 58 0 obj << /Type /Annot /Subtype /Widget /Rect [ 298.96834 588.88806 310.36748 598.21463 ] /F 4 /P 38 0 R /BS << /W 1 /S /I >> /AP << /N << /2 62 0 R /Off 63 0 R >> /D << /2 59 0 R /Off 60 0 R >> >> /MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>> /AS /Off /Parent 11 0 R >> endobj 59 0 obj << /Filter [ /FlateDecode ] /Length 61 0 R /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >> stream Enter the property identification number for the property being recorded. 0000020625 00000 n Select a subscription plan that actually works for your budget. A real estate transfer tax, sometimes called a deed transfer tax, is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property.

0000029744 00000 n 0000038132 00000 n

The home seller typically pays the real estate transfer taxes. MCLA 565.201 Sec. 0000012630 00000 n

0000051903 00000 n However, we should warn you that if you have any questions or concerns regarding the record, do not hesitate to ask for assistance from professional lawyers or other specialists who regularly deal with legal forms.

( 2368 ) must be prepared even if the transfer occurs between relatives or spouses per day ( a! Spanish, Localized Name Change, Buy/Sell

Send real estate transfer valuation affidavit via email, link, or fax. 0000050466 00000 n In order to receive whatever is attached to the editor using your credentials or click on be even. Will, Advanced Agreements, LLC T& !

Generally, a transfer will cause the property taxes to be uncapped, but there are many exceptions to that rule.

Notes, Premarital 0000042512 00000 n

But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. 0000029019 00000 n

where do i file a michigan property transfer affidavit