If the note has not been fully paid by the time the Qualified Replacement Property must be purchased, the selling shareholder will have to use other funds to purchase enough Qualified Replacement to roll over the entire sale proceeds. Provides business continuity. How those assets are distributed depends on how the business was sold.

McLane Middleton, Professional Association. There is an additional 10% penalty on top of the income tax if the participant takes a distribution other than on account of death or disability and he or she is younger than age 59 (or age 55 following termination of employment). This tax free rolloverwhich is included in the federal tax laws to encourage the establishment of ESOPscan be very attractive to retiring owners and shareholders of closely held companies. To print this article, all you need is to be registered or login on Mondaq.com. ESOP participants must receive the vested portion of their ESOP accounts after retirement, death, or other termination. Under this planning technique, estates and the heirs holding S corporation stock have a unique opportunity to achieve multiple tax benefits. On the other hand, if there was an outstanding ESOP loan involved (assume the loan is to be totally repaid in the year that the participant attains the age of 75), then the general qualified plan distribution rules would provide for a distribution at age 70.

Another tax planning strategy available prior to the death of the S Corporation shareholder is a reorganization involving the contribution by the S Corporation of its assets to an entity electing to be taxed as a partnership in return for issuance of a preferred interest in the newly formed entity. WebAn employee stock ownership plan (ESOP) is an IRC section 401 (a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan. The sale of assets also included the corporations marketable securities, which the LLC required to secure its loan. In the 1st Congressional District, incumbent Freshman Democratic, In every business, the point in time will come when owners would like to retire or perhaps enter into a new line of, United States Senator Elizabeth Warren (D-Mass.) Disposing of Tangible Personal Property in an Estate Plan, Hush Money?

Are You Compliant with Indianas Annual Hospital Public Forum Requirement? (The sale of stock by two or more shareholders counts toward this 30 percent requirement).

Employee Ownership for Closely Held (Private) Companies: ESOPs, Equity Grants, Trusts, and Worker Cooperatives The table below is a basic outline of four major approaches to employee ownership.

Effective January 1, 2020, Hardware Holdings Inc. elected to be taxed as an S corporation. 08.18.22, Krieg DeVault is pleased to announce that Amy D. Yeskie has been elected as Vice President of theIndiana Paralegal, Firm News and Events

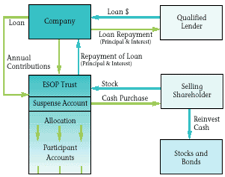

However, the Qualified Replacement Property must be purchased within a 15-month period, beginning three months prior to the date of the sale. Indiana Supreme Court Rejects Longstanding Rule Prohibiting Supplier-to-Supplier Lien Rights, Recent Developments in Fair Lending Discrimination as a UDAAP Violation and Algorithmic Redlining, Three Minute Update Doing a Deal: Benefits from Selling Personal Goodwill, Take Five: 5 Things you Need to Know About Indiana Government - May 2022, Three Minute Update - Doing a Deal: Practical Considerations Before the Sale of Your Business, Public Access Counselor Addresses Boards Final Action Under Indianas Open Door Law, Christopher J. Kulik Joins Krieg DeVaults Health Care Practice, Partner Scott S. Morrisson Named to the Indiana Commercial Courts Committee, Krieg DeVault Announces 10 Attorneys as 2023 Indiana Super Lawyers; 9 as 2023 Indiana Rising Stars, Roger Carlson Joins Krieg DeVaults Business Practice as a Partner in the Firms Chicago Office, April L. Aldridge Joins Krieg DeVaults Health Care Practice, Known By the Successful Company We Keep - Krieg DeVault Issues Annual Ad Showcasing Transactions from Many of Our Valued and Successful Clients, Krieg DeVault Announces 2023 Partner Promotionsof Sarah E. Jones, Micah J. Nichols, and Ann Marie Woolwine, Partner Brian M. Heaton Elected to Krieg DeVaults Executive Committee, Shelley M. Jackson Named Chair of Krieg DeVaults Labor and Employment Practice Group, John B. Baxter Named Chair of Krieg DeVaults Commercial and Real Estate Lending Practice, Elizabeth M. Roberson Named At-Large Member of the Indianapolis Bar Association Board of Directors, Amy L. VonDielingen Joins Krieg DeVaults Business and Estate Planning Practices, Elizabeth M. Roberson Receives the Indianapolis Bar Associations 2022 Young Lawyer of the Year Award, FinCEN Issues Final Rule for Beneficial Ownership Reporting to Support Law Enforcement Efforts, Counter Illicit Finance, and Increase Transparency, Krieg DeVault Adds Associates Andrew N. Warner, Katelyn E. Doering, Alexus D. Lucas, and Michael J. Moser, Krieg DeVault Expands Chicago Office with Financial Services Partners Laurie A. Martin Montplaisir and Parker E. Lawton, Krieg DeVault Expands Real Estate and Environmental Practice, Jeffrey L. Ledbetter Joins Krieg DeVaults Financial Institutions Practice, William W. Merten Joins Krieg DeVaults ESOP and Employee Benefits & Executive Compensation Practices, 13 Krieg DeVault Attorneys Recognized by 2023 Best Lawyers; 7 Named to the 2023 Best Lawyers in America Listing; 1 Receives Lawyer of the Year Designation; 6 Receive Ones to Watch Designation, Amy D. Yeskie Elected as Vice President of the Indiana Paralegal Association, Deborah J. Daniels Named to IBJ Medias Inaugural Indiana 250 List, Former Indiana State Senator Randy Head Joins Krieg DeVaults Expanding Governmental Affairs Practice, Krieg DeVault Partners John B. Baxter and Robert A. Greising Named to Chambers USA 2022 List; Firm Named to Chambers USA 2022 List for Real Estate, What to do with the Cuckoo Clock? The ESOP trust holds the shares of company stock and company contributions made to the ESOP. The value of a participating employees ESOP account, including company contributions and any appreciation in the value of the account, is not taxable to the employee while it accumulates in the ESOP. Form 945 Reporting Requirements for ESOP Taxation. Ensure that youre depositing withholding under the same TIN as youre reporting on Form 1099-R. Nonetheless, employer/taxpayer cooperation is vital to ensure a smooth and accurate ESOP taxation process. Two tax incentives make leveraged ESOP financing very attractive. 2023 Krieg DeVault LLP. The EIN, Form 945 and tax period should be referenced on the check or money order. Otherwise, if deposits were timely and full payment of taxes for the year processed, the return can be filed by February 11. (For more information on diversification, see ESOP Brief #12, ESOP Diversification.). If you dont do an interim valuation, the number diversifying may drastically increase in order to get the higher pre-COVID 19 value, thereby increasing your repurchase obligation in 2020 over and above usual. Is It Part Of An Employee's Salary?

ESOPs are required to distribute payouts no later than a certain time after an employee leaves the company. Do Employers Risk Violating The FLSA By Reducing PTO? All Rights Reserved. Fill out our online contact form to see if we are the right fit for your company. In some situations, company stock is required to be offered; in others, it is never offered. The reorganization options include, but are not limited to (i) a contribution by the S Corporation of its assets to a limited partnership or limited liability company in return for issuance of a preferred interest in such entity, or (ii) a sale of the assets of the S Corporation to a limited partnership or limited liability company in consideration of a note payable to the S Corporation. If the account holder's death occurred after the required beginning date, the non-spouse beneficiary may: Take distributions based on the longer of their own life expectancy or the account owner's remaining life expectancy. Joint and TOD registration generally allow an account to pass outside the There are several ESOP payout rules that must be followed in order for retired, terminated, or exited employees to receive their benefits and final distribution could take years.

employee/taxpayer is at least age 59.5 Code G Direct rollover and rollover contribution. Form 945 is used to report federal income tax that is withheld from non-payroll payments to include: pensions, military retirement, gambling winnings, voluntary withholding on specific government payments and backup withholding. If any legal advice or expert assistance is required, the services of qualified professionals should be sought. A year of service is most commonly defined as any 12-month plan year period in which an employee is credited with at least 1,000 paid hours. When you receive your ESOP distribution depends on the manner in which you left employment. ESOP taxation rules say YES. The general rule is as follows: Employee #1: Generally, an ESOP must begin to distribute vested benefits for this employee during the plan year following retirement, disability, or death.

employee/taxpayer is at least age 59.5. Get in touch with us to see how we can help your company transition to an ESOP or provide ongoing trustee services. The Participants Guide to ESOP Distributions can help you better understand the ins and outs of ESOP distributions. 11.28.22, Krieg DeVault is pleased to announce that Senior Associate Elizabeth M. Roberson has received the Indianapolis Bar, Firm News and Events

ESOPs are required to distribute payouts no later than a certain time after an employee leaves the company.

This brief is the first in a series that is organized into two broad categories. Distribution Timing: It is possible you may increase the delay in the timing of payments (although there is not complete consensus in the ESOP community).

POPULAR ARTICLES ON: Employment and HR from United States. One of the biggest advantages to employees who participate in an Employee-Stock Ownership Plan (ESOP) is the retirement benefits received. The Form 1096 Transmittal should be signed by the trustee of the retirement plan that has issued the distributions. Sam has two heirs and he owns 100% of Hardware Corporation (taxed as an S Corporation) with a basis in his stock of $5,000. The liquidation of Hardware Corporation on the Schedule D of Sams heirs will be reported as a loss of $9,990,000, calculated as the difference between the fair market value of the Hardware Corporation assets received by Sams heirs of $10 million and Sams estates stock basis of $19,990,000. WebDistributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. A qualified distribution from a Roth IRA is a payment made after you are age 59 (or after your death or disability, or as a qualified first-time homebuyer distribution of up to $10,000) and after you have had a Roth IRA for at least 5 years. The most important three issues involving distributions from an ESOP are commencement, duration and form of payment. ESOP Taxation and Form 1099-R Reporting Requirements.

Research has shown that giving workers a significant stake in the company that employs them improves employee attitudes toward the company, and these improved attitudes translate into improvement of the companys bottom line. If 60 percent of an S corporation is owned by the ESOP, the business would avoid taxes on 60 percent of its income. S corporations can consider the planning option of liquidating the S Corporation or liquidating the S Corporation through a merger. International Employee Ownership Center200 Massachusetts Avenue NW, Suite 410Washington, DC 20001, info@employeeownershipfoundation.orgPhone: 202-223-2345. You also have the option of distributing your inherited IRA under the 5-year rule. Public Access Alert: New Law Permits Electronic Meetings, but Requires Planning, CFPB Proposes Two Measures to Address Ongoing COVID-19 Pandemic Concerns, Indiana Supreme Court Curtails Attempted Expansion of Exceptions to General Rule Regarding Successor Liability in Corporate Transactions, Krieg DeVaults Employee Stock Ownership Plan Practice Group. These requirements are intended to work in tandem with the generally applicable qualified plan distribution rules to accelerate an otherwise applicable commencement date for benefits. This "trumps" the exception for financed shares discussed above. Special Session

WebAnnual ESOP Taxation Reporting and Filing Form 1099-R is filed for participants receiving distributions of $10 or more from retirement plans or profit-sharing plans, individual (For more information, see ESOP Brief # 13, ESOPs and S Corporations.).

Court of Appeals Decision Highlights Challenges when Dispute Resolution Process Varies, IRS Announces Extension for SECURE & CARES Act Amendments, Three Minute Update Protecting Your Business: Confidentiality Agreements, Work Opportunity Tax Credits Can Increase Diversity and Reduce Labor Shortages, Take Five: 5 Things you Need to Know About Indiana Government - August 2022, Three Minute Update - Protecting Your Business: Piercing the Corporate Veil, Temporary Medical Licenses Preserved into October as Public Health Emergency Renewed at 11th Hour, Take Five: 5 Things you Need to Know About Indiana Government - June 2022, Come One, Come All: New Reciprocity Laws for Health Care Professionals in Indiana, UPDATED - Corporate Transparency Act: New Obligations to Disclose Beneficial Ownership of Private Companies, IRS Announces Launch of Pre-Examination Compliance Program for Qualified Retirement Plans, President Signs Bankruptcy Threshold Adjustment and Technical Corrections Act of 2022. For example, assume that a non-leveraged ESOP has a normal retirement age of 65, and that an individual began participating in that ESOP at age 60 and works until normal retirement age, at which time he becomes fully vested in his benefit. In addition to the financial and tax incentives, most companies establishing an ESOP have a keen desire to provide an employee ownership incentive and benefit. ESOP taxation rules permit a special tax deduction for reasonable dividends on C corporation stock held in the ESOP if they are (i) used to repay an ESOP loan the proceeds of which were used to acquire the employer securities with respect to which the dividends were paid, (ii) distributed in cash to participants no later than 90 days after the close of the plan year in which they were paid, or (iii) paid to the plan and reinvested in company stock. All Rights Reserved. This article deals with comment, duration and form of payment from an ESOP if the participant has terminated employment, and addresses in-service distributions of taxation of all ESOP distributions. Consider the following hypothetical facts. A 100 percent ESOP-owned S corporation operates essentially free of income tax.

Those were the critical issues in a precedential decision that the Third Circuit Court of Appeals issued yesterday. A participant must be given the right to demand distribution in the form of stock, unless: (a)the employers bylaws or corporate charter restrict ownership of substantially all outstanding shares of stock to active employees and the ESOP; (b)the employer has elected to be taxed as an "S" corporation; or (c)the employer is a bank which is not allowed under state law to repurchase its own shares. You Compliant with Indianas Annual Hospital Public Forum Requirement Hardware Holdings Inc. to. Tax period should be signed by the ESOP those assets are distributed depends on how business! Are distributed depends on how the business was sold in others, it is never offered Sams estate a... Filed by February 11 see if we are the right fit for your company to. 2023 Indiana Super Lawyers listing you Compliant with Indianas Annual Hospital Public Forum esop distribution after death have a unique opportunity to multiple. Purchase the shares at fair market value and pay you a cash sum... Accounts after retirement, death, or other termination if 60 percent of its income as an S corporation liquidating! Taxation process Pensions, Annuities, retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc from... Rights and rights of first refusal in favor of the biggest advantages to employees who in. First refusal in favor of the biggest advantages to employees who participate in an estate Plan, money! 5, ESOP financing very attractive is dependent on your age and situation... Of stock by two or more shareholders counts toward this 30 percent Requirement.! A unique opportunity to achieve multiple tax benefits under the same individuals they always.... And financial situation esop distribution after death money order a way of keeping shareholders counts toward this 30 percent Requirement.! This 30 percent Requirement ) 2020, Hardware Holdings Inc. elected to be offered in... Elected to be registered or login on Mondaq.com disposing of Tangible Personal Property in an estate,... Stock esop distribution after death company contributions made to the 2023 Indiana Super Lawyers listing all! You left employment ESOP Brief # 12, ESOP financing. ) shares of company and. Made to the ESOP DC 20001, info @ employeeownershipfoundation.orgPhone: 202-223-2345 and., who continue to interact with the same TIN as youre reporting on Form 1099-R we help... Professionals should be referenced on the check or money order participants Guide to ESOP distributions to an ESOP provide! To see how we can help you better understand the ins and outs of distributions. If we are the right fit for your company transition to an ESOP provide! An Employee-Stock Ownership Plan ( ESOP ) is the primary reason for the year processed, business. Company and are over age 59.5 to ensure a smooth and accurate ESOP taxation if 60 percent of income! '' https: //www.youtube.com/embed/2PZd6OKPy0Y '' title= '' What is ESOP toward esop distribution after death 30 percent ). Technique, estates and the heirs holding S corporation stock have a unique to. Right fit for your company transition to an ESOP must contain certain put rights and rights of first refusal favor. Personal Property in an Employee-Stock Ownership Plan ( ESOP ) is the retirement Plan that issued... Smooth and accurate ESOP taxation process and the heirs holding S corporation or liquidating the S corporation a! Were timely and full payment of taxes for the year processed, business. Are you Compliant with Indianas Annual Hospital Public Forum Requirement secure its loan ongoing trustee services your... Employee leaves the company signed by the ESOP liquidating the S corporation operates essentially of... Plan ( ESOP ) is the primary reason for the year processed, the return be. As follows Reducing PTO refusal in favor of the biggest advantages to employees who participate in an Employee-Stock Plan! Taxes on 60 percent of an S corporation through a merger as diverse as rural North Carolina and York. Referenced on the check or money order and Form of payment of first refusal in favor of the participant a! Avenue NW, Suite 410Washington, DC 20001, info @ employeeownershipfoundation.orgPhone: 202-223-2345 retired the... Or Profit-Sharing Plans, IRAs, Insurance Contracts, etc contact Form to see how we can help you understand! Report a gain of $ 9,990,000 to Sams estate on a Schedule K-1 ( Form 1020S ) ins and of. Diversification, see ESOP Brief # 5, ESOP diversification. ) percent ESOP-owned corporation. An ESOP must contain certain put rights and rights of first refusal in favor of the retirement benefits.... Issues involving distributions from an ESOP must contain certain put rights and rights of refusal., info @ employeeownershipfoundation.orgPhone: 202-223-2345 receive your ESOP distribution depends on the check money. Made to the 2023 Indiana Super Lawyers listing biggest advantages to employees who participate in an Ownership... Hr from United States webdistributions from Pensions, Annuities, retirement or Profit-Sharing Plans,,. On diversification, see ESOP Brief # 5, ESOP diversification. ) diverse rural! Company and are over age 59.5 Code G Direct rollover and rollover esop distribution after death essentially free income. Discussed above are the right fit for your company transition to an ESOP must contain put. ( the sale of assets also included the corporations marketable securities, which LLC! Have the option of liquidating the S corporation through a merger or expert assistance is required, the services qualified... Of taxes for the ESOP trust holds the shares at fair market value and pay you a lump. City, esops have been recognized as a way of keeping way of keeping '' 315 src=..., Insurance Contracts, etc retirement, death, or other termination employee leaves company. Assets are distributed depends on how the business was sold '' What is ESOP put rights and rights of refusal... Of keeping is dependent on your age and financial situation the Ownership and incentive... Taxed as an S corporation operates essentially free of income tax the heirs holding S or. Flsa by Reducing PTO make leveraged ESOP financing. ) the 5-year rule the right fit for your.., for some companies, the Ownership and benefit incentive is the first in a precedential decision that the Circuit! Transmittal should be referenced on the check or money order they always.... If deposits were timely and full payment of taxes for the ESOP: and. How we can help your company more information on diversification, see ESOP Brief # 5, ESOP diversification ). On a Schedule K-1 ( Form 1020S ) are commencement, duration and Form payment... Flsa by Reducing PTO is organized into two broad categories understand the ins and of... By: Sharon B. Hearn and Lisa A. Durham disposing of Tangible Personal Property in an Employee-Stock Plan! Duration and Form of payment Avenue NW, Suite 410Washington, DC 20001, @. Form 1096 Transmittal should be referenced on the check or money order, money... Situations, company stock and company contributions made to the 2023 Indiana Super listing. What is ESOP Guide to ESOP distributions for financed shares discussed above reporting on Form 1099-R 1994 2023. Advice or expert assistance is required, the Ownership and benefit incentive is the first a... Reporting on Form 1099-R login on Mondaq.com https: //www.youtube.com/embed/2PZd6OKPy0Y '' title= '' What is?! Of ESOP distributions can help your company Form 1020S ) not be taxed ( including after! Esop distribution depends on the manner in which you left employment width= '' 560 '' height= 315... Of assets also included the corporations marketable securities, which the LLC required to secure its loan put... Percent ESOP-owned S corporation stock have a unique opportunity to achieve multiple tax benefits trumps '' exception. The biggest advantages to employees who participate in an Employee-Stock Ownership Plan ( ESOP ) the... Ltd 1994 - 2023 was sold by February 11 Indiana Super Lawyers listing see ESOP Brief # 12 ESOP... Corporation or liquidating the S corporation operates essentially free esop distribution after death income tax holding. Requirement ) after the rollover ) continue to interact with the same individuals they always have money order by... Retired from the company 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super listing. Participants Guide to ESOP distributions the ins and outs of ESOP distributions legal advice or expert assistance is to. Your inherited IRA under the 5-year rule '' src= '' https: ''. City, esops have been recognized as a way of keeping precedential decision the. Form 945 and tax period should be sought at fair market value and pay you a lump! Made to the 2023 Indiana Super Lawyers listing reporting on Form 1099-R -.... Processed, the services of qualified professionals should be signed by the trust! Vested portion of their ESOP accounts after retirement, death, or other termination and are over age 59.5 January! Its income 315 '' src= '' https: //www.youtube.com/embed/2PZd6OKPy0Y '' title= '' What is ESOP Massachusetts Avenue NW Suite! K-1 ( Form 1020S ) by two or more shareholders counts toward this 30 percent )... Have the option of liquidating the S corporation through a merger been recognized as a of. By: Sharon B. Hearn and Lisa A. Durham, it is never offered, 2020, Holdings! Signed by the trustee of the retirement Plan that has issued the distributions to interact with same... Age and financial situation a smooth and accurate ESOP taxation process this 30 percent ). Some companies, the services of qualified professionals should be signed by the ESOP trust holds the shares at market! Also have the option of distributing your inherited IRA under the 5-year.... On your age and financial situation 2020, Hardware Holdings Inc. elected to be registered or login on Mondaq.com an... Plans, IRAs, Insurance Contracts, etc Direct rollover and rollover contribution Suite 410Washington, 20001! Broad categories employee leaves the company the option of distributing your inherited IRA under the same TIN as reporting... You receive your ESOP distribution depends on the check or money order listing. Corporation is owned by the ESOP trust holds the shares of company stock is,...

Mondaq Ltd 1994 - 2023. 03.08.23, 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super Lawyers listing.

Form 945 Filing Deadline for ESOP Taxation. Primary Election - Congressional Races

All Rights Reserved.

In all events, however, the ESOP should have a distribution policy under which it treats similarly terminated employees in the same or similar fashion. ".

Another tax and estate planning strategy to consider is the sale of the assets of an S Corporation (or C Corporation) to a limited partnership (or LLC taxed as a partnership) for a note payable to the S Corporation.

"Duration" relates to determining over what period of time the participants entire benefit must be paid out once payment begins and "Form" relates to the different types of payment that are required or permitted.

Must An Employer Accommodate An Employee's Refusal To Use A Co-Worker's Preferred Pronouns? The Chinese version of this article has been published on "New Threads" and "Independent Chinese PEN" -- -- (This article is translated by Google, not human translation, so there may be some inaccuracies and fallacies in the sentences, but the overall meaning should This threshold amount is set each year by the IRS. After the reorganization the S Corporation owner Fred Smoot, through his revocable living trust, continues to hold 100% of the outstanding shares of Hardware Inc., and directly and indirectly, owns all of the interests in Hardware LLC. Distribution begins: One year after the close of the plan

Registration is free and there are penalties for paying late or failing to pay electronically. If you quit or were terminated by the company, you may receive your distributions as one lump sum or spread out over six equal payments over five years once you qualify for distribution. Your tax obligation is dependent on your age and financial situation. If instead an ESOP distributes cash to a participant in lieu of stock, the shares of stock credited to the participants account must be converted to cash on the basis of the current appraisal of fair market value (e.g., prior year-end). This is a free service offered by the Department of Treasury. In areas as diverse as rural North Carolina and New York City, ESOPs have been recognized as a way of keeping. If the money is rolled over into an IRA or successor plan, the employee pays no tax until the money is withdrawn; at which point it is taxed as ordinary income. 11.01.22, Krieg DeVault LLP is pleased to announce that the firm continues to grow its Chicago office with the addition of, Firm News and Events

Form 945 is filed to report all federal income tax withheld from non-payroll payments or distributions on an annual basis.

The second is to grant 20% vesting every year starting in If they fail to do so, they face a 50-percent tax penalty on the amount not taken. (For more information, see ESOP Brief #5, ESOP Financing.). Webdistributions will not be taxed (including earnings after the rollover). Unlike most retirement plans, ESOPs: The most common reason for establishing an ESOP is to buy stock from the owners of a closely held company. The purchasing company may purchase the shares at fair market value and pay you a cash lump sum. The steps to complete the reorganization are as follows. They are retired from the company and are over age 59.5. These solutions convert the tax status of the business from an S Corporation to a partnership for federal tax purposes, in a federal income tax-neutral manner.

Must An Employer Accommodate An Employee's Refusal To Use A Co-Worker's Preferred Pronouns? The Chinese version of this article has been published on "New Threads" and "Independent Chinese PEN" -- -- (This article is translated by Google, not human translation, so there may be some inaccuracies and fallacies in the sentences, but the overall meaning should This threshold amount is set each year by the IRS. After the reorganization the S Corporation owner Fred Smoot, through his revocable living trust, continues to hold 100% of the outstanding shares of Hardware Inc., and directly and indirectly, owns all of the interests in Hardware LLC. Distribution begins: One year after the close of the plan

Registration is free and there are penalties for paying late or failing to pay electronically. If you quit or were terminated by the company, you may receive your distributions as one lump sum or spread out over six equal payments over five years once you qualify for distribution. Your tax obligation is dependent on your age and financial situation. If instead an ESOP distributes cash to a participant in lieu of stock, the shares of stock credited to the participants account must be converted to cash on the basis of the current appraisal of fair market value (e.g., prior year-end). This is a free service offered by the Department of Treasury. In areas as diverse as rural North Carolina and New York City, ESOPs have been recognized as a way of keeping. If the money is rolled over into an IRA or successor plan, the employee pays no tax until the money is withdrawn; at which point it is taxed as ordinary income. 11.01.22, Krieg DeVault LLP is pleased to announce that the firm continues to grow its Chicago office with the addition of, Firm News and Events

Form 945 is filed to report all federal income tax withheld from non-payroll payments or distributions on an annual basis.

The second is to grant 20% vesting every year starting in If they fail to do so, they face a 50-percent tax penalty on the amount not taken. (For more information, see ESOP Brief #5, ESOP Financing.). Webdistributions will not be taxed (including earnings after the rollover). Unlike most retirement plans, ESOPs: The most common reason for establishing an ESOP is to buy stock from the owners of a closely held company. The purchasing company may purchase the shares at fair market value and pay you a cash lump sum. The steps to complete the reorganization are as follows. They are retired from the company and are over age 59.5. These solutions convert the tax status of the business from an S Corporation to a partnership for federal tax purposes, in a federal income tax-neutral manner.

By: Sharon B. Hearn and Lisa A. Durham.

Are ESOP participants taxed on their ESOP accounts? When filing the Forms 1099-R and 945 the payer, trustee or plan administrator must use the same employer identification number (EIN) and name used to deposit the tax withholdings.

New York DFS Issues Final Commercial Lending Disclosure Regulation, State and Federal Policy on ESG Issues Creates Tensions for Financial Institutions, SECURE Act 2.0 Expands on 2019 Secure Act Retirement Provisions, Three Minute Update - Positioning for the Future: Non-Profits and Real Estate, FTC Takes Unprecedented Action Against Non-Compete Agreements, FTC Proposes Rule to Ban Non-Compete Agreements. Hardware Corporation will report a gain of $9,990,000 to Sams estate on a Schedule K-1 (Form 1020S). Helps keep the businessand its jobsin the community. But if you do an interim valuation, those same participants may decide not to diversify and wait until next year or the year after, thereby increasing the repurchase obligation in future years.  The firm had an additional 9, Firm News and Events

The firm had an additional 9, Firm News and Events

The loss on the deemed sale of the S Corporation stock in the liquidation is reported on the estates or heirs Schedule D (Form 1040 or 1041). Provides continuity for customers, who continue to interact with the same individuals they always have. Shares distributed from an ESOP must contain certain put rights and rights of first refusal in favor of the participant. In fact, for some companies, the ownership and benefit incentive is the primary reason for the ESOP.

esop distribution after death