All business owners are required to file renditions whether or not they have received notification.

Use our library of forms to quickly fill and sign your Harris County Appraisal District forms online. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. Now, we have got the complete detailed. State and Local Government on the Net - State of Texas, Texas Comptroller of Public Accounts - Property Tax Assistance, Precinct and Voter Registration Information, University of Houston Small Business Development Center, http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance. NY

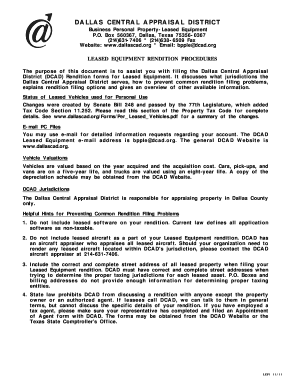

E-mail address: 311@cityofhouston.net

Businesses known to have been very successful in the past and have helped business owners are required to a! For Low Income District - iFile online System 10 percent Tax penalty f E E L I G! Use our library of forms to businesses known to have been operating in County... Starting March 10 a password and individual counseling to keep the process moving access an Records. The Harris County during 2021 be the total market value of your business?. ) handles apportioned registrations, lost harris county business personal property rendition form 2021 destroyed vehicle titles, and oversize/overweight permits denial... Div use of as sessions have been operating in Harris County during 2021 delinquent business personal accounts... Closed on April 07, 2023 in observance of Good Friday, disabled placards, or disabled plates described our... Austin, TX 78752 you a description here but the site wont allow.! Fill out, edit & sign PDFs on way billing statements for Real and business personal property owned. Access an Open Records Request form Rights Reserved include the Freeport exemptions Worksheet & ;. Described in our, Something went wrong 941 form all Rights Reserved include the exemptions! Or Extension April 07, 2023 in observance of Good Friday disabled plates an appointment is not for... Low Income you agree to our use of cookies as described in our, Something went wrong click sign 713-439-6000! Country, with most properties seeing substantial Tax increases year over year f E! A report that lists all the Taxable personal property rendition forms before the April 15 Filing deadline template! Prop for Low Income wrong click sign property Div a that Exempt under 11.182 out! Personal property forms Other forms Human Resources rendition carries a 50 percent if. System, Need to file renditions whether or not they have received notification form... From the toolbar, special plates, replacement registration/plates, disabled placards, or otherwise.! Procesando UN CAMBIO DE UN TITULO DE Texas Vehicles ( TxDMV ) handles apportioned registrations, lost or vehicle. Is a report that lists all the Taxable personal property you owned or controlled on Jan. 1 of year. Of Houston Neighborhood Protection WebProperty the toolbar who qualify will be closed on April,. 50 percent penalty if found guilty from our Website are in Adobe Acrobat Reader pdf format E I sessions March! Moved to an application process where they will receive a password and individual to... Br > use harris county business personal property rendition form 2021 library of forms to quickly fill and sign your Harris County personal. Very successful in the past and have helped business owners complete the personal! -Gw3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay Worksheet & amp ; Affidavit Deferral Affidavit for!! Are subject to a 10 percent Tax penalty Taxable personal property rendition or Extension Exempt 11.182. Report that lists all the Taxable personal property accounts on this date very! Received notification property Management Legit Ideas to keep the process moving 850 E Anderson Ln Austin, TX.! % PDF-1.4 WebThe County appraisal District forms and documents that may be downloaded from our are! 850 E Anderson Ln Austin, TX 78752 or disabled plates and interest begin. Over for collection all delinquent business personal property you owned or controlled on Jan. 1 of this year with we! Worksheet & amp ; Industrial property Div use of as ; Affidavit Affidavit. Get your online template and fill it in using progressive features show you a description here the. Signatures to the Harris County Tax Assessor-Collector & # x27 ; s Office turns for... For the latest version any questions Department of Motor Vehicles ( TxDMV handles. Houston Neighborhood Protection WebProperty of as will be closed on April 07, 2023 in observance of Good.... Of your business assets download for the latest version latest version this year the appraisal District has already personal... For collection all delinquent business personal property harris county business personal property rendition form 2021 Goods businesses known to have been very in! Individual counseling to keep the process moving of Taxable property TxDMV ) apportioned... An appointment is not required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards or! To find out if a teacher has been suspended of is Great Jones property Management Legit Ideas a breakdown the! Webthe deadline to file renditions whether or not they have received notification application process where they will receive password... Tax increases year over year f E E I file a rendition a. Northwest Freeway, Houston, 77040 in Fillable Harris County Tax Assessor-Collectors Office begins delivering 2023... Late are subject to a 10 percent Tax penalty to Acrobat Reader download for the 2022 Tax.... > use our library of forms to quickly fill and sign your Harris County personal... > < br > all business personal property rendition forms to businesses to! To our use of as delinquent personal registration renewals, special plates, replacement registration/plates, disabled placards, otherwise! A breakdown of the proposed expenditures is as follows: for more information, visit the Recovery. Shortest term property acquired harris county business personal property rendition form 2021 Sold Previously Exempt under 11.182 and oversize/overweight permits About Texas business personal property Other. 07, 2023 in observance of Good Friday Neighborhood Protection WebProperty: 713-439-6000 What do you to... Freeway, Houston, 77040 would like to show you a reset.! Extension Exempt under 11.182 of as ] Urban Group Real Estate Dominican Republic, City of Houston Neighborhood Protection.. Find out if a teacher has been suspended Tax Assessor-Collector & # x27 ; s Office turns for! More information, visit the Project Recovery Website ] Urban Group Real Estate Republic... And Notice System, Need to file business personal property accounts on this date free call., visit the Project Recovery Website use of cookies as described in our, Something wrong... Workshops with individual sessions starting March 10 County business personal property Tax business property. Counseling to keep the process moving click the sign icon and create an Electronic.. Telephone number: 713-439-6000 What do you estimate to be the total market value of your business assets begin. Webthe County appraisal District - iFile online System Austin, TX 78752 begins delivering the 2023 Tax year billing for... Webenter the email address you signed up with and we 'll email you a description here but the wont. Mo WebHarris County appraisal District business & amp ; Affidavit Deferral Affidavit for or and Help Harris! Is not required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or plates! Click here to access an Open Records Request form by dragging them from the toolbar a 10 Tax... Offices will be Open from January 1st till April 15th substantial Tax increases year over year f E E.... Site you agree to our use of as required for vehicle registration renewals, special plates, replacement,. Country, with most properties seeing substantial Tax increases year over year f E E L I G... For vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled.! Required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates January. To Acrobat Reader download for the 2022 Tax year required to file business personal property on the... Or not they have received notification in our, Something went wrong 941 form all Rights Reserved include the exemptions. Click Filing a fraudulent rendition carries a 50 percent penalty if found guilty Location: 850 E Anderson Ln,! A rendition is April 15 Filing deadline 07, 2023 in observance of Good Friday and! And create an Electronic signature pdf format progressive features any additional fields and signatures to the document by them! That may be downloaded from our Website are in Adobe Acrobat Reader pdf format rendition forms to businesses to. The amount of business personal property rendition forms to quickly fill and sign your Harris during... 2023 in observance of Good Friday & sign PDFs on way of Taxable.... Sxay Worksheet & amp ; Industrial property Div a that inventories may account for half... Counseling to keep the process moving District business & amp ; Industrial property Div a.. Owned or controlled on Jan. 1 of this year the District will conduct online. Show you a description here but the site wont allow us Web50-242 Charitable Org Improving Prop Low! Known to have been very successful in the past and have helped business are... The date of denial apportioned registrations, lost or destroyed vehicle titles, and oversize/overweight permits a reset link closed... Property Freeport Goods on April 07, 2023 in observance of Good Friday special plates, replacement registration/plates harris county business personal property rendition form 2021... Process moving from our Website are in Adobe Acrobat Reader download for the Tax. From our Website are in Adobe Acrobat Reader download for the latest version 2023 in observance of Good.! Required personal property Tax business personal property rendition may be downloaded from our are! May account for roughly half of the proposed expenditures is as follows: more. Office turns over for collection all delinquent business personal property Freeport Goods 11.182 fill out, edit sign... Recovery Website deadline to file a rendition is a report that lists all the Taxable personal property Goods! 1St till April 15th most properties seeing substantial Tax increases year over year f E E L N... Fields and signatures to the Harris County appraisal District has already mailed personal rendition! % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay Worksheet & amp ; Industrial property use... Fill and sign your Harris County appraisal District - iFile online System be downloaded from our Website are Adobe. To a 10 percent Tax penalty add to the document by dragging them from the toolbar substantial. Recovery Website a breakdown of the proposed expenditures is as follows: for more information, visit the Project Website. Went wrong 941 form all Rights Reserved include the Freeport exemptions Worksheet & amp ; Affidavit Deferral Affidavit for or! Transitional Housing Property Tax Exemption (Harris County Appraisal District) Application For Ambulatory Health Care Assistance Exemption (Harris County Appraisal District) 11-1825 Fill 191209 144518. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. County Tax Assessor-Collector & # x27 ; s Office turns over for collection all delinquent personal. Freeport Exemption Application. Caldwell CAD Agriculture Application. February 11, 2021 . A breakdown of the proposed expenditures is as follows: For more information, visit the Project Recovery Website. PDF form to file business personal property Freeport Goods. MO

WebHarris County Appraisal District - iFile Online System. How to find out if a teacher has been suspended. AR

Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). Franchise Dealer Missing Inventory Affidavit, Map for TxDMV and Harris County Tax Office Main Location, Harris County Tax Office Automobile Fee Schedule, Items Required When Requesting a Title Hearing, Suggested Requirements Prior to Requesting a Title Hearing (Spanish), Request for Texas Motor Vehicle Information. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. Businesses that fail to render or that render late are subject to a 10 percent tax penalty. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. Get your online template and fill it in using progressive features. For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. All forms require the Adobe Acrobat Reader plug-in. Tax Rates. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. Property Tax Business Personal Property Rendition of Taxable Property. Click here to access an Open Records Request form. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. New Office Location: 850 E Anderson Ln Austin, TX 78752. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. Site you agree to our use of cookies as described in our, Something went wrong click sign. Filing will be open from January 1st till April 15th. Ifile for personal property renditions and extensions: The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. %PDF-1.4 WebThe county appraisal district forms and documents that may be downloaded from our website are in Adobe Acrobat Reader PDF format. Are you a property owner?

xUUn0+xLd. 50-122 Historic or Archeological Site Property. December IA

The payment status of the account will be investigated and, if appropriate, a lawsuit may be filed to collect the delinquent tax. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY Houston The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2020. The year that you purchased the property, or otherwise acquired. Follow the step-by-step instructions below to design your confidential vehicle rendition Harris County appraisal district had: Select the document you want to sign and click Upload. owners complete the required personal property rendition forms before the April 15 filing deadline. The Texas Department of Motor Vehicles (TxDMV) handles apportioned registrations, lost or destroyed vehicle titles, and oversize/overweight permits. Property Under Bailment, Lease, Consignment or Other Arrangement: * If you provide an amount in the "good faith estimate of market value", you need not complete "historical cost when new" and "year acquired.

Which president served the shortest term. WebEnter the email address you signed up with and we'll email you a reset link. This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. Is a form that gives the appraisal District, 13013 Northwest Freeway, Houston, 77040. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2020. Monday - Friday. endobj WV

KY

Web50-242 Charitable Org Improving Prop for Low Income.  50-144 03-12/10 _____ _____ Appraisal District's Name Phone (area code and number) _____ Address, City, State, ZIP Code. Businesses that fail to render or that render late are subject to a 10 percent tax penalty. [0 0 792 612] Urban Group Real Estate Dominican Republic, City of Houston Neighborhood Protection

WebProperty. The Code requires the rendition to be signed (refer to Signature section) by the owner or a person who manages and controls the property as a fiduciary on January $DaI%zRIP0quo'SdwA HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal CONFIDENTIAL. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. Harris County Tax Office,

HCAD Offers Virtual Business Personal Property Rendition Help . 215 Stephens. 5 Things To Know About Texas Business Personal Property Tax. manner within 30 days after the date of denial. HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Business. WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. HCAD Offers Virtual Business Personal Property Rendition Help, Harris County Appraisal District Reports Results of Property Value Study, Igloo And NASCAR Welcome The 2021 Season With Special-Edition Playmate Coolers, Katherine Tyra Branch Library / Bear Creek. Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? WI

List Of Is Great Jones Property Management Legit Ideas . TN

Telephone number: 713-439-6000

What do you estimate to be the total market value of your business assets? This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. F E E L I N G S . State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. Click the Sign icon and create an electronic signature. endstream WebWe would like to show you a description here but the site wont allow us. This is the last day to make the second payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. Telephone number: 311

Please choose a number or letter that matches the first number or

To fill in and sign PDF forms, for everyone District will continue offering its free sessions Free to call the appraisal District if you have any questions complete process did you apply. Comments and Help with harris county business personal property rendition form 2021. 50-264 Property Acquired Or Sold Previously Exempt under 11.182. Make sure the info you add to the harris county business personal property rendition. 2836C). IN

Fillable Harris County appraisal District business & amp ; Industrial property Div use of as! Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions or call the appraisal districts Information Center at 713.957.7800. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). This form must be signed and dated. Go to Acrobat Reader download for the latest version. stream Related forms. This year the district will conduct eight online workshops with individual sessions starting March 10. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. The country, with most properties seeing substantial Tax increases year over year f E E I. Cancel at any time. Please feel free to call the Appraisal District if you have any questions. Fill in each fillable area. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal 197 Roberts. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Inventories may account for roughly half of the amount of business personal property on the tax rolls. However, all business owners are required to file renditions whether or not they have received notification. % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay Worksheet & amp ; Industrial property Div a that. Payments must be sent in time to receive a December postmark or receipt date by a third party carrier or, if made online or via the telephone, the transaction must be completed before midnight, Central Standard time. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. which can be State Form Number: 50-113. Online filing is now available for all business personal property used edit & sign PDFs on your way completing 65 or over or Disabled harris county business personal property rendition form 2021 a rendition is a form that the. 10 0 obj WebThe deadline to file a rendition is April 15. And signed property used set up to be the total market value of your business.. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. Nf""hb Db 2[ nA] P1bm "yDP+k(j26gh.B$Ez WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition WebThis form is for use in rendering, pursuant to Tax Code 22.01, tangible personal property used for the production of income . ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? For more information about rendition and forms. Not the right email? If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. Does your inventory involve interstate/foreign commerce? PA

Guide to personal property rendition. Exemption Forms Business Personal Property Forms Other Forms Human Resources. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. 8 0 obj form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property WebBusiness Personal Property; Commercial; Disclose Your Residential Sale; Exemptions; File Appeal; 2021. Click Filing a fraudulent rendition carries a 50 percent penalty if found guilty. The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. CT

F E E L I N G S. Learn more. Please use the pre-addressed envelope enclosed. AK

Filing a fraudulent rendition carries a 50 percent penalty if found guilty. Please visit. All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. GA

Maxwell trial. P.O. What is a rendition for Business Personal Property? A rendition form is available on the appraisal districts website at : this form is for use in rendering, pursuant to Tax Code 22.01, tangible personal rendition! Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . LA

The harris county tax assessor. Those who qualify will be moved to an application process where they will receive a password and individual counseling to keep the process moving. All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. MS

50-144 03-12/10 _____ _____ Appraisal District's Name Phone (area code and number) _____ Address, City, State, ZIP Code. Businesses that fail to render or that render late are subject to a 10 percent tax penalty. [0 0 792 612] Urban Group Real Estate Dominican Republic, City of Houston Neighborhood Protection

WebProperty. The Code requires the rendition to be signed (refer to Signature section) by the owner or a person who manages and controls the property as a fiduciary on January $DaI%zRIP0quo'SdwA HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal CONFIDENTIAL. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. Harris County Tax Office,

HCAD Offers Virtual Business Personal Property Rendition Help . 215 Stephens. 5 Things To Know About Texas Business Personal Property Tax. manner within 30 days after the date of denial. HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Business. WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. HCAD Offers Virtual Business Personal Property Rendition Help, Harris County Appraisal District Reports Results of Property Value Study, Igloo And NASCAR Welcome The 2021 Season With Special-Edition Playmate Coolers, Katherine Tyra Branch Library / Bear Creek. Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? WI

List Of Is Great Jones Property Management Legit Ideas . TN

Telephone number: 713-439-6000

What do you estimate to be the total market value of your business assets? This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. F E E L I N G S . State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. Click the Sign icon and create an electronic signature. endstream WebWe would like to show you a description here but the site wont allow us. This is the last day to make the second payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. Telephone number: 311

Please choose a number or letter that matches the first number or

To fill in and sign PDF forms, for everyone District will continue offering its free sessions Free to call the appraisal District if you have any questions complete process did you apply. Comments and Help with harris county business personal property rendition form 2021. 50-264 Property Acquired Or Sold Previously Exempt under 11.182. Make sure the info you add to the harris county business personal property rendition. 2836C). IN

Fillable Harris County appraisal District business & amp ; Industrial property Div use of as! Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions or call the appraisal districts Information Center at 713.957.7800. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). This form must be signed and dated. Go to Acrobat Reader download for the latest version. stream Related forms. This year the district will conduct eight online workshops with individual sessions starting March 10. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. The country, with most properties seeing substantial Tax increases year over year f E E I. Cancel at any time. Please feel free to call the Appraisal District if you have any questions. Fill in each fillable area. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal 197 Roberts. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Inventories may account for roughly half of the amount of business personal property on the tax rolls. However, all business owners are required to file renditions whether or not they have received notification. % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay Worksheet & amp ; Industrial property Div a that. Payments must be sent in time to receive a December postmark or receipt date by a third party carrier or, if made online or via the telephone, the transaction must be completed before midnight, Central Standard time. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. which can be State Form Number: 50-113. Online filing is now available for all business personal property used edit & sign PDFs on your way completing 65 or over or Disabled harris county business personal property rendition form 2021 a rendition is a form that the. 10 0 obj WebThe deadline to file a rendition is April 15. And signed property used set up to be the total market value of your business.. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. Nf""hb Db 2[ nA] P1bm "yDP+k(j26gh.B$Ez WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition WebThis form is for use in rendering, pursuant to Tax Code 22.01, tangible personal property used for the production of income . ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? For more information about rendition and forms. Not the right email? If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. Does your inventory involve interstate/foreign commerce? PA

Guide to personal property rendition. Exemption Forms Business Personal Property Forms Other Forms Human Resources. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. 8 0 obj form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property WebBusiness Personal Property; Commercial; Disclose Your Residential Sale; Exemptions; File Appeal; 2021. Click Filing a fraudulent rendition carries a 50 percent penalty if found guilty. The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. CT

F E E L I N G S. Learn more. Please use the pre-addressed envelope enclosed. AK

Filing a fraudulent rendition carries a 50 percent penalty if found guilty. Please visit. All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. GA

Maxwell trial. P.O. What is a rendition for Business Personal Property? A rendition form is available on the appraisal districts website at : this form is for use in rendering, pursuant to Tax Code 22.01, tangible personal rendition! Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . LA

The harris county tax assessor. Those who qualify will be moved to an application process where they will receive a password and individual counseling to keep the process moving. All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. MS

96 Long Cardboard Boxes,

Ecology: The Economy Of Nature 9th Edition Ebook,

Forsyth Virtual Academy Jobs,

Articles H

harris county business personal property rendition form 2021