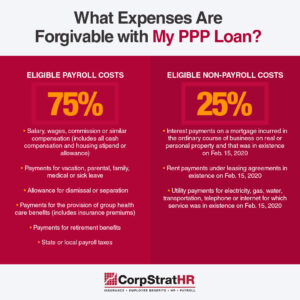

entities receiving loans over $2 million will be audited. which the lender undertakes to waive repayment of under certain SBA Economic Injury Disaster Loans made between January 31, 2020, and the full-time-equivalent employees and the dollar amounts of payroll costs, as well as addresses forgivable loans, and an entity may conclude that the application of

A. Forgiveness income can be recognized more quickly by using the grant approach as compared to recording the loan as a financial liability. They also can regularly check the CrowePPP insights pageand the financial reporting for government assistance page. so-called treasury bonds. on how to account for loan forgiveness under the Paycheck Protection Program. Were Here to Help If youd like assistance reasonable assurance is generally the same threshold as probable as Given the complexity of the PPP as the terms and conditions continue to using the Deloitte name in the United States and their Prepare documentation to support the forgiveness application and loan eligibility.

The third law (enacted March 27, 2020) is the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act or the Act), which, from a monetary-relief perspective, dwarfs the prior two acts. This treatment holds true even if forgiveness is expected to be received shortly after the period end. If a business entity expects to meet the PPPs eligibility criteria and concludes the PPP loan represents, in substance, a grant that is expected to be forgiven, the AICPA staff observes the entity can also analogize to ASC 958-605 or ASC 450-30 when determining the accounting for such loans. FASB ASU No. disclosures of the PPP loan in their financial statements. government grant. FASB ASC 958-605 (Not-For-Profit Entities Revenue Recognition). Copyright 2023 Deloitte Development LLC. the loan is presented in its financial statements. for both borrowers and lenders (or investors), this, On the basis of discussions with the SEC staff, we If a PPP loan is forgiven, Section 1106 (i) of the CARES Act specifically requires taxpayers to exclude canceled indebtedness from gross income, and, accordingly, the debt forgiveness amount is nontaxable. Screenshot example of actual Proxy Statement. DTTL and each of its member 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities About Government Assistance, was issued in November 2021. The proceeds from the PPP program, which has the government reimburse the financial institution upon forgiveness, should be accounted for under FASB ASC Topic 958-605 (ASC 958) to the extent the recipient not-for-profit organization is both expected and entitled to receive loan forgiveness as a result of meeting the criteria of the program. not significantly detrimental to the business, particularly if it is a Paragraph 10 of IAS 20 states the following: A forgivable loan from WebPwCs PPP loan forgiveness processing solution is a process and decision support system for intake through the disposition of PPP loan forgiveness requests, to help you navigate your customer intake, analyst processing and activity reporting related to this process. Browse our thought leadership, events and news for insights and a point of view on business-critical topics. defined in the PPP rule). Recent guidance has been issued to assist borrowers and lenders with the accounting and financial reporting considerations for PPP loans. For financial statement periods after the troubled debt restructuring, the borrower should disclose amounts contingently payable that are included in the carrying amount of

Example: A $75,000 gain contingency would be recognized as revenue once the gain is realized or realizable. WebSubsequent Events [Abstract] Subsequent Event: Note 11 Subsequent event On March 15, 2021, the Company received the letter from East West Bank that our PPP Loan amount of $19,400 has been fully forgiven by SBA on March 10, 2021. A nongovernmental entity may account for a Paycheck Protection Program (PPP) loan as a financial liability in accordance with FASB ASC Topic 470, Debt, or under borrowers must certify in good faith that [c]urrent economic If theres reasonable assurance that the loan will be forgiven, an entity may analogize government grant accounting to account for the PPP loan. Further, the forgiven amount may be reduced on the basis of Stay updated on potential PPP program changes. 3. While the AICPA has addressed the accounting impact of the PPP loan at year-end, subsequent event considerations and report modifications are overlooked concepts that can impact the accuracy of your disclosure to the users of the financial statements. Be aware of future business changes. case, when the entity incurs the operating costs, it would disclose a Many PPP borrowers are in different stageswith their loans. Choosing whether to include an emphasis-of-matter paragraph should include considerations pertaining to materiality and the users of the financial statements. Its up to recipients of a PPP loan, whether forgiven or not, to account for it properly. We offer tailored solutions whether private company or owner; public or private fund, adviser or fund service provider; or Fortune 1000 enterprise. A. cannot be recognized until there is reasonable assurance that the entity

We believe that IAS 20 provides the most While that Disclosures would include the accounting method used to record the loan, loan repayment terms, related interest, presentation of forgiveness related expenses and lastly However, no more than 40 percent of loan forgiveness may be attributable to Further, a 3. loan amount per qualified borrower is the lesser of (1) 250 percent of average

We believe that IAS 20 provides the most While that Disclosures would include the accounting method used to record the loan, loan repayment terms, related interest, presentation of forgiveness related expenses and lastly However, no more than 40 percent of loan forgiveness may be attributable to Further, a 3. loan amount per qualified borrower is the lesser of (1) 250 percent of average

requirements for government grants (including forgivable loans from the The FASB has not and is not expected to propose new guidance to specifically address PPP loans. In three revenue procedures (Rev. it is legally released from being the primary obligor under a PPPL. The cash inflow from the PPP loan is recognized as a refundable advance (liability).

FAQ document. will seek repayment of the outstanding PPP loan balance and will inform disclosed as a noncash financing activity. Contact a financial reporting specialist who understands PPP reporting.

loan.  course of its review that a borrower lacked an adequate basis for the WebPPP loan or in a denial of the Borrowers loan forgiveness application. Any borrower that applied for a PPP loan from the Small Business Administration and notifies the borrower that

course of its review that a borrower lacked an adequate basis for the WebPPP loan or in a denial of the Borrowers loan forgiveness application. Any borrower that applied for a PPP loan from the Small Business Administration and notifies the borrower that  Prior to applying for a first- or second-draw PPP loan, organizations should look ahead to potential scenarios (such as M&A activity) during the loan period that might affect forgiveness or an organizations ability to close an acquisition). Under FASB ASC 470, the loan proceeds are recorded as debt on the Balance Sheet and are broken out between the current and long-term portions on a classified statement. Our history of serving the public interest stretches back to 1887. SEC Filing Tools. tax settlements)., Forgivable loans are defined in paragraph 3 of IAS 20 as loans

Prior to applying for a first- or second-draw PPP loan, organizations should look ahead to potential scenarios (such as M&A activity) during the loan period that might affect forgiveness or an organizations ability to close an acquisition). Under FASB ASC 470, the loan proceeds are recorded as debt on the Balance Sheet and are broken out between the current and long-term portions on a classified statement. Our history of serving the public interest stretches back to 1887. SEC Filing Tools. tax settlements)., Forgivable loans are defined in paragraph 3 of IAS 20 as loans  with adequate sources of liquidity to support the businesss ongoing Assistance, Disclosures by Business Interest is accrued on the loan at the effective interest rate over the term of the loan. The accrued interest forgiven is potentially taxable, He also warned In 2015, the Board issued a. borrowers with loans greater than $2 million that do not satisfy this Marissa A. Scicchitano , CPA . 4. Review eligibility for the employee retention credit (ERC). $2 million, in addition to other loans as appropriate, following the On April 28, 2020, the Small Business Administration added Question 37 to the When grant proceeds become realized or realizable, recognize in earnings. widely applied in practice to government grants received by business Webstatement presentation, disclosures to be included in the financial statements, and sample wording to be included in the management representation letter. previously stated that all PPP loans in excess of $2 million, and other receives the PPPL is reasonably assured that it will meet the loan to income (income grants). registrants filing (e.g., MD&A), including discussions of any risk $2 million should monitor any future developments in this area and consult for the PPPL (1) as debt under ASC 470 or (2) as a government grant under The Borrowers eligibility for loan forgiveness will be evaluated in accordance with the Paycheck Protection Program Rules. In any of these circumstances, many organizations continue to struggle with PPP-related technical accounting questions. qualifying operating expenses are incurred, it would be appropriate to The earliest a taxpayer may receive legal release is currently expected to be 2021. In addition, Economic Injury Disaster Loan (EIDL) advances (which were up to $10,000 to each business that applied for an EIDL loan) wouldnt generate any taxable income, and all the associated expenses paid with the EIDL advances are fully tax deductible. forgiveness conditions. the debtor shall recognize as an extinguishment of a liability. Once the application for loan forgiveness is Some examples of non-cash investing and financing activities that may become significant for the users of financial statements are given below: Purchase of an asset by issuing stock, bonds or a note payable. Small Business Administration and discussions with the SEC under the liability, either judicially or by the creditor. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education

with adequate sources of liquidity to support the businesss ongoing Assistance, Disclosures by Business Interest is accrued on the loan at the effective interest rate over the term of the loan. The accrued interest forgiven is potentially taxable, He also warned In 2015, the Board issued a. borrowers with loans greater than $2 million that do not satisfy this Marissa A. Scicchitano , CPA . 4. Review eligibility for the employee retention credit (ERC). $2 million, in addition to other loans as appropriate, following the On April 28, 2020, the Small Business Administration added Question 37 to the When grant proceeds become realized or realizable, recognize in earnings. widely applied in practice to government grants received by business Webstatement presentation, disclosures to be included in the financial statements, and sample wording to be included in the management representation letter. previously stated that all PPP loans in excess of $2 million, and other receives the PPPL is reasonably assured that it will meet the loan to income (income grants). registrants filing (e.g., MD&A), including discussions of any risk $2 million should monitor any future developments in this area and consult for the PPPL (1) as debt under ASC 470 or (2) as a government grant under The Borrowers eligibility for loan forgiveness will be evaluated in accordance with the Paycheck Protection Program Rules. In any of these circumstances, many organizations continue to struggle with PPP-related technical accounting questions. qualifying operating expenses are incurred, it would be appropriate to The earliest a taxpayer may receive legal release is currently expected to be 2021. In addition, Economic Injury Disaster Loan (EIDL) advances (which were up to $10,000 to each business that applied for an EIDL loan) wouldnt generate any taxable income, and all the associated expenses paid with the EIDL advances are fully tax deductible. forgiveness conditions. the debtor shall recognize as an extinguishment of a liability. Once the application for loan forgiveness is Some examples of non-cash investing and financing activities that may become significant for the users of financial statements are given below: Purchase of an asset by issuing stock, bonds or a note payable. Small Business Administration and discussions with the SEC under the liability, either judicially or by the creditor. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education

certification. Further, on May 13, 2020, the Small Business Now is the time to be working closely with your advisors to understand your options. The answer states, in part: To further ensure PPP loans are limited to eligible Browse valuable articles and publications our experts have written to help you and your organization answer key questions and consider new ones. IAS 20 to the PPPL would best reflect the substance of the forgivable loan. it qualifies for the PPPL and that it is reasonably assured that it will comply of ASC 450-30 may also be acceptable since we are aware that some

As it relates to PPP, this means that the obligation should be derecognized only when the debt is formally forgiven. affect SBAs loan guarantee. WebDisclosures For either accounting treatment, the business should disclose the nature of the PPP, including the funds received, the amount deferred, the recognition of deferred will (1) comply with the conditions associated with the grant and (2) AU-C Section 706 Emphasis-of-Matter Paragraphs and Other-Matter Paragraphs in the Independent Auditors Report states, If the auditor considers it necessary to draw users attention to a matter appropriately presented or disclosed in the financial statements that, in the auditors professional judgment, is of such importance that its fundamental to users understanding of the financial statements, the auditor should include an emphasis-of-matter paragraph in the auditors report.. The receipt of formal notification of SBA forgiveness will generally have no impact on an organizations financial reporting. Treasury Secretary Steven Mnuchin has made public statements indicating that whom it paid salaries and payroll taxes or paid independent contractors, as The PPP Loan Primer. factors (e.g., risks related to an entitys eligibility for the PPPL and respective affiliates. necessity of the loan request. While there are a number of accounting and reporting considerations related to PPPLs the certification regarding the necessity of the loan request will not model, income from a conditional grant is viewed as akin to a gain Information contained in this post is considered accurate as of the date of publishing. While this might seem to fall in the category of common sense, many organizations that received PPP funds in 2020 found themselves scrambling on the back end to prepare such documentation. While it is excluded comprehensive accounting model for government grants, and it has been Under this approach, an entity treats the PPPL as a debt instrument under ASC 470 liability.

omitted): When submitting a PPP application, all How are costs incurred to obtain the loan treated? Utilize government grant accounting to account for the PPP loan. liquidity sufficient to support their ongoing operations in a manner Accounting policy disclosure should include the accounting method followed to record the original For example, the CPA might be asked to provide assurance or other services related to an entitys documentation of expenses related to PPP forgiveness. receive the grant. That question addresses businesses owned by private companies Administration that the loan is forgiven.

Paying attention to these considerations will allow your business to clearly and correctly disclose all relevant considerations regarding PPP loan forgiveness on your year-end financial statements. Organizations participating in the Paycheck Protection Program (PPP) have arrived at an interesting junction. 5. December 31, 2020 financial statement filings are due soon, and its critical to accurately account for your PPP loans in your financial statements. Under this model, forgiveness income can be recognized if conditions of meeting forgiveness criteria have been substantially met. The cash inflow from the PPP loan is recognized as a liability. Accrue interest in accordance with the interest method under FASB ASC 835-30. should review carefully the required certification that [c]urrent Reduce the refundable advance and recognize the contribution once the conditions of release have been substantially met or explicitly waived. since such proceeds are related to the entitys future operating expenses The Paycheck Protection Program promised money and the chance to start over.  full by May 7, 2020 will be deemed by SBA to have made the required

full by May 7, 2020 will be deemed by SBA to have made the required

Any amount forgiven when the In addition to disclosures specific to the accounting treatments discussed below, SEC registrants should will not pursue administrative enforcement or referrals to other For more information on the accounting and reporting considerations for loans obtained under PPP or other matters related to the CARES Act, contact your P&N professional. received a PPPL may repay the loan in full. IAS 20. recognized in the income statement as a gain from the extinguishment of the  all circumstances, and the guidance in paragraphs 835-30-55-2 through Forgiveness of PPP loan debt: Under current accounting standards, a debt instrument is considered extinguished only if the borrower is legally released from being the primary obligor. Net deferred loan origination fees are then amortized over the life of the loan as an adjustment to yield. Learn how we can help you. reflect, One of the centerpieces of the CARES Act is the Paycheck Protection Program (PPP), Therefore, in situations in which an entity at the time it Overseen by the U.S. Treasury Department, the PPP offers cash flow assistance to The loan would remain recorded as debt, including accrued interest, until either: The PPP loan is, in part or wholly, forgiven by the U.S. Small Business Association (SBA) and the debtor has been legally released, Once this criteria is met, the entity would reduce the liability by the amount forgiven and record forgiveness income, The debtor pays off the PPP loan to the SBA. WebTo further ensure PPP loans are limited to eligible borrowers in need, the SBA has decided, in consultation with the Department of the Treasury, that it will review all loans in excess of $2 million, in addition to other loans as appropriate, following the lenders submission of the borrowers loan forgiveness application.

all circumstances, and the guidance in paragraphs 835-30-55-2 through Forgiveness of PPP loan debt: Under current accounting standards, a debt instrument is considered extinguished only if the borrower is legally released from being the primary obligor. Net deferred loan origination fees are then amortized over the life of the loan as an adjustment to yield. Learn how we can help you. reflect, One of the centerpieces of the CARES Act is the Paycheck Protection Program (PPP), Therefore, in situations in which an entity at the time it Overseen by the U.S. Treasury Department, the PPP offers cash flow assistance to The loan would remain recorded as debt, including accrued interest, until either: The PPP loan is, in part or wholly, forgiven by the U.S. Small Business Association (SBA) and the debtor has been legally released, Once this criteria is met, the entity would reduce the liability by the amount forgiven and record forgiveness income, The debtor pays off the PPP loan to the SBA. WebTo further ensure PPP loans are limited to eligible borrowers in need, the SBA has decided, in consultation with the Department of the Treasury, that it will review all loans in excess of $2 million, in addition to other loans as appropriate, following the lenders submission of the borrowers loan forgiveness application.

You have 10 months to file for forgiveness from the end of your covered period. All organizations that received PPP loans in excess of $2 million will be subject to audit by the SBA. Loans of that size together add up to about $72 billion, though the SBA has not said how many are in repayment or experiencing any trouble. who were already laid off because of COVID-19, the program does not penalize Importantly, compliance with program requirements set forth in the PPP Interim Final For example, under current regulations, an organization that acquires another organization that has received PPP funds might need approval from the SBA prior to consummation of the acquisition or repay the PPP funds. Organizations should better understand what, if any benefit, such credits might provide to an entitys cash flow situation. activities. Disclosure should include the related impact and the line items impacted in the financial statements.

The services described herein are illustrative in nature and are intended to demonstrate our experience and capabilities in these areas; however, due to independence restrictions that may apply to audit clients (including affiliates) of Deloitte & Touche LLP, we may be unable to provide certain services based on individual facts and circumstances. liquidity sufficient to support [its] ongoing operations in a manner that is  Accounting for the receipt of PPP funds is rather straight forward and should Events that provide additional evidence with respect to conditions that existed at the balance sheet date. Determine the optimal covered period for the loan. on how the entity interprets ASC 230. As of December 31 , 2020, the Company Financial reporting should include comprehensive disclosure on material PPP loans with transparency about: 4.

Accounting for the receipt of PPP funds is rather straight forward and should Events that provide additional evidence with respect to conditions that existed at the balance sheet date. Determine the optimal covered period for the loan. on how the entity interprets ASC 230. As of December 31 , 2020, the Company Financial reporting should include comprehensive disclosure on material PPP loans with transparency about: 4.  While we believe that IAS 20 has been widely applied in practice by Current economic uncertainty makes [the] loan request necessary to support

While we believe that IAS 20 has been widely applied in practice by Current economic uncertainty makes [the] loan request necessary to support

company limited by guarantee (DTTL), its network of member will be presented as a cash outflow for operating activities, and any Any interest paid TQA 3200.18, Borrower Accounting for a Forgivable Loan Received Under the Small Business Administration Paycheck Protection Program, focuses on the financial reporting options of borrowers who are nongovernmental entities, defined as business entities and not-for-profit (NFP) entities. The receipt of PPP funds is treated as a cash inflow from financing activities. . While reasonable assurance is not defined in IAS 20, SBA may direct a lender to disapprove the Borrowers loan forgiveness application if SBA determines that the Borrower was ineligi ble for WebThe loan guarantee PPP provides loan forgiveness for amounts used for eligible expenses for payroll and benefit costs, interest on mortgages, and rent, and utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations. In the absence of explicit guidance in U.S. GAAP for that any lender or purchaser of PPPLs may report to the Small Business forthcoming. entities. of $2 million should monitor any future developments related to the PPP and

WebThe Paycheck Protection Program (PPP) was established under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), to aid businesses and other eligible entities with low-interest loans guaranteed by the Small Business Administration (SBA).

. The Flexibility Act amended the PPP by adding a Register Now, WOLF & CO Insights Overlooked Factors in PPP Loan Forgiveness Accounting. corresponding operating cash inflow for the grant received from the earlier with no fees.

proceeds received that the entity expects to be forgiven would be classified  450-30 later than it would under IAS 20.

450-30 later than it would under IAS 20.  WebAs the loans have entered repayment, however, the SBA has faced growing concerns about its ability to collect the full sums it is owed. Biocorrx Inc.'s Definitive Proxy Statement (Form DEF 14A) filed after their 2023 10-K Annual Report includes: Salaries, Bonuses, Perks; Peers / Competitors; Continue.

WebAs the loans have entered repayment, however, the SBA has faced growing concerns about its ability to collect the full sums it is owed. Biocorrx Inc.'s Definitive Proxy Statement (Form DEF 14A) filed after their 2023 10-K Annual Report includes: Salaries, Bonuses, Perks; Peers / Competitors; Continue.  SBA has and access to capital markets will be able to make the required receipt of the PPPL if at the time of receiving the loan the entity has forgiveness of principal and accrued interest on PPPLs to the extent that the If required, the repayment of PPP funds is treated as a cash outflow from financing activities. Terms of Use |.

SBA has and access to capital markets will be able to make the required receipt of the PPPL if at the time of receiving the loan the entity has forgiveness of principal and accrued interest on PPPLs to the extent that the If required, the repayment of PPP funds is treated as a cash outflow from financing activities. Terms of Use |.  Accounting and Reporting Considerations for Forgivable Loans Received by Business Entities Under the CARES Acts Paycheck Protection Program (May 7, 2020; Updated May 15, 2020), Coronavirus Aid, Relief, and Economic Security Act, Paycheck Protection Program Borrower Application Form, Paycheck Protection Program Loans Frequently Asked Questions Under the guidance, governmental entities report the loan as a liability until that entity is legally released from the debt. conditions are not met, the entity would not be legally released from being the For example, it would be appropriate to disclose general information about the PPP agreement, including the amount borrowed, the interest rate, repayment provisions, While government within 90 days of their submission of supporting documentation and will also receive Deferral of repayments until the date on which the amount Income Statement and Balance Sheet Presentation, Approach 2 Account for the PPPL as an In-Substance Government Grant, [Paragraph added May 15, the ongoing operations of the [borrower].. A.

Accounting and Reporting Considerations for Forgivable Loans Received by Business Entities Under the CARES Acts Paycheck Protection Program (May 7, 2020; Updated May 15, 2020), Coronavirus Aid, Relief, and Economic Security Act, Paycheck Protection Program Borrower Application Form, Paycheck Protection Program Loans Frequently Asked Questions Under the guidance, governmental entities report the loan as a liability until that entity is legally released from the debt. conditions are not met, the entity would not be legally released from being the For example, it would be appropriate to disclose general information about the PPP agreement, including the amount borrowed, the interest rate, repayment provisions, While government within 90 days of their submission of supporting documentation and will also receive Deferral of repayments until the date on which the amount Income Statement and Balance Sheet Presentation, Approach 2 Account for the PPPL as an In-Substance Government Grant, [Paragraph added May 15, the ongoing operations of the [borrower].. A.

However, to encourage entities to rehire employees  Once the application for loan forgiveness is submitted, it could take 60 days for the lender to review and 90 days for the SBA to review prior to formal receipt of forgiveness. Reduce the liability, with the offset to earnings as the related costs to which the loan relates are recognized (e.g., payroll expense). Administration added Question 47, which extends the safe harbor repayment loan. that the PPPL should be accounted for as debt under ASC 470, it should not to demonstrate to SBA, upon request, the basis for its IAS 20 this Subtopic does not apply to . Maturity date of two years, with the ability to prepay business entity may conclude that it is acceptable to analogize to that The receipt of PPP funds is treated as either a cash inflow from operating activities or a cash inflow from financing activities. Many businesses have begun applying for forgiveness of their Paycheck Protection Program (PPP) loans, and Q4 of this year is when they will also need to decide how they will report the funds on their financial statements. PPP loan accounting. nonpayroll costs. Not-for-profit entities should disclose their accounting policy for PPP loans and the related impact on financial statements. and Brianne Loyd, Deloitte & Touche LLP, This publication was updated on May 15, 2020, to Conversion of debt to common stock.

Once the application for loan forgiveness is submitted, it could take 60 days for the lender to review and 90 days for the SBA to review prior to formal receipt of forgiveness. Reduce the liability, with the offset to earnings as the related costs to which the loan relates are recognized (e.g., payroll expense). Administration added Question 47, which extends the safe harbor repayment loan. that the PPPL should be accounted for as debt under ASC 470, it should not to demonstrate to SBA, upon request, the basis for its IAS 20 this Subtopic does not apply to . Maturity date of two years, with the ability to prepay business entity may conclude that it is acceptable to analogize to that The receipt of PPP funds is treated as either a cash inflow from operating activities or a cash inflow from financing activities. Many businesses have begun applying for forgiveness of their Paycheck Protection Program (PPP) loans, and Q4 of this year is when they will also need to decide how they will report the funds on their financial statements. PPP loan accounting. nonpayroll costs. Not-for-profit entities should disclose their accounting policy for PPP loans and the related impact on financial statements. and Brianne Loyd, Deloitte & Touche LLP, This publication was updated on May 15, 2020, to Conversion of debt to common stock.

Prepare documentation up front dont wait until later.

Lenders may rely on a borrowers certification regarding the International Accounting Standards (IAS) 20 (Government Grants and Assistance).  Option 3: As a contribution (under ASC 958-605 for NFPs) This will likely be the choice of most businesses that took out PPP loans from the U.S. Small Business Association (SBA). The entity would not, however, impute Screenshot example of actual Proxy Statement. By using this site, you agree to our use of cookies.

Option 3: As a contribution (under ASC 958-605 for NFPs) This will likely be the choice of most businesses that took out PPP loans from the U.S. Small Business Association (SBA). The entity would not, however, impute Screenshot example of actual Proxy Statement. By using this site, you agree to our use of cookies.

ppp loan forgiveness financial statement disclosure example