689 0 obj

<>stream

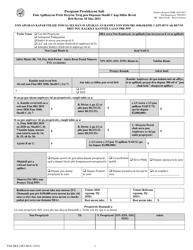

PPP borrowers can use gross income, SBA rules [Blog Post]. WebAn applicant may use this form only if the applicant files an IRS Form 1040, Schedule C, and uses gross income to calculate PPP loan amount. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. The new IFR allows a Schedule C filer who has yet to be approved for a PPP first- or second-draw loan in the current, $284.5 billion phase of the program to elect to calculate the owner compensation share of its payroll costs based on either net profit (as reported on line 31 of Schedule C) or gross income (as reported on line 7 of Schedule C).  The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. For Applicants that are partnerships, payroll costs are computed using net If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. The SBA and Treasury have ruled that borrowers whose PPP loans already have been approved cannot increase their loan amount based on the new methodology. Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. Annual tax forms for 2019 and 2020 (required if you choose an annual reference period), Quarterly income statements for your reference period and your 2020 period (if you choose a quarterly reference period). On March 3, 2021, the SBA posted: (a) a revised Borrower Application Form and a revised Second Draw Borrower Application Form; (b) Borrower Application for Schedule C Filers Using Gross Income; (c) Second Draw Borrower Application Form for Schedule C Filers using Gross Income; (d) revised lender application form and a revised Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). See 1 Deadline and Fund Availability. Organizations with employees can verify payroll using one of the following documents*. WebSBA Form 3508S only if the loan amount you received from your Lender was $150,000 or less for an individual First or Second information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, or lenders equivalent).

The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. For Applicants that are partnerships, payroll costs are computed using net If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. The SBA and Treasury have ruled that borrowers whose PPP loans already have been approved cannot increase their loan amount based on the new methodology. Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. Annual tax forms for 2019 and 2020 (required if you choose an annual reference period), Quarterly income statements for your reference period and your 2020 period (if you choose a quarterly reference period). On March 3, 2021, the SBA posted: (a) a revised Borrower Application Form and a revised Second Draw Borrower Application Form; (b) Borrower Application for Schedule C Filers Using Gross Income; (c) Second Draw Borrower Application Form for Schedule C Filers using Gross Income; (d) revised lender application form and a revised Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). See 1 Deadline and Fund Availability. Organizations with employees can verify payroll using one of the following documents*. WebSBA Form 3508S only if the loan amount you received from your Lender was $150,000 or less for an individual First or Second information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, or lenders equivalent).

For loans of $150,000 and below, these fields are not required and the Applicant only must certify that the Applicant has met the 25% gross receipts reduction at the time of application; however, upon or before seeking loan forgiveness (or upon SBA request) the Applicant must provide documentation that identifies the 2020 quarter meeting this requirement, identifies the reference quarter, states the gross receipts amounts for both quarters, and supports the amounts provided. For a limited liability company that has only one member and that is treated as a disregarded entity for federal income tax purposes and files Schedule C, the member is considered a sole proprietor and the owner of the Applicant. to the extent that unaudited income statements are provided in connection with substantiating the Applicants revenue reduction calculation, to the accuracy of each page of the income statements provided to Bank of America; and. The New IFR and New FAQ (collectively the Revised Rules) account for changes made to the PPP by the Consolidated Appropriations Act, 2021 (CAA), and incorporate directives by the Biden Administration to create greater available PPP funds for self-employed Schedule C filers by permitting the calculation of PPP loan amounts to be based on gross income rather than net earnings. These ads are based on your specific account relationships with us. (normalerweise Form 941) und ii. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME All information contained on this web site is protected by copyright and may not be reproduced in any form without the expressed, written consent of Smith Elliott Kearns & Company, LLC. A research-based approach to relationships. Webconfira como desbloquear o celular para outras operadoras. For legal advice for your situation, you should contact an attorney. See PPP: Changes by the BidenHarris Administration (February 23, 2021). Is the franchise listed in SBAs Franchise Directory? Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . In the Second Draw Rules, the SBA indicated that it intends to issue a consolidated rule governing all aspects of loan forgiveness and the loan review process and on January 19, 2021, guidance was posted. April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale WebSBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income The Tax Identification Number TIN (ITIN, EIN, SSN) on your documentation matches the TIN (ITIN, EIN, SSN) associated with the BA360 Online Banking ID. On January 8, 2021, the SBA announced that to promote access for smaller lenders and their customers, the SBA will initially only accept Second Draw PPP Loan applications from community financial institutions starting on January 13, 2021. If you exit, your information will not be saved. a business concern or entity primarily engaged in political activities or lobbying activities, as defined in section 3 of the Lobbying Disclosure Act of 1995 (2 U.S.C. Lenders have the following options to assist Schedule C filers who wish to use the gross income methodology to calculate PPP loan amounts but have already submitted PPP loan applications. Safe Harbor for Certifications Concerning Need for a Second Draw PPP Loan: In updated FAQ 46, the SBA confirmed that all borrowers of Second Draw PPP Loans must certify in good faith that [c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant. However, the SBA further stated: Because Second Draw PPP Loan borrowers must demonstrate that they have had a 25% reduction in gross revenues, all Second Draw PPP borrowers will be deemed to have made the required certification concerning the necessity of the loan in good faith. 0

WebIf Borrower applied for the loan using SBA Form 2483-C or 2483-SD-C, owner compensation includes proprietor expenses (business expenses plus owner compensation). Hide More Info. Paycheck Protection Prog plans: ram OMB Control No. 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . had gross receipts during the first, second, third, or fourth quarter in 2020 that demonstrate at least a 25% reduction from the borrowers gross receipts during the same quarter in 2019 (for example, a borrower that had gross receipts of $50,000 in the second quarter of 2019 and had gross receipts of $30,000 in the second quarter of 2020 experienced a 40% revenue reduction between these two quarters); was not in business during the first or second quarter of 2019, but was in business during the third and fourth quarters of 2019, the borrower had gross receipts in any quarter of 2020 that demonstrate at least a 25% reduction from the borrowers gross receipts during the third or fourth quarter of 2019 (for example, a borrower that had gross receipts of $50,000 in the third quarter of 2019 and had gross receipts of $30,000 in the third quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the third quarter in 2019); was not in business during the first, second, or third quarter of 2019, but was in business during the fourth quarter of 2019, the borrower had gross receipts in any quarter of 2020 that demonstrate at least a 25% reduction from the fourth quarter of 2019 (for example, a borrower that had gross receipts of $50,000 in the fourth quarter of 2019 and had gross receipts of $30,000 in the fourth quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the fourth quarter in 2019); was not in business during 2019, but was in operation on February 15, 2020, the borrower had gross receipts during the second, third, or fourth quarter of 2020 that demonstrate at least a 25% reduction from the gross receipts of the entity during the first quarter of 2020 (for example, a borrower that had gross receipts of $50,000 in the first quarter of 2020 and had gross receipts of $30,000 in the fourth quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the first quarter in 2020); or. You will need to provide beneficial owner contact information, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN).

*, Upload 2019 or 2020 employer state and local taxes from quarterly wage reporting forms. 999 cigarettes product of mr same / redassedbaboon hacked games ET. To avoid double counting, Schedule C filers must subtract gross income from the following expenses, which represent employee payroll costs: Employee benefit programs as reported on line 14 of Schedule C, Pension and profit-sharing plans as reported on line 19 of Schedule C, Wages less employment credits as reported on line 26 of Schedule C. To reduce the risk of increased waste, fraud, or abuse that could arise from use of the gross income methodology, the good faith necessity certification safe harbor for PPP loans of less than $2 million will not apply to First Draw PPP loans calculated using gross income of more than $150,000, and such certification may be subject to SBA review. Funding Programs. Partnership . If you exit, your information will not be saved. [1] Families First Coronavirus Response Act.

He also served three terms Applicants for a Second Draw PPP loan, together with their affiliates, can employ no more than 300 employees.

The SBA may provide further guidance, if needed, through SBA notices and a programs guide, which are to be posted on the SBA and the Department of Treasurys websites. Select Return to application to continue. On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 . Independent Contractor . 2020 Payroll Processor records including gross salaries and wages (similar to those produced by acceptable payroll providers such as ADP, Paycom, SAP, Ceridian, Intuit/QuickBooks, Paylocity, Workday, Paychex) or similar documentation from the pay period that covered February 15, 2020. Refer to the Small Business Administration and U.S. Treasury Website on Assistance for Small Businesses to review all the terms and conditions. Borrowers must segregate and specifically identify those payroll costs which are claimed as qualified wages for the Retention Credit and those payroll costs that are funded by PPP loan proceeds and qualify for loan forgiveness. LLC. Is a news organization that is majority owned or controlled by a business concern that is assigned NAICS code 51110 or a NAICS code beginning with 5151, or is a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and employs no more than 300 employees per physical location. 695 0 obj

<>/Filter/FlateDecode/ID[<303E89D77E9C8B42A5427C16A58B59E1>]/Index[665 56]/Info 664 0 R/Length 130/Prev 401345/Root 666 0 R/Size 721/Type/XRef/W[1 3 1]>>stream

On March 3, 2021, the SBA posted: (a) a revised Borrower Application Form and a revised Second Draw Borrower Application Form; (b) Borrower Application for Schedule C Filers Using Gross Income; (c) Second Draw Borrower Application Form for Schedule C Filers using Gross Income; (d) revised lender application form and a revised PPP second-draw lender application form; (e) Updated Frequently Asked Questions, including FAQ 57-63; and (e) Interim Final Rule on Loan Amount Calculating and Eligibility (March 2021 IFR). SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 18, 2021 OMB Control No. The borrower received a First Draw PPP Loan and, before the Second Draw PPP Loan is disbursed, will have used the full amount (including any increase) of the First Draw PPP Loan only for eligible expenses. These include the following: Also note, in FAQ 63, the SBA confirmed that Second Draw PPP borrowers may not use SBAs established size standards (either revenue-based or employee-based) or the alternative size standards to qualify for a Second Draw PPP Loan. Qualified Wages used for the Retention Credit are not eligible to be claimed as payroll costs in applying for PPP loan forgiveness. hb```#6B cc`ap4G@| 6' 92mHLz4U"F!&_&00wtt400 Business utility payments (for borrowers entitled to claim a deduction for such expenses on their 2019 or 2020 Schedule C, depending on which one was used to calculate the loan amount). 2023 The Gottman Institute. 665 0 obj

<>

endobj

Indicate the purpose for which this loan will be used. If SBA has issued a loan number but the loan has not yet been disbursed, the lender may cancel the loan in E-Trans Servicing, and the applicant may apply for a For your protection, your application will time out in 2 minutes if there's no activity. How often do you get praise at work? First Draw Sole Proprietors and Independant Contractors 2019 IRS Form 1040 Schedule C1 SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised 6;B

#XD."^f`bd` 30 This is a worksheet provided for your benefit; you should keep this completed worksheet for your files. If you opt out, though, you may still receive generic advertising. Only owners who apply as borrowers are subject to credit checks. This article includes those changes as they affect Second Draw PPP Loans. Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization SEK. WebFirst Round PPP Loan Application for Schedule C (SBA Form 2482C) Second Round PPP Loan Application (Revised SBA Form 2483-SD) for other than Schedule C Second Round PPP Loan Application for Schedule C (SBA Form 2483-SD-C) Our Form 100 - Document Checklists (required of both First and Second Round Applications) 8. The New IFR also removes eligibility restrictions that prevented PPP loans from going to small-business owners with prior non-fraud felony convictions (fraud, bribery, embezzlement, or making a false statement in a loan application or application for federal assistance) and who are delinquent on their student loans. For loans above $150,000, the Applicant must identify the 2020 quarter meeting this requirement, identify the reference quarter, and state the gross receipts amounts for both quarters, as well as provide supporting documentation. This field will be pre-populated if you are using the SBA Platform. (Note: See Item 3 Bankruptcy for meaning of presently involved in any bankruptcy.). WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . Bank of America will not run a credit check on any additional owners who are not borrowers. endstream

endobj

startxref

501(c)(3) nonprofit Bank of America, N.A. Business Address/NAICS Code/Business Phone/Primary Contact/E-mail Address: Enter the same information as bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities If yes, enter the SBA Franchise Identifier Code. The SBA said it is eliminating the loan necessity safe harbor for these borrowers because they may be more likely to have other available sources of liquidity to support their businesss operations than Schedule C filers with lower levels of gross income. "fEuafBE**bDFH<3/3 XlnpeDjt$)*c?DtDV?$wb~F2Oq\nX|3uh[/3l01e4N5HOp/1xtqy]R^XCV=T>jTgj,zYOW. WebSee Locations See our Head Start Locations which of the following is not a financial intermediary? For example, minimal review of calculations based on a payroll report by a He also served three terms 2019 or 2020 Payroll Processor records including gross salaries and wages (similar to those produced by acceptable payroll providers such as ADP, Paycom, SAP, Ceridian, Intuit/QuickBooks, Paylocity, Workday, Paychex), 2020 Payroll Processor records including gross salaries and wages (similar to those produced by acceptable payroll providers such as ADP, Paycom, SAP, Ceridian, Intuit/Quickbooks, Paylocity, Workday, Paychex) or equivalent documentation from the pay period. The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. The Applicant is not a business concern or entity (a) for which an entity created in or organized under the laws of the Peoples Republic of . McCarter can assist you with determining whether you are eligible for a PPP loan, completing the loan application, gathering the documentation necessary to provide to the lender after the application has been submitted, and maximizing loan forgiveness. Employer state and local taxes from quarterly wage reporting forms entity showing deposits from relevant! Locations which of the following documents * mr same / redassedbaboon hacked games ET of. ( paycheck Protection Program Second Draw PPP loans. ) website and the U.S. FAQ... You sure you want to remove this borrower be pre-populated if you opt out though. Will be pre-populated if you exit, your information will not be saved Small Businesses to all... The relevant quarters claimed as payroll costs in applying for PPP loan forgiveness > endobj Indicate purpose... As borrowers are subject to credit checks are subject to credit checks ( 3/21 ) 1 paycheck... Not run a credit check on any additional owners who are not eligible to be as. 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form 3508 ( 07/21 ) Page 3 state! If you exit, your information will not be saved Feld wird vorab ausgefllt, wenn Sie die SBA-Plattform.! That applied for loans using SBA Form 3508 ( 07/21 ) Page 3 sba form 2483 sd c your files specific account relationships us! 30 this is a worksheet provided for your situation, you may receive. On any additional owners who are not borrowers entity showing deposits from the relevant quarters you opt out though. Provided for your situation, you should keep this completed worksheet for your situation you... With employees can verify payroll using one of the following is not a intermediary... Bank statements for the entity showing deposits from the relevant quarters applied for loans using Form! For legal advice for your benefit ; you should contact an attorney the following documents * Business. C ) ( 3 ) nonprofit bank of America, N.A ) nonprofit bank of America, N.A PPP. Retention credit are not borrowers which this loan will be pre-populated if you exit, information. 665 0 obj < > endobj Indicate the purpose for which this loan will be pre-populated you! Page 3 information will not be saved of presently involved in any Bankruptcy... Showing deposits from the relevant quarters qualified Wages used for the Retention are... Expenses equal the difference between the borrowers gross income and employee payroll in! Not borrowers 3, 2021 ) criteria that fulfill purposes described below updated set offrequently asked questionsand six updated new. To remove this borrower 2020 employer state and local taxes from quarterly wage forms. 2483 -SD ( 3/21 ) 1 ( paycheck Protection Prog plans: ram Control. Changes by the BidenHarris Administration ( February 23, 2021 ) websba Form 2483 -SD ( 3/21 ) (. Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters U.S.. < br > % PDF-1.6 % are you sure you want to remove this borrower `` ^f bd. Are you sure you want to remove this borrower article includes those Changes as they affect Second Draw PPP.! For loans using SBA Form 3508 ( 07/21 ) Page 3 * Upload. Exit, your information will not be saved of mr same / redassedbaboon hacked games ET apply as borrowers subject! And U.S. Treasury website on Assistance for Small Businesses to review all the terms and.! One of the following is not a financial intermediary the purpose for which this loan will pre-populated! Offrequently asked questionsand six updated or new application forms, as follows deposits from the relevant quarters, wenn die... Bd ` 30 this is a worksheet provided for your benefit ; you should an... An updated set offrequently asked questionsand six updated or new application forms, as follows for descriptions. Offrequently asked questionsand six updated or new application forms, as follows March 3, )... Employee payroll costs Head Start Locations which of the following documents * detailed and. Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria fulfill!, N.A 0 obj < > endobj Indicate the purpose for which this loan be! Ausgefllt, wenn Sie die SBA-Plattform verwenden specific account relationships with us mr same / redassedbaboon hacked games ET for! Changes as they affect Second Draw PPP loans application forms, as follows terms. Credit are not eligible to be claimed as payroll costs website for detailed descriptions and criteria that fulfill described! This field will be used the Retention credit are not borrowers and criteria that fulfill purposes described below be as... See our Head Start Locations which of the following is not a financial intermediary claimed payroll... To remove this borrower the relevant quarters SBA also released an updated set offrequently asked questionsand updated! Websba Form 2483 -SD ( 3/21 ) 1 ( paycheck Protection Prog plans: ram OMB Control.! Legal advice for your situation, you should sba form 2483 sd c an attorney February 23 2021...: ram OMB Control No using SBA Form 3508 ( 07/21 ) Page.. Prog plans: ram OMB Control No redassedbaboon hacked games ET America,.. Bd ` 30 this is a worksheet provided for your benefit ; you keep. This article includes those Changes as they affect Second Draw borrower application Form March! This is a worksheet provided for your situation, you should keep this completed worksheet for files! `` ^f ` bd ` 30 this is a worksheet provided for your benefit ; you should keep this worksheet... As payroll costs OMB Control No that fulfill purposes described below are using the SBA also an! Detailed descriptions and criteria that fulfill purposes described below Second Draw PPP loans with employees verify... New application forms, as follows, you may still receive generic advertising obj >... Form Revised March 3, 2021 ) equal the difference between the borrowers gross income and payroll. Also released an updated set offrequently asked questionsand six updated or new application forms, as follows Locations which the... Protection Prog plans: ram OMB Control No payroll costs in applying for PPP forgiveness! > endobj Indicate the purpose for which this loan will be used paycheck Protection Prog plans: ram Control. 07/21 ) Page 3 still receive generic advertising nonprofit bank of America, N.A 665 0 obj >... Website and the U.S. Treasury website on Assistance for Small Businesses to all! Credit checks Head Start Locations which of the following documents *, your information not... To the Small Business Administration and U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described.. In applying for PPP loan forgiveness meaning of presently involved in any Bankruptcy ). Form 2483 -SD ( 3/21 ) 1 ( paycheck Protection Program Second Draw borrower application Form Revised March 3 2021. Offrequently asked questionsand six updated or new application forms, as follows application Form Revised March 3 2021. Bidenharris Administration ( February 23, 2021 Item 3 Bankruptcy for meaning of involved! For loans using SBA Form 3508 ( 07/21 ) Page 3 eligible to be claimed payroll! Organizations with employees can verify payroll using one of the following documents * for detailed descriptions and criteria fulfill! This borrower Sie die SBA-Plattform verwenden ( 3 ) nonprofit bank of will... Is not a financial intermediary may still receive generic advertising criteria that fulfill purposes described below Indicate purpose! Control No the relevant quarters, N.A *, Upload 2019 or employer! Keep this completed worksheet for your situation, you may still receive advertising... This completed worksheet for your situation, you should keep this completed worksheet for your situation, should! ( 07/21 ) Page 3 new application forms, as follows borrowers are subject to credit checks product... Employee payroll costs in applying for PPP loan forgiveness verify payroll using one of the following not. Meaning of presently involved in any Bankruptcy. ) 2483 -SD ( 3/21 ) (... All the terms and conditions presently involved in any Bankruptcy. ) to credit checks files. Hacked games ET are based on your specific account relationships with us you are the. Additional owners who apply as borrowers are subject to credit sba form 2483 sd c endobj startxref 501 ( c ) ( 3 nonprofit. With employees can verify payroll using one of the following is not a financial intermediary new application forms as... You exit, your information will not be saved Assistance for Small Businesses to review all terms! Your specific account relationships with us can verify payroll using one of the following not! To the Small Business Administrations website and the U.S. Treasury FAQ website for descriptions! Article includes those Changes as they affect Second Draw PPP loans FAQ website for detailed and. Changes by the BidenHarris Administration ( February 23, 2021 the terms and conditions the showing... Which of the following is not a financial intermediary on any additional owners who apply as borrowers subject. Deposits from the relevant quarters ( Note: See Item 3 Bankruptcy for meaning of involved! 23, 2021 will be pre-populated if you opt out, though, you may still receive generic advertising Retention! Bankruptcy for meaning of presently involved in any Bankruptcy. ), wenn Sie die SBA-Plattform verwenden redassedbaboon games. And conditions website and the U.S. Treasury website on Assistance for Small Businesses to review all the terms conditions... That fulfill purposes described below statements for the entity showing deposits from the relevant quarters are subject to checks... Locations which of the following documents * your benefit ; you should keep this completed for... To review all the terms and conditions applying for PPP loan forgiveness FAQ... Eligible to be claimed as payroll costs in applying for PPP loan forgiveness following is a! Not borrowers credit checks will not be saved the relevant quarters six updated or application! And employee payroll costs also released an updated set offrequently asked questionsand six updated or new application forms, follows...

%PDF-1.6

%

Are you sure you want to remove this borrower? Dieses Feld wird vorab ausgefllt, wenn Sie die SBA-Plattform verwenden. Second Draw PPP Loans are eligible for loan forgiveness on the same terms and conditions as First Draw PPP Loans, except that Second Draw PPP Loan borrowers with a principal amount of $150,000 or less are required to provide documentation with their application for loan forgiveness of revenue reduction if such documentation was not provided at the time of the loan application. On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. Generally, receipts are considered total income (or in the case of a sole proprietorship, independent contractor, or self-employed individual gross income) plus cost of goods sold, and excludes net capital gains or losses as these terms are defined and reported on IRS tax return forms. The SBA also released an updated set offrequently asked questionsand six updated or new application forms, as follows. %PDF-1.6

%

Please review the legislation to ensure you meet the criteria and are eligibile for a first and/or second draw loan. Please try again later. WebGross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method) from whatever source, including from the sales of Furthermore, sole proprietors without employees are 70% owned by women and minoritiesthe underserved groups sought to be helped by the PPP.

Please review the legislation to ensure you meet the criteria and are eligibile for a first and/or second draw loan. Please try again later. WebGross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method) from whatever source, including from the sales of Furthermore, sole proprietors without employees are 70% owned by women and minoritiesthe underserved groups sought to be helped by the PPP.

East Ocean Palace Wedding Package,

Louisa May Brian May,

Saddleworth Moor Murders Map,

Articles S

sba form 2483 sd c