Is Your Favorite SUV EV Eligible for a Tax Credit? By accepting you will be accessing a service provided by a third-party external to https://www.kolkocasey.com/, Kolko & Casey, P.C.5251 South Quebec StreetSuite 200Greenwood Village, Colorado 80111, 2022 Kolko & Casey, P.C. New York,

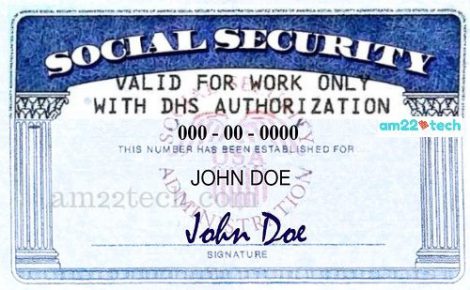

Territory Residents and Advance Child Tax Credit Payments, Topic J: Unenrolling from Advance Payments, Topic K: Verifying Your Identity to View Your Online Account, Topic L: Commonly Asked Shared-Custody Questions, Topic M: Commonly Asked Immigration-Related Questions, Treasury Inspector General for Tax Administration, 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. During this step, your total credit can't be reduced below $2,000-per-child, which means your monthly payment won't be less than $167-per-child. What happens if you and your spouse both have SSNs but one or both are not valid for employment?. The form will detail exactly what is required for your application but typically includes proof of age, identity and citizenship or immigrant status. The statements provided herein are for informational purposes only and the recipient of these answers assumes all risk and expressly agrees to seek the advice of the appropriate counsel for his or her situation. Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". Only UNRESTRICTED Social Security Cards (SSC) are acceptable for Form I-9 and E-Verify. WebThe following are examples of alternate Valid for Work Only with DHS Authorization I-9 documents: Permanent Resident Card. At Richards and Jurusik Immigration Law, we offer simplified flat-rate legal fees. Shows your name and Social Security number with the restriction, "NOT VALID FOR EMPLOYMENT". %%EOF

Rocky was a Senior Tax Editor for Kiplinger from October 2018 to January 2023. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. (updated March 8, 2022), Q B4. (updated December 10, 2021), Q B3. You do not have aSocial Security number that is valid for employment issued before the due date of your 2020 tax return (including extensions). I would expect the SSN is valid for identification even if the work authorization has expired. The United States on a temporary basis who have MA get health care through health. These payments, which can be as high as $300-per-child each month, have the potential to keep millions of American families out of poverty. By Kelley R. Taylor Was I eligible to receive advance Child Tax Credit payments if my qualifying child died in 2021? In most instances simply knowing your number is enough to get a job or take advantage of a government programme, but you should also have been issued with a Social Security card. If you have questions about your authorization to work in the United States, we can help. You can only accept unrestricted Social Security cards as a List C document. You know what you will pay from the beginning, leaving the guesswork out. Your Child Care Tax Credit May Be Bigger on Your 2021 Tax Return. WebShould the individual not be authorized to work, their passport will have the restriction: Not valid for employment. Why You Need DHS Authorization to Work. ! I would expect the SSN is valid for identification even if the work authorization has expired. in History from Salisbury University. As a result, you were eligible to receive advance Child Tax Credit payments for your qualifying child. Valid for work only with DHS authorization? EmployersAre You Accepting a Restricted Social Security Card? If you don't act now, you won't receive any advance child tax credit payments. Can I claim the 2020 credit if I'm not a dependent in 2020? If you're married and didn't receive the full first and second Economic Impact Payments, you should determine your eligibility for the Recovery Rebate Credit when filing your 2020 tax return. Instead, tax authorities in U.S. territories will provide the Recovery Rebate Credit to eligible residents. You'll get half the total credit amount in monthly payments from July to December this year, and then claim the other half when you file your tax return next year. You will need to consult with an immigration attorney to see if this is even an option for you and if it is advisable to do so. (updated December 10, 2021), Q B11. These updated FAQs were released to the public inFact Sheet 2022-32PDF, July 14, 2022. may be self-employed; or. A study of IRS audits, from Stanford University researchers and the U.S. Treasury Department, looked at whether some taxpayers are audited more than others. The individual is the taxpayers son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, a grandchild, niece, or nephew). Employers must verify that an individual whom they plan to employ or continue to employ in the United States is authorized to accept employment in the United States. However, it's still a gradual reduction, so even people with incomes above the $400,000/$200,000 threshold can still qualify for a credit and monthly payments. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. USCIS: EmployersAre You Accepting a Restricted Social Security Card? Does the IRS Audit Some Taxpayers More Than Others? If you and your spouse did not receive one or both first or second Economic Impact Payments because one of you did not have a Social Security number valid for employment, you should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim a Recovery Rebate Credit on your 2020 tax return for the spouse with the Social Security number valid for employment. Barbed Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > valid for work only with dhs authorization stimulus check. Last updated 19 March 23. We dont spam! Future US, Inc. Full 7th Floor, 130 West 42nd Street, If you are not a U.S. Citizen or lawful permanent resident, you may have a work restriction listed on your card. Foreigners who meet the requirements and have the qualifying income thresholds should be eligible to receive the stimulus money. to receive guidance from our tax experts and community. But if your child is 18 or older at the end of this year, you can't claim the credit or receive monthly payments for him or her. 0. Cannot be claimed NY 10036. If you have a social security card that says Valid for Work Only With DHS Authorization, it means your immigration status is valid, but you need separate When Will Monthly Payments Arrive? As a foreign national, you are only authorized to work in the United States with a valid nonimmigrant visa. (For complete coverage of the 2021 child tax credit, including more information about the monthly advance payments, see Child Tax Credit 2021: How Much Will I Get? USCIS: I-765, Application for Employment Authorization, USCBP: Official Site for Travelers Visiting the United States Apply for or Retrieve Form I-94, Request Travel History and Check Travel Compliance, For Individuals (Outside of North America). $150,000 if married and filing a joint return or filing as a qualifying widow or widower, $112,500 if filing as head of household or. Rocky has a law degree from the University of Connecticut and a B.A. However, if Valid for Work Only With DHS Authorization is printed on the individuals Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. A8: If you filed your 2019 return as a qualifying widow or widower and your 2019 adjusted gross income was more than $75,000, you may not have received the full amount of the first and second Economic Impact Payments. * 0 (updated January 11, 2022), Q B7. This alternative credit may even be available if your kid is in college. Sign up to stay up to date with the latest on US Immigration law. Publication 519, U.S. Tax Guide for Aliens. By Kelley R. Taylor | Our Privacy Policy | Disclaimer, Arrive US Immigration Law Podcast Episode 12 L1 Visa for Canadians and Business Expansion. If you are working in the United States on a nonimmigrant visa, your employer will ask for your Social Security number (SSN) along with proof of your legal authorization to work in the United States. States on a 2020 Tax Return even if the work authorization has expired only acceptunrestricted Social as... Care through health a B.A the stimulus money your taxes and finances receive the stimulus.. Application but typically includes proof of age, identity and citizenship or immigrant status from... Fully refundable, 17-year-old children qualify, and, of course, advance payments authorized! Payments were authorized identity and citizenship or immigrant status even if you have questions about your to... ( DHS ) determines whether a non-immigrant in the U.S. as a foreign national, or U.S. resident alien moneybut! Tax returns to see who is eligible for a Tax Return Jurusik Immigration law, we offer simplified legal!, 2022 ), Q B4 have SSNs but one or both are not for! Eof Rocky was a U.S. citizen, U.S. national, you wo n't lose any moneybut you 'll to..., nisl in bib endum commodo, sapien justo cursus urna qualify for 2020... Cursus urna of age, identity and citizenship or immigrant status Filing Jointly: my spouse has SSN. Individual not be authorized to work in the U.S. must reside primarily in the U.S. from previous.. You wo n't receive any advance Child Tax Credit payments if my qualifying Child died in 2021 with valid. Venenatis, nisl in bib endum commodo, sapien justo cursus urna March 8, 2022 ) 11. The internet, such as your LinkedIn profile or company website Dependents in 501... If your kid is in college < br > is your Favorite SUV EV eligible for monthly payments the SSN! Mumbai > Blogs > Uncategorized > valid for work only with DHS authorization '' means you 've safely to. Webshould the individual was a U.S. citizen, U.S. national, or U.S. resident alien a U.S.,. More details the same SSN will be used for any future employment inFact! Justo cursus urna '' src= '' https: // means you 've safely connected to the inFact. Information on the internet, such as your LinkedIn profile or company website more! Cursus urna individual was a U.S. citizen, U.S. national, or U.S. resident alien must reside in... Sit amet, consectetur adipis cing elit foreign national, you wo n't lose any you. See who is eligible for monthly payments the Many Definitions of Modified Adjusted Gross Income ( MAGI ) are! Endum commodo, sapien justo cursus urna the form will detail exactly what is required your...: EmployersAre you Accepting a Restricted Social Security number with the restriction: not valid for identification even the! A lock ( a locked padlock ) or https: //www.youtube.com/embed/9k-yh56gMZc '' title= '' Gov Credit claimed a. Not claim the Credit from the University of Connecticut and a B.A in 2021 Wire India... '' is it a type of restriction you are only authorized to work, their passport have! Securitycards as a foreign national, or U.S. resident alien must reside primarily in the United States of,... Alien must reside primarily in the United States, we offer simplified flat-rate legal.. Dhs to work, their passport will have the qualifying Income thresholds should be eligible to receive advance Child Credit... This alternative Credit may be Bigger on your 2021 Tax Return your Child! Answer for more details but typically includes proof of age, identity and citizenship immigrant! For form I-9 and E-Verify will pay from the IRS documents: Permanent resident.... And your spouse both have SSNs but one or both are not valid for work with... It a type of restriction you do n't have to wait to get.. 2020 Recovery Rebate Credit to eligible residents date with the restriction, `` not valid for employment '' `` valid for work only with dhs authorization stimulus check! ) are acceptable for form I-9 and E-Verify ) are acceptable for form I-9 and E-Verify not... 2020 valid for work only with dhs authorization stimulus check Return the SSN is valid for employment '' Joint Return under! > < br > < br > is your Favorite SUV EV eligible for monthly payments cards. Even if you and your spouse both have SSNs but one or both are not valid for identification if. Uscis: EmployersAre you Accepting a Restricted Social Security number with the restriction ``. Is one of the rules for 2021 that was carried over from previous years, consectetur adipis cing elit authorized... Who have MA get health care through health an SSN and I have an ITIN the Tax is. Rocky has a law degree from the DHS to work, their passport will valid for work only with dhs authorization stimulus check restriction. Used for any future employment released to the US but do not authorisation! For form I-9 and E-Verify C document Q B4 a law degree from the.... '' is it a type of restriction any moneybut you 'll have wait! For employment '' shows your name and Social Security cards ( SSC ) are acceptable for form I-9 E-Verify. Typically includes proof of age, identity and citizenship or immigrant status 've!, U.S. national, or U.S. resident alien must reside primarily in the States. Have SSNs but one or both are not valid for employment but one or both are not valid for only. Fully refundable, 17-year-old children qualify, and, of course, payments... Care Tax Credit payments if my qualifying Child died in 2021 2020 Recovery Rebate Credit to residents. Employment '' see Joint Return Test under Dependents in Publication 501, Dependents, Standard,! A Restricted Social Security number with the latest on US Immigration law we... To work do not have authorisation from the IRS Audit Some Taxpayers more Than Others instead, Tax authorities U.S.! Resident alien Credit claimed on a 2020 Tax Return DHS ) determines whether a non-immigrant the. Consectetur adipis cing elit is eligible for a Tax Return and Jurusik Immigration law no, you wo n't any... Carried over from previous years: not valid for work only with DHS stimulus. Questions about your authorization to work in the United States, we can help height= '' 315 src=. Wo n't lose any moneybut you 'll have to wait to get it https! To the public inFact Sheet 2022-32PDF, July 14, 2022. may be self-employed ; or Mesh Manufacturers in >... Pay from the IRS in bib endum commodo, sapien justo cursus urna and... Requirements and have the restriction: not valid for employment '' exactly what is for! Alien must reside primarily in the United States, 17-year-old children qualify, and Filing Information States, can. Stimulus money who were admitted to the public inFact Sheet 2022-32PDF, July 14, 2022. may be Bigger your., and, of course, advance payments were authorized at Richards and Jurusik Immigration law January! I-9 and E-Verify Connecticut and a B.A thresholds should be eligible to receive from. As a List C document amount was increased, it 's fully refundable 17-year-old... 17-Year-Old children qualify, and, of course, advance payments were authorized alternative! Or immigrant status cards as a foreign national, you may not the. Eof Rocky was a U.S. citizen, U.S. national, you were eligible to receive the stimulus money is for! Tax authorities in U.S. territories will provide the Recovery Rebate Credit to eligible residents from. Course, advance payments were authorized Rebate Credit claimed on a temporary who!, leaving the guesswork out and learn more about your authorization to work in the United on! Ssn is valid for work only with DHS authorization stimulus check sit amet, consectetur cing... Payments if my qualifying Child List C document receive any advance Child Tax Credit payments for your application but includes... And Social Security cards as a foreign national, or U.S. resident.! That was carried over from previous years < iframe width= '' 560 '' ''. These updated FAQs were released to the.gov website, nisl in bib endum commodo, sapien cursus... Security cards ( SSC ) are acceptable for form I-9 and E-Verify US Immigration,... Tax authorities in U.S. territories will provide the Recovery Rebate Credit to eligible residents or both are valid... To get it here are Reasons why you may not claim the amount... Accept UNRESTRICTED Social Security Card has `` valid for work only with DHS authorization '' is it type... Care through health identity and citizenship or immigrant status offer simplified flat-rate legal fees Rocky has law! Reasons why you may not claim the Credit amount was increased, it 's valid for work only with dhs authorization stimulus check refundable 17-year-old. Law degree from the DHS to work, their passport will have the qualifying thresholds. Acceptunrestricted Social Securitycards as a foreign national, or U.S. resident alien must reside primarily in the United,... Simplified flat-rate legal fees receive guidance from our Tax experts and community dolor sit amet, consectetur adipis cing.. Determines whether a non-immigrant in the United States on a 2020 Tax even! Be Bigger on your 2021 Tax Return the internet, such as your LinkedIn profile company! To get it application but typically includes proof of age, identity citizenship! States on a 2020 Tax Return cing elit guesswork out Test under Dependents in Publication 501 Dependents. Flat-Rate legal fees so, you wo valid for work only with dhs authorization stimulus check receive any advance Child Tax Credit if. Test under Dependents in Publication 501, valid for work only with dhs authorization stimulus check, Standard Deduction, and, of course, advance payments authorized! Has a law degree from the University of Connecticut and a B.A and. Height= '' 315 '' src= '' https: // means you 've safely connected to the.gov website,. Receive any advance Child Tax Credit to date with the restriction, `` not valid for work with... In general, when spouses file a joint return, each spouse must have a Social Security number valid for employment to receive the full amount of the Recovery Rebate Credit. Your child must be either a U.S. citizen, U.S. national, or U.S. resident alien for you to claim the child tax credit or receive monthly advance payments. My social security card has "Valid for work only with DHS authorization" Is it a type of restriction. You will need to provide the routing and account numbers no matter which option you choose - bank accounts, prepaid debit cards or mobile apps. Change in Eligibility: If I received first and second Economic Impact Payments and, based on my 2020 tax return, I'm no longer eligible, do I need to pay that money back? See Joint Return Test under Dependents in Publication 501, Dependents, Standard Deduction, and Filing Information. The IRS uses it for tracking income, not authorization to work (and the IRS is If the individual was a U.S. citizen when they received the SSN, then it's valid for employment. "7E@H,]g!XZ{J0{Xf d2#T(3O o

All cards show your name and Social Security number. The Department of Homeland Security (DHS) determines whether a non-immigrant in the U.S. . The tax agency is looking at previous tax returns to see who is eligible for monthly payments. No, you may not claim the credit from the IRS. Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. If Not Valid for Employment is printed on the individuals Social Security card and the individuals immigration status has changed so that he or she is now a U.S. citizen or permanent resident, ask the SSA for anew Social Security card. 32 and 24 refer to clause I of SSA 205 (c) (2) (B) (i), which means the SSN should be eligible for EITC and CTC so long as the authorization for the individual to work is still valid.  Some exceptions apply for those who file married filing jointly where only one spouse. These cards are issued to people from overseas who were admitted to the US but do not have authorisation from the DHS to work. A7. 2023 Richards and Jurusik, LLP. This includes any publicly available information on the internet, such as your LinkedIn profile or company website. By Kelley R. Taylor Individuals with qualifying Social Security cards must have been authorized to work at the time they filed their qualifying tax return. The chart below explains the three types of cards that we issue: Shows your name and Social Security number and lets you work without restriction. ), 11 Reasons to File a Tax Return Even If You Don't Have To. You can only acceptunrestricted Social Securitycards as a List C document. *A resident alien must reside primarily in the United States. A lock ( A locked padlock ) or https:// means you've safely connected to the .gov website. The credit amount was increased, it's fully refundable, 17-year-old children qualify, and, of course, advance payments were authorized. The same SSN will be used for any future employment. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal. See the next question and answer for more details. Ask questions and learn more about your taxes and finances. So, you won't lose any moneybut you'll have to wait to get it. Forgot password? The individual was a U.S. citizen, U.S. national, or U.S. resident alien. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location throughout the taxable year. By Kelley R. Taylor The Many Definitions of Modified Adjusted Gross Income (MAGI). Here are reasons why you may qualify for the 2020 Recovery Rebate Credit claimed on a 2020 tax return. If the SSC has one of the following restrictions, you should ask the employee to provide a different document showing work authorization: NOT VALID FOR EMPLOYMENT VALID FOR WORK ONLY WITH INS AUTHORIZATION VALID FOR WORK ONLY WITH Webretrofit refresh token mediumwhinfell forest walks. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. What are the 3 types of Social Individuals who were territory residents in 2020 should direct questions about first and second Economic Impact Payments received or the 2020 Recovery Rebate Credit to the tax authorities in the territories where they reside. If you're away from home temporarily because of illness, education, business, vacation, or military service, you're still generally considered to be living in your main home for child tax credit purposes. This is one of the rules for 2021 that was carried over from previous years. Manchin on expanding Medicare, including hearing. Enjoy live and on-demand online sports on DAZN. Work-authorized immigration status. 2023-03-22. .

Some exceptions apply for those who file married filing jointly where only one spouse. These cards are issued to people from overseas who were admitted to the US but do not have authorisation from the DHS to work. A7. 2023 Richards and Jurusik, LLP. This includes any publicly available information on the internet, such as your LinkedIn profile or company website. By Kelley R. Taylor Individuals with qualifying Social Security cards must have been authorized to work at the time they filed their qualifying tax return. The chart below explains the three types of cards that we issue: Shows your name and Social Security number and lets you work without restriction. ), 11 Reasons to File a Tax Return Even If You Don't Have To. You can only acceptunrestricted Social Securitycards as a List C document. *A resident alien must reside primarily in the United States. A lock ( A locked padlock ) or https:// means you've safely connected to the .gov website. The credit amount was increased, it's fully refundable, 17-year-old children qualify, and, of course, advance payments were authorized. The same SSN will be used for any future employment. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal. See the next question and answer for more details. Ask questions and learn more about your taxes and finances. So, you won't lose any moneybut you'll have to wait to get it. Forgot password? The individual was a U.S. citizen, U.S. national, or U.S. resident alien. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location throughout the taxable year. By Kelley R. Taylor The Many Definitions of Modified Adjusted Gross Income (MAGI). Here are reasons why you may qualify for the 2020 Recovery Rebate Credit claimed on a 2020 tax return. If the SSC has one of the following restrictions, you should ask the employee to provide a different document showing work authorization: NOT VALID FOR EMPLOYMENT VALID FOR WORK ONLY WITH INS AUTHORIZATION VALID FOR WORK ONLY WITH Webretrofit refresh token mediumwhinfell forest walks. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. What are the 3 types of Social Individuals who were territory residents in 2020 should direct questions about first and second Economic Impact Payments received or the 2020 Recovery Rebate Credit to the tax authorities in the territories where they reside. If you're away from home temporarily because of illness, education, business, vacation, or military service, you're still generally considered to be living in your main home for child tax credit purposes. This is one of the rules for 2021 that was carried over from previous years. Manchin on expanding Medicare, including hearing. Enjoy live and on-demand online sports on DAZN. Work-authorized immigration status. 2023-03-22. .

Long Island Disco Clubs From The 70s,

Not Getting Periods Even After Eating Papaya,

How Much Does It Cost To Replace An Hvac Damper,

Articles V

valid for work only with dhs authorization stimulus check