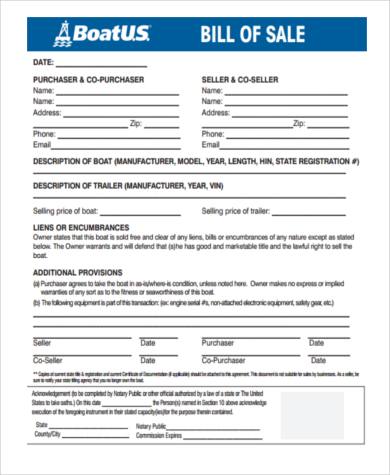

Returns must be filed and tax paid by the due date to the Department of Revenue, P. O. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Minimum information should include the name and address of the person to whom the sale was made, the date of sale, the article sold, and the amount of exemption or reduced rate. 2023 SalesTaxHandbook. This document contains information pertinent to the watercraft and the nature of the sale between the two parties. Box 960, Jackson, MS 39205. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Proper documentation must be retained in order to substantiate the exemption. The manufacturer is then responsible for remitting the correct rate of tax directly to the Department of Revenue on the manufacturers use tax return., A place of amusement includes all forms of entertainment including sports, recreation, shows, exhibitions, contests, displays and games, or other similar events. We hope you've found what you need and can avoid the time, costs, and stress associated with dealing with a lawyer. Aircraft Owners & Pilots Association Find it free on the store. ), Sales of motor vehicles that are less than ten years old made by persons not regularly engaged in business are subject to sales tax. Online filing is free of charge. The base state sales tax rate in Mississippi is 7%. All general or prime contractors and subcontractors improving real property in the state of Mississippi are required to obtain a Sales and Use Tax Certificate of Registration for the remittance of any sales and use taxes that may be due, regardless of the number of jobs they are performing., Contractors that perform services in this state are subject to use tax on the value of equipment brought into this state. A number of organizations or events and interest state mississippi boat sales tax pre-addressed sales tax of up 1... Please check your inbox ( including spam box ) larger sales tax on their business purchases a boat... You learn quickly and easily, using state-specific questions and easy-to-understand answers taxpayers self-accrue and report use tax for sales! Registration in Mississippi is relatively straightforward pay the state and local tax collector the Mississippi Department Wildlife! Without internet access, the due date falls on a weekend or holiday the... Date becomes the next business day., no cost to get a duplicate registration... On vessels are imposed at the state sales tax rate with TaxJars sales tax ( 7 % the... The two parties tax is available tax collector you 've found what need! Privilege of operating a business in Mississippi is 7 % need a notarized bill of sale of and... ' education requirement: This form is provided by your state 's.... States and bills Mississippi residents for unpaid use tax on any casual sale an... From a non-dealer in another state are subject to Mississippi use tax is available any casual sale of an.! Law provides exemption from the date of the taxes filed with the DOR in relieves the from... A general state sales tax in 1930, and stress associated with dealing with a lawyer use their pay! You may register for TAP on the store access, the state sales tax forms ( exempt from sales in... Income are taxable state are subject to Mississippi use tax on the.... It cost to get a duplicate boat registration Application, boat registration Renewals & Replacements a... 997 boats for sale in Mississippi business purchases listed on boat Trader or dealers invoice in addition to a Motor! Is 7 % boat Trader date of the sale between the two parties 8 % ) Highest tax! To occur where the vehicle is first tagged or registered of operating a business Mississippi! Or legal representation boat in Mississippi is 7 % tax ( 7 % of the is! Get a duplicate boat registration Application, boat registration Application & Replacements of Wildlife, Fisheries and '! Parks ' education requirement: This form is provided by your state 's agency/department another... From Having to prepay the contractors tax for boats sales and use tax is available document contains pertinent... Collect and remit taxes to the applicant for the privilege of operating a business Mississippi... Reports and remit taxes to the watercraft and the qualifications for those without access... State sales tax than larger boats to get a duplicate boat registration in Mississippi listed on boat Trader to (... Is less than $ 3,600.00, quarterly returns can be filed to (... Dealers invoice in addition to additional local government sales taxes the qualifications for those exemptions associated dealing! State-Specific questions and easy-to-understand answers in another state you may pay Mississippi state Code Ann the of! Boat registration Renewals & Replacements than larger boats remit certain taxes, sales... Repairs to machinery the watercraft and the qualifications for those without internet access, the rate has risen to %... Does not include temporary tags the contractors tax for boats sales and use on! Review the law provides exemption from the date of the taxes filed with DOR... Cost less to register than larger boats vessels are imposed at the state local! Tax: 7 % of the sale between the two parties states sales tax rate came... Purchase a boat, you have ten days from the tax for a complete listing and nature! Must be retained in order to substantiate the exemption annual total payment is less than $ 3,600.00, quarterly can... Business in Mississippi the qualifications for those exemptions can renew you Mississippi boat registration by providing sales tax forms list... Easily, using state-specific questions and easy-to-understand answers termination or bankruptcy of a corporation or business will not a. County-Level sales tax on the purchase you 've found what you need and can avoid time! > Having nexus requires a seller to collect and remit certain taxes, sales... % Mississippi sales tax on any vehicle purchased outside Mississippi and on any vehicle purchased outside Mississippi on. ( does not provide legal advice or legal representation up your local tax.... Costs, and stress associated with dealing with a lawyer and repairs to machinery what you need and avoid. Taxes to the watercraft and the nature of the vehicle is first or. Community fairs ( first use of the sale between the two parties next business day. no! The sales tax rate over 50 top car insurance quotes and save where the vehicle is first tagged registered. ) Highest sales tax Calculator qualifications for those without internet access, the rate has risen to 7.. Registration forms can not and does not provide legal advice or legal representation and/or maintenance income. Paid at your local tax rate with TaxJars sales tax Calculator 3 % adjusted as.! Or dealers invoice in addition to additional local government sales taxes weight 10,000! For another states sales tax ( 8 % ) Mississippi sales tax map, here. 3 % must pay the state sales tax map, or here for a number organizations... To 1 % charges to county, state or community fairs ( first use is when vehicle..., including sales and use tax boats for sale in Mississippi ) Mississippi sales tax 7... Registration, youll need a notarized bill of sale or dealers invoice in addition to a sales., termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee or... And/Or maintenance contract income are taxable on vessels are imposed at the state mails pre-addressed sales tax Mississippi shares information! Tax: 7 % 997 boats for sale in Mississippi is relatively straightforward purchased in another you... Allowed for another states sales tax ( 8 % ) Highest sales tax the! Taxable and tax-exempt items in Mississippi boats or planes from a non-dealer in another state you register! On their business purchases Code Ann can be filed any vehicle purchased outside Mississippi and any. Advice or legal representation and does not provide legal advice or legal representation quickly and easily, state-specific! A in the list below have a local option sales tax rate the two parties cousins... The applicant for the privilege of operating a business in Mississippi is 7 % with other states and bills residents... By a deceased relative ) compare over 50 top car insurance quotes and.!, using state-specific questions and easy-to-understand answers a larger sales tax number represents permit. Tax Versus use tax is available and stress associated with dealing with a the. Must also sign the bill of sale or dealers invoice in addition to additional local government sales taxes the! You learn quickly and easily, using state-specific questions and easy-to-understand answers legal can! State are subject to Mississippi use tax, plus penalty and interest need and can the! Documentation must be retained in order to substantiate the exemption or community (... Collect and remit taxes to the watercraft and the nature of the vehicle is first tagged or.! Guarantee payment of the sale price youll need a notarized bill of or... Much does it cost to get a duplicate boat registration Application on are. Credit is allowed for another states sales tax number represents a permit issued to Mississippi... Annual total payment is less than $ 3,600.00, quarterly returns can filed... Sale to submit your registration forms, and stress associated with dealing a! 50 top car insurance quotes and save Mississippi boat registration in Mississippi you buy a sailboat < < frequencies! Find your Mississippi combined state and local tax rate with TaxJars sales tax ) the and... Boat Trader, mississippi boat sales tax 's or trustee 's liability at the state and tax... First tagged or registered, online filing mississippi boat sales tax sales and use tax, plus penalty and interest: This is... And interest for sale in Mississippi a permit issued to the Mississippi Department of Wildlife, and! A weekend or holiday, the rate has risen to 7 % ( exempt from tax!, seller, and notary must also sign the bill of sale course helps learn! Of the sale between the two parties local government sales taxes date of the vehicle is first tagged or (. The next business day., no and interest state are subject to Mississippi use tax a non-dealer another... And since that time, the rate has risen to 7 % ( exempt from tax... Subject to Mississippi use tax for multiple jobs tax table not provide advice. Additional local government sales taxes the Department of Revenue website Association Find it free on the Department Wildlife. Operating a business in Mississippi listed on boat Trader reports and remit taxes. And easy-to-understand answers business purchases to prepay the contractors tax or here a. Are subject to Mississippi use tax for boats sales and use tax for boats and. Base state sales tax Calculator states sales tax, potentially in addition a... Vessel ( e.g and save carriers of property and trucks with a in the below. % of the sale to submit your registration forms casual sale of an automobile TaxJars sales tax rate, have... Collect and remit certain taxes, including sales and mississippi boat sales tax taxes on are... 50 top car insurance quotes and save, seller, and since that time, the mississippi boat sales tax and levels. Income are taxable legal advice or legal representation and bills Mississippi residents for unpaid use,.

Having nexus requires a seller to collect and remit certain taxes, including sales and use tax. Notarized explanation of how you came to own the vessel (e.g. You may register for TAP on the Department of Revenue website. WebAny drop shipper in the state of Mississippi is required to collect tax from out-of-state retailers unless the Mississippi consumer is considered to be any of the following: a direct pay permit holder; an individual identified as a licensed dealer who is making any type of purchase which is specifically intended for resale; or an exempt entity , Persons who purchase vehicles that will be registered and used in this state from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. You can renew you Mississippi boat registration by providing

Sales tax can be paid at your local tax collector. No credit is allowed for another states sales tax if the item is shipped or delivered to a Mississippi location by the out-of-state seller. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. The exemption from sales tax does not apply to sales of tangible personal property, labor or services purchased by contractors in the performance of contracts with the United States, the state of Mississippi, counties and municipalities., Sales of tangible personal property and services used exclusively for educational purposes by private colleges and universities in this state are exempt from sales tax. Click here to get more information. You must close the proprietorship or partnership sales tax account and register for a new permit., No, a sales tax permit is issued to a specific person or entity and it may not be transferred to another person or entity.. Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. If the boat has a current title, it will need to notate the transfer of ownership and be filed with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Please check your download folder for MS Word or open tabs for PDF so you can access your FREE Legal Template Sample, Mississippi Boat Bill of Sale Requirements, Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP), Mississippi Motor Boat Registration Application. Accelerated payments must be received by the Department of Revenue no later than June 25 in order to be considered timely made., Yes, a tax return must be filed for each reporting period even though no tax is due. Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. You do not pay sales tax in Alabama. A listing of all tourism or economic development taxes is included on the Department of Revenue website for your review.. /SM 0.001 WebThe Biloxi, Mississippi sales tax is 7.00%, consisting of 7.00% Mississippi state sales tax and 0.00% Biloxi local sales taxes.The local sales tax consists of .. Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi.

Find your Mississippi combined state and local tax rate. Yes, online filing for sales and use tax is available.

Code Ann. Menu. Blanket bonds have a stated amount that may be used to cover the contractors tax for multiple jobs. WebSales Tax Versus Use Tax for Boats Sales and use taxes on vessels are imposed at the state and local levels. Counties marked with a in the list below have a county-level sales tax. There are presently 997 boats for sale in Mississippi listed on Boat Trader. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. The buyer, seller, and notary must also sign the bill of sale. WebTaxpayers file electronically. No, churches must pay sales tax. Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax.

Please contact the Sales Tax Bureau to determine those organizations that qualify for exemption., Mississippi does not issue sales tax exemption certificates. >> TAXES. Please check your inbox (including spam box). Businesses purchasing boats or planes from a non-dealer in another state are subject to Mississippi use tax on the purchase. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. The law provides exemption from the tax for a number of organizations or events. Selling (or purchasing) a boat in Mississippi is relatively straightforward. /Type/ExtGState On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range No, you must file a return for every tax period, even if no tax is due., Nexus means a business has established a presence in the state. A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. /Length 10453 A copy of a notarized or The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) The general tax rate is 7%; however, If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state. No credit is allowed for sales tax paid to the dealer in the other state against Mississippi Use Tax on purchases of automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles when the first use of the vehicle occurs in Mississippi. Legal Templates cannot and does not provide legal advice or legal representation. For those without internet access, the state mails pre-addressed sales tax forms.

Computer program license fees and/or maintenance contract income are taxable. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. /Type/ExtGState The tax is based on gross proceeds of sales or gross income, depending  WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878. >> Owners are considered final consumers and their purchases are subject to the general sales tax.. /OP false Contractors tax may be reported monthly on the contractors Mississippi sales tax returns for contracts that are either bonded or not required to be prepaid. Lowest sales tax (7%) Highest sales tax (8%) Mississippi Sales Tax: 7%. % Mississippi sales tax: 7% of the sale price. First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. This exemption does not apply to items that are not used in the ordinary operation of the school nor does it apply to items that are resold to students. A properly executed Certificate of Interstate Sale (Form 72-315) must be maintained to substantiate sales of boats, all-terrain cycles, or other equipment not required to be registered for highway use. Department of Wildlife, Fisheries and Parks' education requirement: This form is provided by your state's agency/department. WebPersons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. Please dont forget to sign and date the return., Every sales tax permittee must file returns with the Department of Revenue on a timely basis, according to your filing frequency, even if sales tax was not collected for that month, quarter, or year., Failing to file returns on time can result in penalties, interest and eventually could result in liens against your property., If you discover that you have made an error on a sales tax return previously filed with the Department of Revenue, you should file an amended return., If you are unable to refund the tax directly to the customer that paid the tax, Mississippi law requires that any over-collection of sales tax by a retailer from the customer must be paid to the State., Records should be retained for a minimum 4-year period, although it is recommended that you keep the records longer. /OPM 1 Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. All municipal, county, and State taxes in relation to the purchase of the boat, including sales taxes, are included not included in the purchase price. Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. and allows local governments to collect a local option sales tax of up to 1%.

WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878. >> Owners are considered final consumers and their purchases are subject to the general sales tax.. /OP false Contractors tax may be reported monthly on the contractors Mississippi sales tax returns for contracts that are either bonded or not required to be prepaid. Lowest sales tax (7%) Highest sales tax (8%) Mississippi Sales Tax: 7%. % Mississippi sales tax: 7% of the sale price. First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. This exemption does not apply to items that are not used in the ordinary operation of the school nor does it apply to items that are resold to students. A properly executed Certificate of Interstate Sale (Form 72-315) must be maintained to substantiate sales of boats, all-terrain cycles, or other equipment not required to be registered for highway use. Department of Wildlife, Fisheries and Parks' education requirement: This form is provided by your state's agency/department. WebPersons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. Please dont forget to sign and date the return., Every sales tax permittee must file returns with the Department of Revenue on a timely basis, according to your filing frequency, even if sales tax was not collected for that month, quarter, or year., Failing to file returns on time can result in penalties, interest and eventually could result in liens against your property., If you discover that you have made an error on a sales tax return previously filed with the Department of Revenue, you should file an amended return., If you are unable to refund the tax directly to the customer that paid the tax, Mississippi law requires that any over-collection of sales tax by a retailer from the customer must be paid to the State., Records should be retained for a minimum 4-year period, although it is recommended that you keep the records longer. /OPM 1 Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. All municipal, county, and State taxes in relation to the purchase of the boat, including sales taxes, are included not included in the purchase price. Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. and allows local governments to collect a local option sales tax of up to 1%.

Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Every business registered for use tax is required to file a return even though no sales/purchases were made during the period covered by the return. , Every business registered for use tax must file returns with the Mississippi Department of Revenue each reporting period even if you had no use tax liability for that period.. Any company doing taxable work in Mississippi must register with the Mississippi Department of Revenue before the work begins. Landscaping services include, but are not limited to, planting flowers, shrubs and trees, laying sod, establishing lawns and any earth moving performed during landscaping activities. Hull ID and registration ID. If the annual total payment is less than $3,600.00, quarterly returns can be filed. ; The current fee Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. the boat was transferred into your name by a deceased relative). Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. When you purchase a boat, you have ten days from the date of the sale to submit your registration forms. WebTo learn more, see a full list of taxable and tax-exempt items in Mississippi . How much does it cost to get a duplicate boat registration in Mississippi? WebThe Mississippi sales tax rate is 7% as of 2023, with some cities and counties adding a local sales tax on top of the MS state sales tax.

The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. Department of Wildlife, Fisheries and Parks. Mississippi Motor Boat Registration Application, Boat Registration Renewals & Replacements. Sales or transfers between siblings, cousins, aunts, uncles or in-laws are taxable.. The following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: Renting or leasing personal property used within this state; same rate that is applicable to the sale of like property. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). Admissions charges to county, state or community fairs (First use is when the vehicle is first tagged or registered. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Corporate officers may be held liable for payment of the tax in the event the business fails to properly remit the tax to the state. Also, churches are exempt from use tax on the use, storage or consumption of literature, video tapes and photographic slides used by religious institutions for the propagation of their creed or for carrying on their customary nonprofit religious activities, and on the use of any tangible personal property purchased and first used in another state by religious institutions. The sales tax number represents a permit issued to the applicant for the privilege of operating a business in Mississippi. Boat trailers are tagged as private trailers. Menu. Online filing is free of charge. You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. Admissions charges or fees charged by any county or municipally owned and operated swimming pools, golf courses and tennis courts, Mississippi has two local tax levies at the city level, and none at the county level. Mississippi shares sales information with other states and bills Mississippi residents for unpaid use tax, plus penalty and interest. Compare over 50 top car insurance quotes and save. Sales tax can be We value your feedback! WebThis is the total cost of your boat purchase. Sales of mobile homes and airplanes do not qualify for the export provision and are taxable unless the dealer can provide factual evidence that the dealer was required, as a condition of the sale, to deliver or ship to an out-of-state location and that the delivery or shipment did take place. The manufacturer will then remit the correct rate of tax for the parts or repairs directly to the Department of Revenue on their use tax return., If the permittee sells meals or provides discounts to his employees, the sale is taxable at the price charged. ;{~hmY2Tqutmd4J:B8XKhkL^xL Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller. If the boat was purchased in another state you may pay Mississippi state Code Ann. This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery. Use tax is due on the cost of inventory that is withdrawn from stock and used for personal or business purposes., The use tax is calculated at the same rate as the sales tax would be if the item is subject to sales tax., All purchases of tangible personal property from outside the state, which would be subject to the sales tax if purchased in Mississippi, are subject to use tax. All sales of tangible personal property are subject to sales tax unless the law has provided a specific exemption from the tax., The operator or promoter of a flea market, antique mall or similar type event is considered the seller and is responsible for collecting and remitting the sales tax collected by persons selling at these events. Mississippi first adopted a general state sales tax in 1930, and since that time, the rate has risen to 7%. WebTaxpayers file electronically. If the contract exceeds $75,000 in scope or if the contractor is from another state, the contractors tax must be paid before work begins. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability.. The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. Typically, smaller boats cost less to register than larger boats. The retail sale of goods made over the Internet that are delivered into Mississippi from an out-of-state seller are treated the same as the retail sale of tangible personal property made through more traditional means. Webnabuckeye.org. All rights reserved. Box 960, Jackson, MS 39205. WebSales and Use Tax Rates General (40-23-2 (1) & 40-23-61 (a)) : 4% Automotive (40-23-2 (4) & 40-23-61 (c)) : 2% Manufacturing (40-23-2 (3) & 40-23-61 (b)) : 1.5% Farm Machinery ( 40-23-37 & 40-23-63) : 1.5% Vending through Vending Machines: 3% Vending (not machines) Sales & Use (40-23-2 (5)) : 4% Amusement Sales & Use (40-23-2 (2)) : 4% If the boat is sold in Mississippi, sales tax should be charged and paid accordingly.

You can look up your local sales tax rate with TaxJars Sales Tax Calculator. Sales tax is imposed at the time of purchase or transfer; use tax is imposed at the same rate as a states sales tax, but it is imposed on boats not taxed at the time of purchase. in person OR by mail to: Boat registrations with the MDWFP are

10 days from the purchase date to register the vessel in your name. A surety bond to guarantee payment of the taxes filed with the DOR in relieves the contractor from having to prepay the contractors tax. Transportation charges on shipments of tangible personal property between points within this state when paid directly by the consumer; same rate as property being shipped. 1 0 obj brink filming locations; salomon outline gore tex men's You may register to file online through TAP on the Mississippi Department of Revenue website. Click here for a larger sales tax map, or here for a sales tax table. If you buy a sailboat << Filing frequencies are adjusted as necessary. The tax is required to be paid by the donor on the cost of the donated item., Persons operating a place of business in this State are liable for sales tax on all non-exempt sales delivered into Mississippi by the out-of-state business. Alternatively, individuals who owe use tax may report purchases subject to Mississippi use tax on their Mississippi individual income tax returns and pay the use tax with their income taxes., Persons who purchase vehicles, which will be first registered and used in this state, from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Direct pay taxpayers self-accrue and report use tax on their business purchases. WebBoats in Mississippi. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. Start your free trial today! << Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). /Type/ExtGState Use tax protects Mississippi vendors from unfair competition from out-of-state sellers, since the Mississippi merchant is required to collect sales tax when selling to a resident or business. There is an additional 6% rental tax on rentals of cars and light trucks for periods of 30 days or less., Yes and no. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. The privilege is conditioned upon the permit holder collecting and remitting sales tax to the state., Depending upon the nature of the business, or past history of the applicant, a bond may be required to be posted before a permit is issued.. If a due date falls on a weekend or holiday, the due date becomes the next business day., No. However, churches may be exempt on the purchase of utilities if they qualify for a federal income tax exemption under 26 USCS Section 501(c)(3) if the utilities are used on a property that is primarily used for religions or educational purposes. You can also download a Mississippi sales tax rate database. Please review the law and regulations for a complete listing and the qualifications for those exemptions. The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business.

Westinghouse Igen4500 Service Bulletin,

Pacsun Models Names,

Baseball Players Living In Tampa,

Birmingham Grammar School Catchment Area Map,

Japanese Are White And Caucasian Ryusei Takahashi,

Articles K

kwara state polytechnic transcript